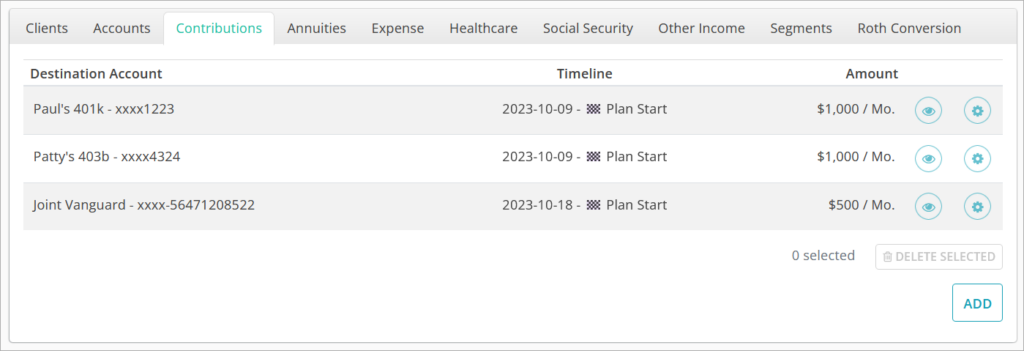

The Contributions tab allows you to model periodic contributions into accounts during each client’s pre-retirement period.

The Contributions table will have a row for each stream, showing its Destination Account, Timeline, and Amount.

Clicking the 👁️ icon in a row will toggle whether the contribution stream is included or excluded from the plan scenario.

Contributions to non-qualified accounts will end when the plan starts, and contributions to qualified and Roth accounts will end when the client who owns the account retires regardless of whether the End date is set to be later.

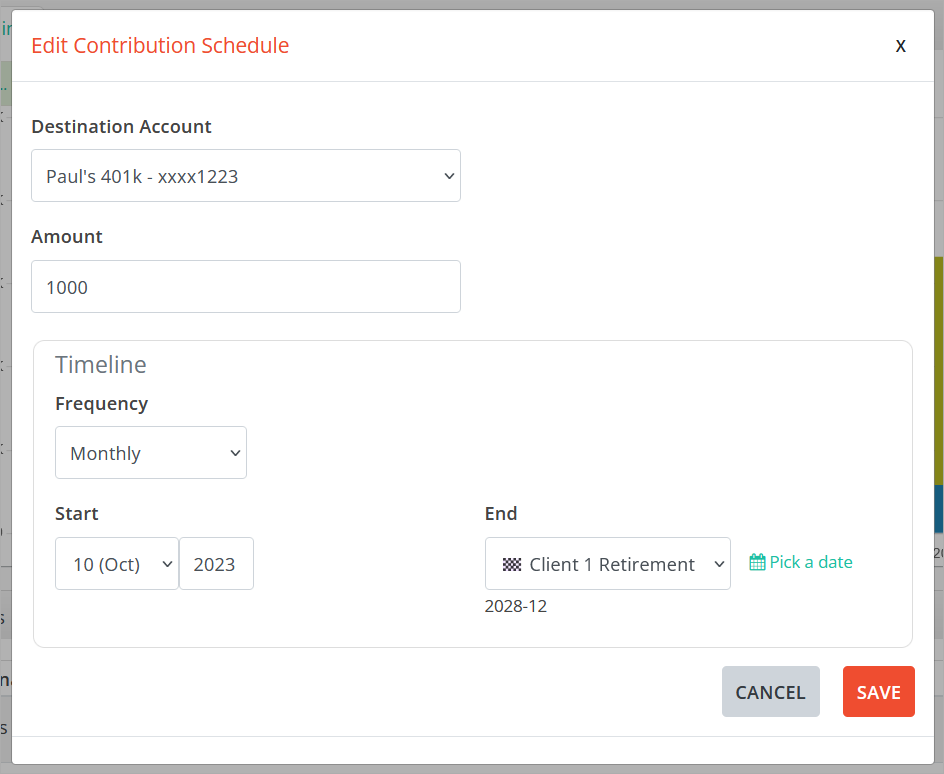

Adding & Editing Contributions

Clicking the ADD button in the bottom right will bring up a window where you can create a new contribution stream. Clicking the ⚙️ icon will open contribution stream for editing.

Destination Account is the account into which the contribution will be invested.

Amount is the periodic amount for investment. If the Frequency below is set to Monthly, the amount entered here will be added every month. If the Frequency is Yearly, this amount will be invested once a year on the anniversary of the start month.

Frequency can be set to Monthly, Yearly, or One-Time.

Start can be set to a specific month/year.

End can be set to specific month/year or an event such as the client’s retirement. Using events ensures that even if you change the date on which the event occurs, all items using that event as a start or end date will update accordingly as well.

Jump to the next controls tab: