The Roth Conversion tab allows you to model one or more conversion schedules to move assets from qualified tax-deferred accounts into tax-free Roth accounts before and/or during the income plan scenario.

Additional taxes projected as a result of performing Roth conversions before plan start are added into the Tax Owed figure in the Obligations Summary Panel. Be sure to enter any other income, including wage income that is expected to be earned leading up to each clients’ retirement date to more accurately estimate the net tax impact of Roth conversions.

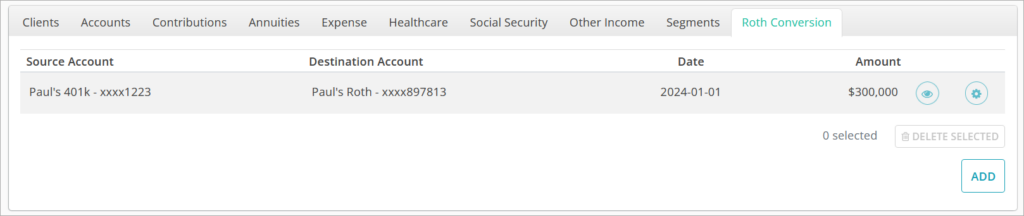

The Roth Conversion table has a row for each conversion schedule, showing the Source Account, Destination Account, (start) Date and Amount.

Clicking the 👁️ icon in a row will toggle whether the Roth conversion schedule is included or excluded from the plan scenario.

Clicking the ADD button in the bottom right will bring up a window where you can create a new conversion schedule. Clicking the ⚙️ icon in a conversion row will open a window where you can edit the conversion’s attributes.

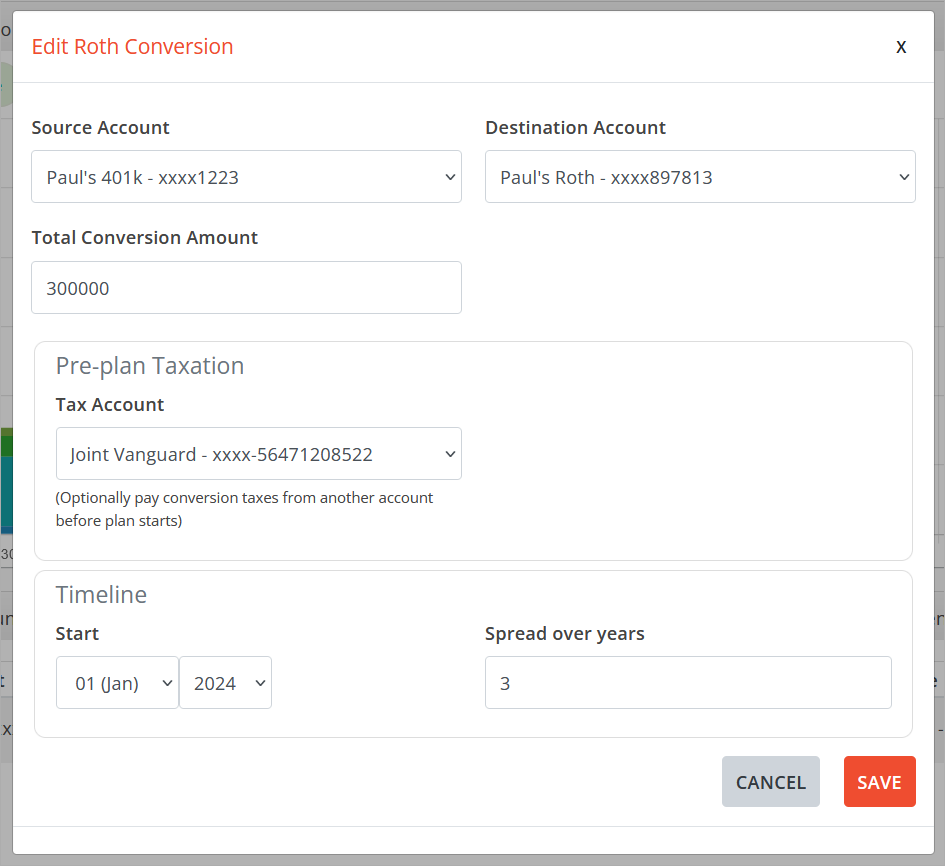

Add & Edit Roth Conversion

Source Account is the account from which assets will be drawn to perform the conversion. Only qualified accounts are presented as options.

Destination Account is the account into which conversion proceeds will be invested. If the household does not currently have a Roth account, you can create one for use as a destination in the Accounts tab.

Total Conversion Amount is the pre-tax dollar amount that will be modeled for the conversion over the full period. This is not a periodic annual amount.

Tax Account gives the option of paying taxes from a non-qualified account so that the entire pre-tax conversion amount ends up in the destination account. You can also choose to pay taxes out of the proceeds, which will diminish the resulting Roth balance by the amount of taxes incurred as a result of performing the conversion.

Start is the month/year at which the conversion will begin.

Spread over years is the number of years over which the Total Conversion Amount will be evenly spread.