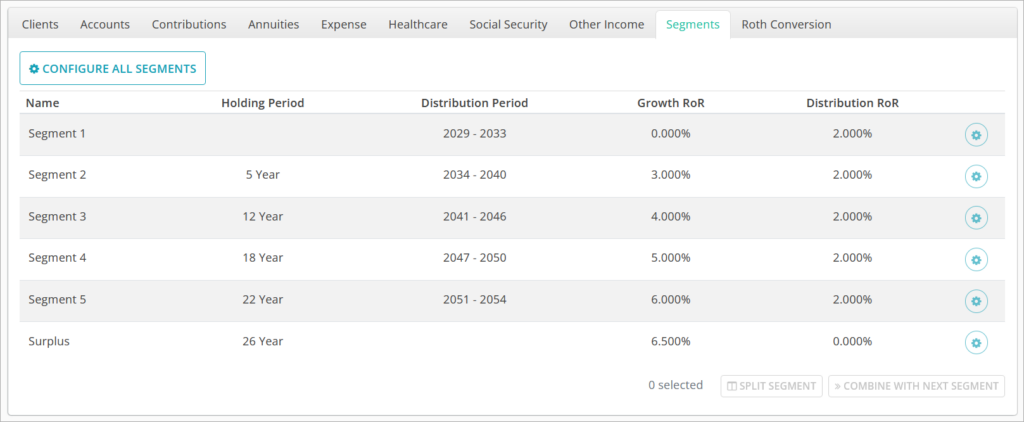

The Segments tab allows you to customize your time segment structure and edit their attributes, such as rate-of-return assumptions for each’s growth and distribution period.

A focused illustration of the projected required allocation of assets to segments by account is found in the Allocations view under the Segments tab above.

The Segments table has a row for each segment, showing their Name, Holding Period, Distribution Period, Growth RoR, and Distribution RoR.

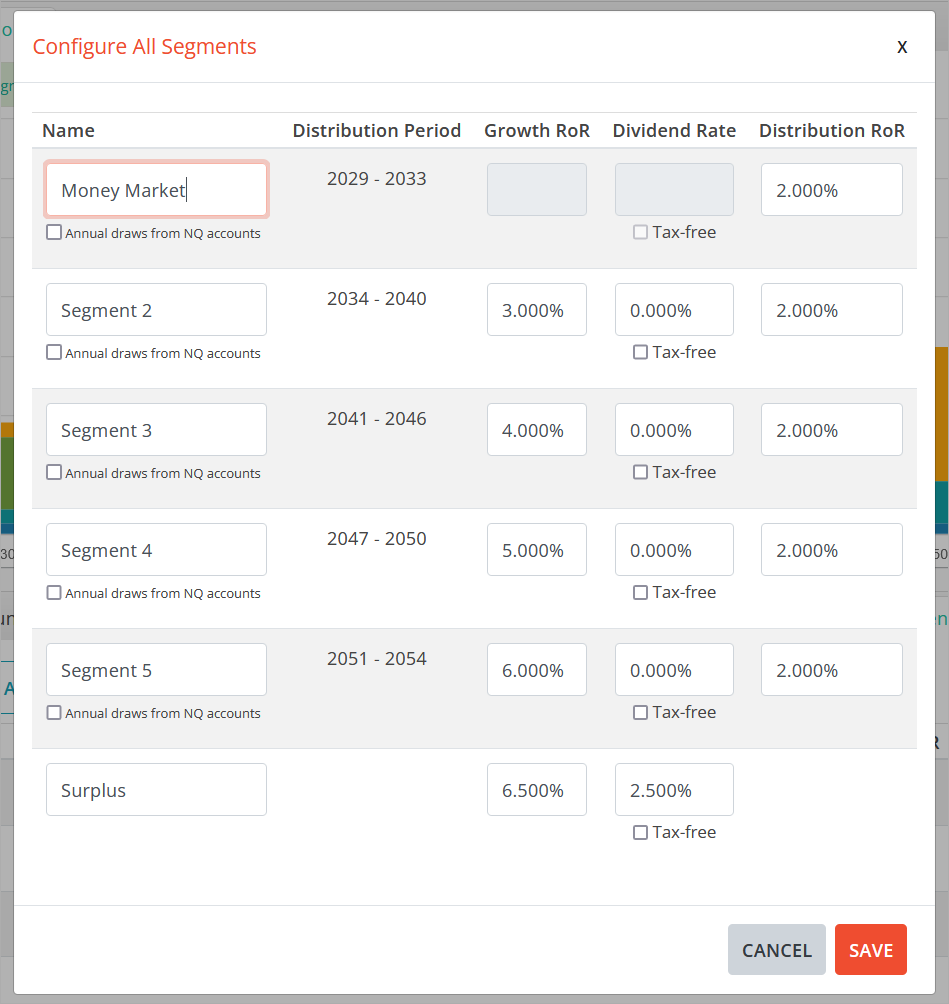

Clicking the ⚙️CONFIGURE ALL SEGMENTS button in the top left will bring up a window where you can modify segment attributes all at once. Clicking the ⚙️ icon in a segment row will open a window to edit only that segment’s attributes.

Editing Segment Attributes

The assumptions you make regarding projected segment performance are important in illustrating the level of market risk being taken in the plan.

Name is a free text field where you can enter a custom name for the segment to better convey to the client concepts such as the “phase” of retirement that it will cover, or the investment strategy that will be used for it.

Distribution Period is the timeframe over which the segment is designed to pay out income. Prior to this period, the segment is assumed to be in its growth phase. The Surplus segment has no Distribution Period.

Growth RoR is the annual average net-of-fees rate of return assumption that the segment is projected to target over the years prior to the Distribution Period. The Growth RoR field for the first segment will only be used when Annual draws from NQ accounts is enabled. More about this feature is below.

Dividend Rate is the absolute portion of the Growth RoR that is attributable to dividend income for non-qualified accounts so they cannot exceed the value of the Growth RoR. Dividends are assumed to be 100% qualified and thus taxed as ordinary income. If the Tax-free checkbox is enabled, no ordinary income tax liability will be generated as the dividends are credited.

Dividends are credited at the end of each month after the growth rate has been applied. The cost basis of any non-qualified accounts allocated to this segment will increase as dividends are credited and reinvested. This figure has no impact on qualified or non-taxable accounts allocated to the segment.

The Dividend Rate field for the first segment will only be used when Annual draws from NQ accounts is enabled. More about this feature is below.

Distribution RoR is the annual average net-of-fees rate of return assumption that the segment is projected to target during the Distribution Period. The Surplus segment has no Distribution RoR.

Annual Draws From NQ Accounts

Annual draws from NQ accounts is a setting that allows you to override the transition from Growth RoR to Distribution RoR for non-qualified accounts that takes place immediately at segment start with an assumed 100% portfolio turnover as a result.

For qualified and non-taxable accounts, this transition event does not trigger any taxes. For non-qualified taxable accounts, all long-term capital gains for the assets dedicated to distribute during that segment are realized in the first year of the segment.

When overridden, non-qualified accounts will be assumed to remain fully invested in their Growth RoR portfolio, and liquidations will only take place at the beginning of the year in which distributions are required.

For example, take a segment that needs to distribute $100,000 from a non-qualified account over a five year period to cover expenses and for simplicity’s sake it will be withdrawn from the account at $20,000/yr.

The system will assume that $100,000 is converted from Growth RoR to Distribution ROR in the first year of the segment via asset liquidation and reinvestment.

To arrive at an after-tax account balance of $100,000, there may need to be $115,000 of holdings liquidated. In the first year of the segment, that means $20,000 is withdrawn from the account to cover projected expenses for the year, and another $15,000 is withdrawn to cover the long-term capital gains tax on the asset liquidation. The remaining $80,000 of the liquidated assets remain in the account awaiting withdrawal over the subsequent four years.

With annual NQ draws enabled, assuming the same long-term capital gains rate and projected annual expenses, only $23,000 needs to be liquidated in the year to cover $20,000 in expenses and $3,000 in tax liability. A lower liquidation amount may prevent crossing over the NIIT threshold, or IRMAA from being incurred two years later.

However, this approach can significantly increase risk to the reliability of the segment’s income stream, as described below.

Modifying Segment Structure

Changing segment lengths can be done by clicking and dragging the vertical segment dividers on any of the bar charts under the Spending, Income, and Assets views. The plan will recalculate automatically when the bar is dropped. You cannot drag segment dividers beyond the first or last year of the plan, or past other dividers.

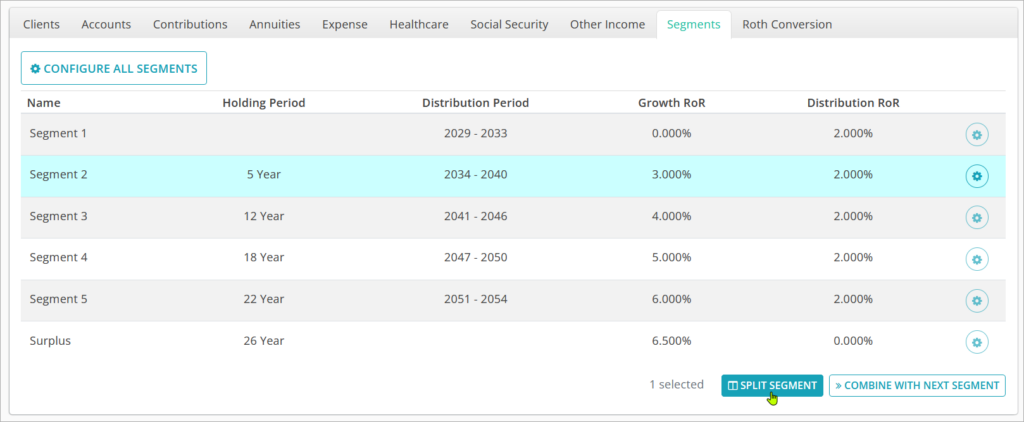

To increase the number of segments, select a segment by clicking its row to highlight it in blue and then click the ⏸️SPLIT SEGMENT button in the bottom right. The selected segment will be split in half, and the resulting two segments will inherit the attributes of the original segment. You cannot split the Surplus segment.

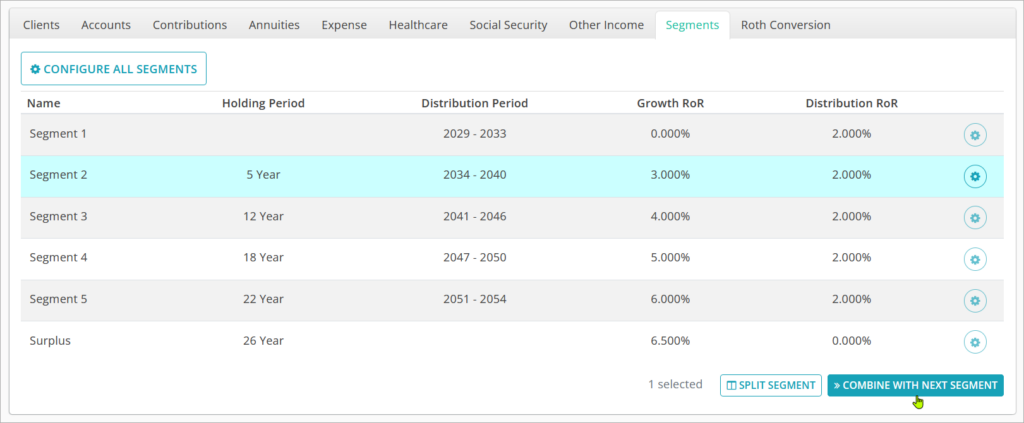

To decrease the number of segments, select a segment by clicking its row to highlight it in blue and then click the ⏩COMBINE WITH NEXT SEGMENT button in the bottom right. The selected segment will merged into the segment after it and retain the original segments attributes. You cannot merge the Surplus segment.

Jump to the next controls tab: