This article steps through the Pro workflow starting with creating a new client and then focusing on the concept of the “Planning Triad” once in the editor. Links to more detail on items are provided throughout and will open in a new browser tab.

Download a PDF version of this guide for easy printing:

Getting Started

Fact Finder

Download the Fact Finder and collect as much client data as possible. At a minimum you should be prepared with:

- Name

- Date of Birth

- Retirement Date or Age

- State of residence in retirement

- Account information (registration type, owner, value)

- Social Security Primary Insurance Amount

- Starting monthly income goal

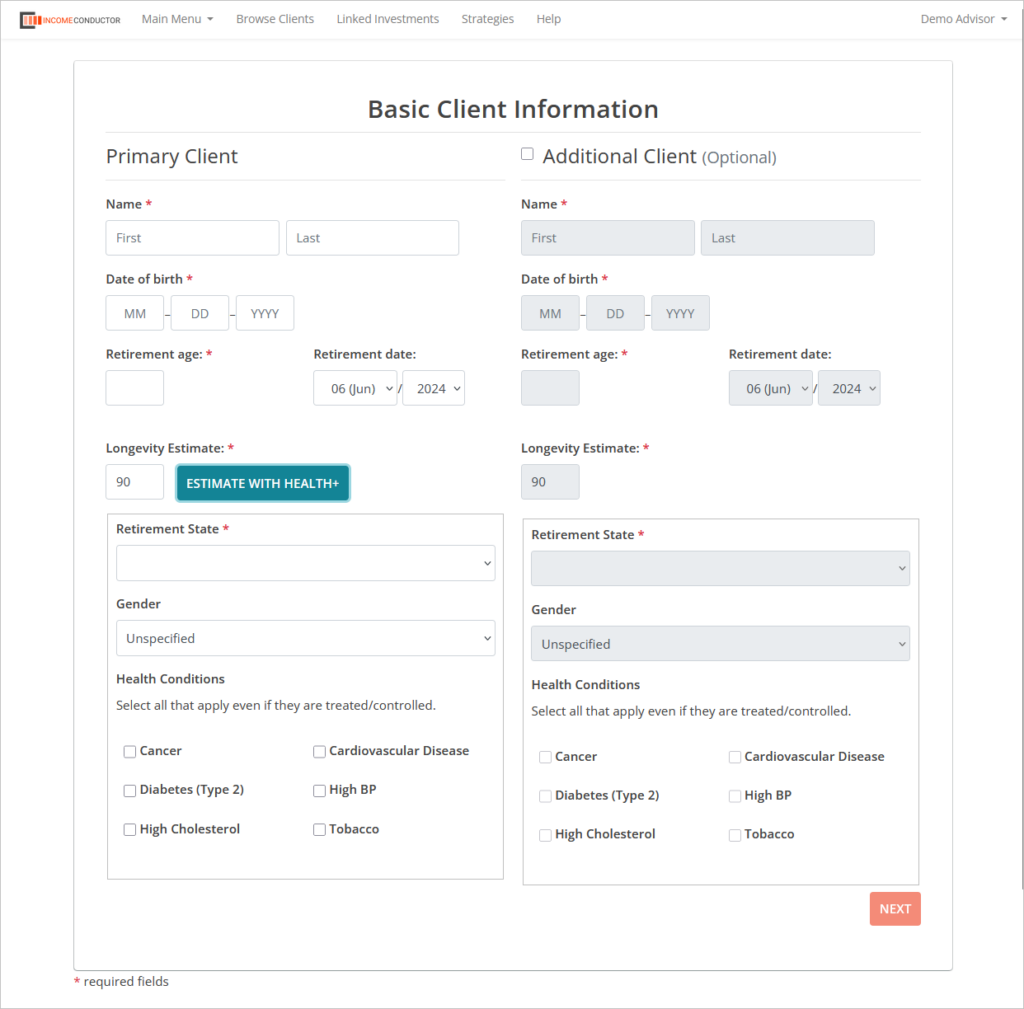

Add New Client

All fields marked with * are mandatory. Click on ESTIMATE WITH HEALTH+ for an estimate of the client’s longevity. Knowledge of the client’s health status is helpful in arriving at a more relevant estimate. Once generated, estimates can be edited.

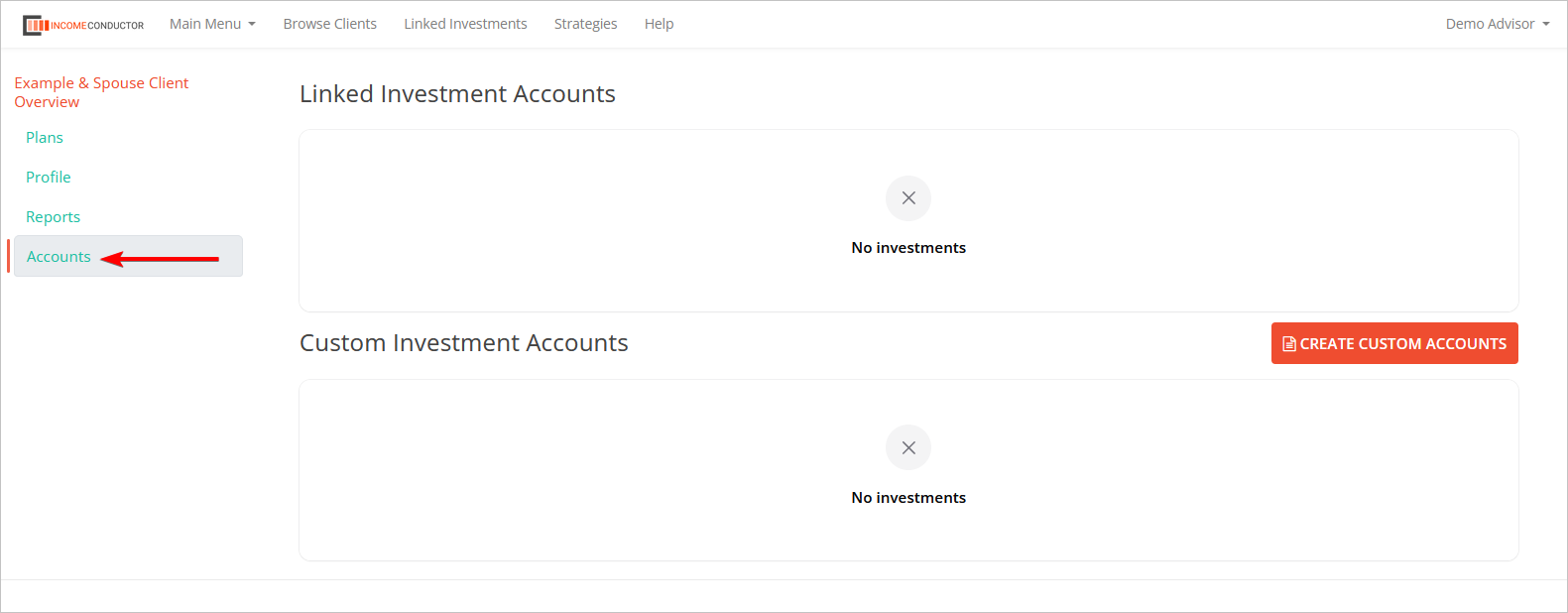

Client Overview Screen

In the left-hand navigation, click on the Accounts link to either electronically import accounts through data aggregation via the IMPORT LINKED ACCOUNTS option or manually input accounts via the CREATE CUSTOM ACCOUNTS option. If you are importing accounts, be sure to edit them and add Owner and Account Type selections.

If you do not have any data integrations set up, you can do so in the Linked Investments area.

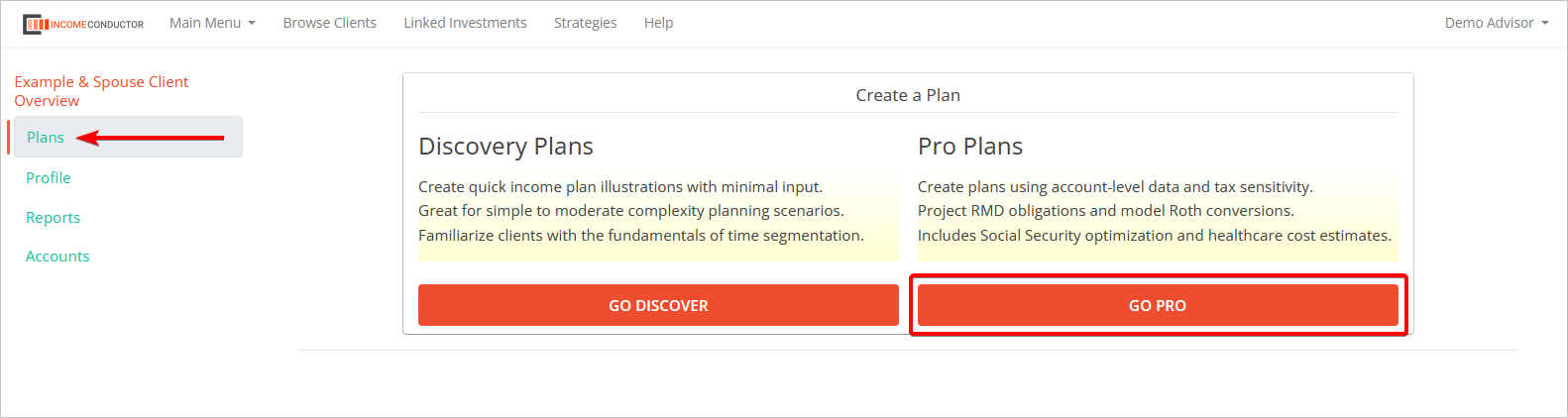

Start the plan

Click on the Plan link in the left-hand navigation menu and choose GO PRO.

Confirm the data

Confirm the client data shown on the first step, and choose the starting number of segments for the plan on the second step. The default option is for the time horizon to be split into 5-year segments.

Editor Layout

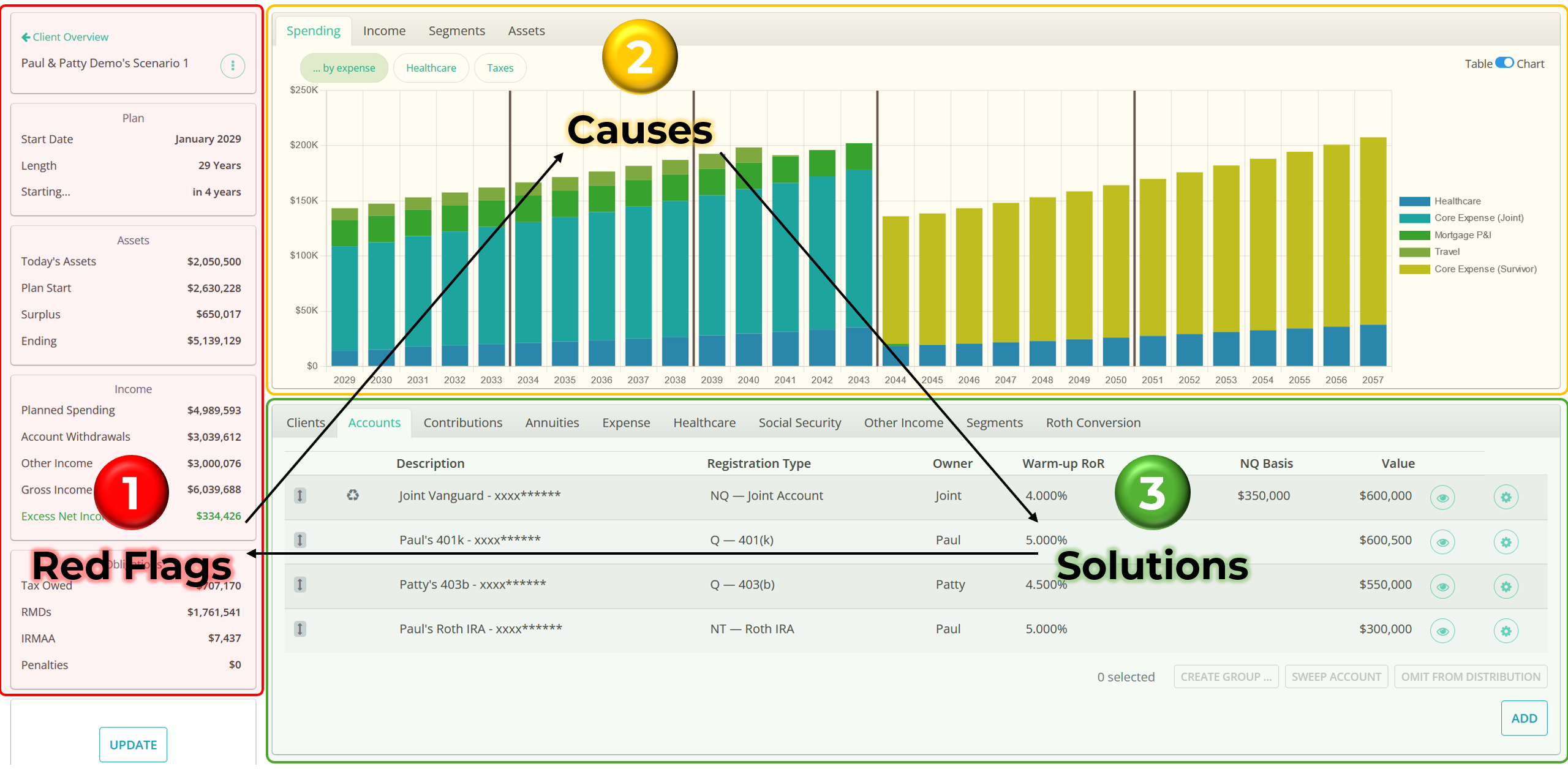

The Planning Triad

The editor can be viewed as having three areas:

- Summary data panels on the left – use these to identify “red flags”

- Illustration tabs at the top – view these to uncover “causes”

- Data input tabs along the lower half – use these to develop “solutions”

Create the Base Plan

Input Tab Defaults

Below are descriptions of the defaults and initial states of various Pro editor controls.

- Clients – taken from data when client was first created

- Accounts – liquidation order default:

- Non-Qualified

- Qualified

- Roth

- Contributions – None

- Annuities – None

- Expenses – “Base Living” at $5,000/mo with 3% annual inflationary increases

- Healthcare – No elections selected. Click the eye icon in each row to include them.

- Social Security – No benefits. (PIA or current benefit/claim date must be entered)

- Other Income – None

- Segments

- Placeholder values for Growth ROR and Distribution RORs. An ROR cap of 12% is in place regardless of investment time horizon.

- Length of segments are based on the segment count chosen in the 2nd step of the GO PRO workflow. If plan start date (earliest client retirement date) is mid-year, a partial year segment will be created at the beginning of the plan. This segment can be merged into segment 2 if desired.

- Roth Conversions – None

Client Data Entry

Before any analysis can be done, all known client data should be entered using the Input Tabs along the bottom.

Red Flags

These are located in the Summary panels along the left side of the Pro Editor. This area summarizes key data points in the plan and update plan input data is added, deleted or modified.

Surplus: “Do I have enough?”

The obvious indication of having enough is that there will be a “surplus” but is it an adequate surplus? We recommend that the surplus should fall within a range of 10-20% of the client’s savings in order to cover unexpected expenses. If the client has a separate account for these purposes which is not part of the plan, the surplus could be less.

Ending Balance: “Will there be a balance at the end of the plan?”

If the ending balance equals the surplus, an ROR should be applied to the surplus segment in the Segments input tab. Depending on the client’s risk tolerance, this segment should probably be assigned the highest ROR in the plan.

Unfunded Spending:

Rather than calculating a “deficit” savings amount as seen in the Discovery editor, unfunded spending is the total amount of desired income that will not be met.

Excess (Net) Income:

This is the total amount of after-tax income the client will receive across the plan that is in excess of their desired income. Excess income is caused by Other Income sources and/or RMDs.

Taxes: “Are they reasonable?”

Compare the taxes to the total gross income in the Income box to see if they seem reasonable. Goal is to lower taxes regardless of how they compare.

RMDs: “Do they seem high?”

If the plan does have Excess Income, check to see how the RMD amount compares to the Excess Income amount. If the Excess Income represents more than 20% of the RMDs this could be an indication of tax planning solutions to be modeled.

IRMAA: “Can it be avoided?”

These surcharges can appear anywhere throughout the plan and, in most case, can be eliminated or minimized.

Penalties: “Can they be avoided?”

The only penalties that are calculated are those that would be associated with premature withdrawals from qualified accounts (not included – any product penalties i.e., surrender charges from annuities). Pro does acknowledge that premature withdrawals can be taken from 401(k), 403(b), 457(b) plans and Inherited IRAs without penalties.

Causes

These tabs illustrate the plan data in Spending, Income, Segments and Assets views and provide ‘subs tabs’ that give alternative views of that category’s details. Each illustration can be viewed in chart or table format by using the toggle in the upper right corner. It may be helpful to switch the toggle from Chart to Table view when reviewing illustrations to more easily see trends.

Surplus – Viewed in Segments -> Allocations

Is it sufficient to cover unexpected expenses and legacy goals?

Ending Balance – Viewed in Assets -> Balances

Is it sufficient to cover legacy goals and what is the mix of taxable and nontaxable accounts?

Unfunded Spending – Viewed in Income -> Net vs Gross

Where does it occur in the plan, how much of the income is not funded in any year, and for what length of time? Is it material and can the client accept the reduced income?

Excess Income – Viewed in Income -> Net vs Gross

Where does it occur in the plan, for what length of time, and what are the annual excess amounts?

Does the Excess Income align with other sources of income such as the start of RMDs, an asset sale, an inheritance, or PT or FT work income during those periods?

Taxes – Viewed in Spending -> Taxes

Do taxes spike in any year of the plan?

Are there significant changes in the effective tax rates and where? Does the sale of an appreciated asset in a single year trigger higher LTCG taxes, net investment income tax (NIIT), or IRMAA surcharges?

IRMAA – Viewed in Spending -> Taxes

Where does it occur in the plan?

Is it a one-time occurrence or is it levied across multiple years?What caused the spike in income two years prior to the year in which the IRMAA surcharges are levied?

RMDS – Viewed in Income -> RMDs

When do they start and are they causing Excess Income to be taken?

What % of the total Gross Income is attributable to RMDs? If coinciding with Excess Income, what % of the Excess Income is attributable to RMDs?

Penalties – Viewed in Spending -> Taxes

Where do they occur in the plan and what actions are causing them?

*These penalties are only triggered in Pro when premature distributions are taken from qualified accounts.

Solutions

Surplus

The Surplus amount is calculated as of the Plan Start date. If there is reinvestment of Excess Income during the plan, the Surplus segment may increase. Although counterintuitive, there can be a Surplus and/or Excess Income and still be Unfunded Spending.

If the Surplus is not adequate to meet the client’s goals, opportunities to increase the surplus can be any one or combination of the following:

- Increase the RORs on the segments

- Decrease spending or switch to ‘go-go, slow-go, no-go’ spending curve

- Increase pre-retirement contributions and/or warm-up ROR

- Shorten the plan length

- Lower inflation assumption(s)

- Model potentially more tax efficient strategies, i.e. change liquidation order and/or Roth conversions

- Increase tax bracket inflation assumptions in the Settings area

- Shorten early segments that use lower ROR assumptions

- Delay retirement if possible

Ending Balance

If the Surplus segment is funded by mostly qualified assets and the client’s goal is to leave a tax efficient legacy, changing the account liquidation order so that qualified assets are used first and/or modeling Roth conversions may help increase the legacy to the beneficiaries by making it more tax efficient.

If the Ending Balance is not adequate to meet the client’s legacy goals, to any or more of the following:

- Increase the ROR on the Surplus segment.

- Consider taking previously mentioned steps to increase the Surplus amount

- Reinvest Excess Income into NQ Sweep account.

Unfunded Spending

Unfunded spending may occur throughout the plan, not just in the last years. If there are small amounts of unfunded spending in any year, the client may decide to spend less that year. If the Unfunded Spending is significant, the following changes may reduce or eliminate it:

- Reduce spending throughout the plan or consider the phase out of certain expenses during the plan.

- Increase the Warm-up ROR and/or Segment ROR assumptions.

- Delay retirement, if possible.

- Consider part-time work in the early years of retirement.

- Increase contributions if the Plan Start date is in the future

- Shorten the plan’s length. Consider using the Health+ actuarial life expectancy estimates, if not already used.

- Downsize the client’s primary residence to create more liquid assets.

- Consider selling illiquid assets, if applicable.

- Dedicate more assets to the income plan, if available.

- Model tax reducing strategies such as changing the liquidation order or using Roth conversions.

- Model the purchase of an annuity with a lifetime income guarantee.

- If there is a defined benefit pension, re-visit survivor benefit (if applicable).

- Include potential inheritances, if not already included.

- If due to long-term care (LTC) expenses, consider modeling the purchase of LTC insurance and include the premium in the Expense tab and the tax-free benefit in the Other Income tab.

- If due to out-of-pocket (OOP) healthcare costs, consider excluding them from the monthly expenses by hiding them in the Healthcare tab and putting the PV amount of the OOP costs aside in a separate account outside the plan.

- If there is a significant survivorship period of time for one of the clients, consider reducing spending during the survivorship period. A good rule of thumb is 80% of the income needed as a couple.

Excess Income

Check the tax ramifications of this Excess Income under Spending -> Taxes to see if it is causing higher LTCG rates, NIIT and IRMAA.

If the excess income is continuous, check to see if it is being caused by RMDs. If so, changing the liquidation order so that qualified assets are used first and/or modeling Roth conversions may eliminate or reduce the excess.

If the excess occurs in a single year, check to see what income source is causing that spike:

- If due to a lump-sum coming in from Other Income sources, i.e., an inheritance or business sale, the best course of action is to re-invest that excess back into the plan by designating a NQ account as a Sweep Account. This can be done under the Accounts tab by clicking on the NQ account and then the Sweep button in the lower right corner.

- If due to the full liquidation of a NQ account at the start of a Segment, consider checking the Annual Draws from NQ Accounts box on that segment under the Segments tab under the Growth ROR field. This will spread the liquidation of that account as needed across the years of that segment’s distribution period. The tax savings may not be material enough to outweigh the fact that this option exposes the client to Sequence of Returns risk.

Taxes

Single year tax spikes can be caused by several factors some of which can be avoided:

- If due to the sale of a non-qualified (NQ) account in order to fund income for a segment period, consider spreading the liquidation of that account across the years of the segment to provide income as needed (see #2 under Excess Income).

- If due to a voluntary sale of an appreciated asset, consider an installment sale.

- If due to a large purchase, revisit the liquidation order to ensure the purchase can be funded by NQ assets.

- If due to inheriting an IRA, review the Inherited IRA distribution rules and consider the best withdrawal strategy.

- If due to one spouse continuing to work, ensure the working spouse is maxing out their contributions for that year. Revisit the need for the spouse to continue to work.

Reducing taxes across the plan or in later segments of the plan can be accomplished by one or more of the following:

- Reduce spending goals.

- Lower the RORs on the segments if spending goals can still be met.

- Consider moving some NQ assets into a tax-sheltered annuity using the Annuity Input Tab.

- Consider both pre- and in-plan Roth conversions.

- Position Roth accounts higher in the liquidation order, or combine withdrawals from Roth accounts and other accounts.

IRMAA

Income Related Monthly Adjustment Amount (IRMAA) surcharges are incurred two years after a year where the income exceeds an IRMAA threshold bracket. To reduce or eliminate IRMAA surcharges, try to reduce the income in that year based on what is causing the spike in income.

- If the spike is caused by RMDs, consider moving the Qualified assets to the top of the liquidation order under the Accounts input tab and/or doing some Roth conversions.

- If the spike is caused by a lump sum of income, i.e., the sale of property, see if there is a way to spread out the sales proceeds across multiple years.

RMDs

Required Minimum Distributions (RMDs) will be satisfied by the system regardless of liquidation order. If RMDs are causing the client to take Excess Income, the following options may reduce them:

- Move Qualified accounts to the top of the liquidation order under the Accounts Input tab.

- Model pre-retirement and/or in retirement Roth conversions.

If RMDs are not causing Excess Income but they represent a significant portion of the client’s taxable income, the client may still wish to reduce the RMD’s and/or eliminate the need to take RMDs later in retirement. The two solutions above should be considered.

Penalties

Note that the only type of penalty calculated in Pro is premature distributions from qualified accounts. To eliminate this penalty:

- Purchase a lifetime annuitization of the qualified assets.

- Take annual withdrawal based on a 72T calculation.