The Other Income tab allows you to model income sources coming from outside the household, such as pensions, rental income, wages, and more.

A focused annual illustration of all projected income sources is found in the By Source view under the Income tab.

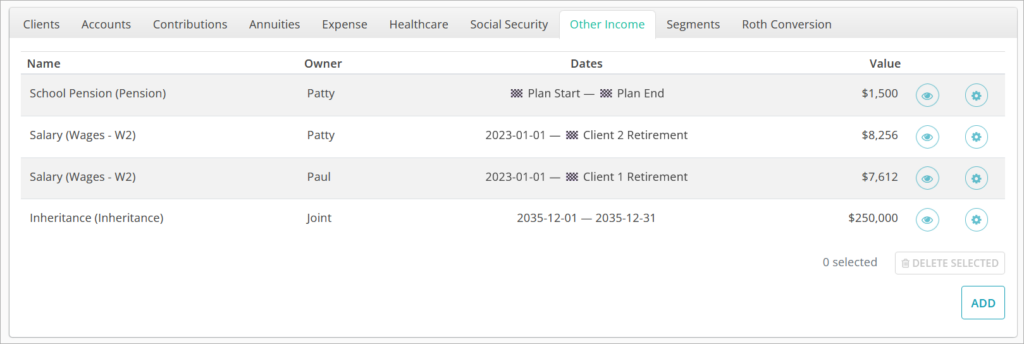

The Other Income table has a row for each income source, showing their Name, Owner, Dates, and Value with frequency.

Clicking the 👁️ icon in a row will toggle whether the income source is included or excluded from the plan scenario.

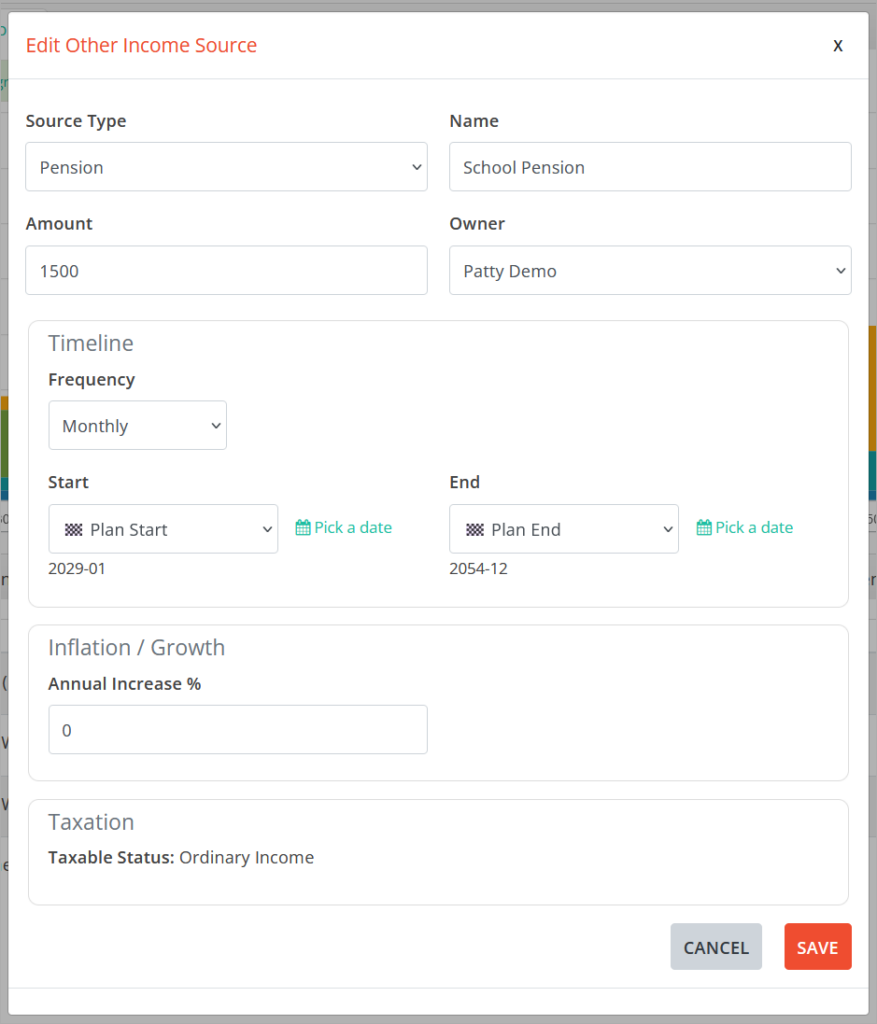

Clicking the ADD button in the bottom right will bring up a window where you can create a new income source. Clicking the ⚙️ icon will open the income window for editing.

Add & Edit Other Income

Source Type is a drop-down list of types of income that can be modeled. The selection made will dictate the taxation scheme for the income source. Detailed information about taxation by type can be found later in this article.

Name is a free-form text field for naming the income source.

Amount is the periodic amount for the income. If the Frequency below is set to Monthly, the amount entered here will be modeled as received every month. If the Frequency is Yearly, this amount will be modeled as received once a year on the anniversary of the start month.

Frequency can be set to Monthly, Yearly, or One-Time.

Start can be set to a specific month/year or an event, such as Plan Start. Using events ensures that even if you change the date on which the event occurs, all items using that event as a start or end date will update accordingly as well.

End can be set to specific month/year or an event. This date is ignored when using the Frequency of One-Time.

Annual Increase % will increase the income level each year at the beginning of the calendar year.

Income Source Types

Choosing the correct source type to reflect the income being modeled is important in ensuring accurate taxation modeling. All source types and their treatment are below:

- Dividend/Interest: 100% ordinary.

- Income Rider: 100% ordinary. For more accurate modeling of income riders, it is suggested that you model the product using the Annuities area, even if the product has already been purchased and is already generating income.

- Loan Payments: 100% ordinary.

- Part Time Work: 100% ordinary.

- Pension: 100% ordinary.

- Rental Income: 100% ordinary.

- Reverse Mortgage Income: 100% tax free.

- Severance: 100% ordinary.

- Deferred Compensation: 100% ordinary.

- Inheritance: 100% tax free.

- Repayment of Loan Principal: 100% tax free.

- Real Estate – Primary: 100% long-term capital gains between the provided cost basis and amount once the exclusion amount has been reached of $250,000 for single filers or $500,000 for joint filers. The basis for this income source should be set to the purchase price of the property.

- Real Estate – Investments: 100% long-term capital gains. The basis for this income source should be set to the purchase price of the property plus the value of any improvements made. Taxation of depreciation recapture is not currently modeled.

- Business Sale – Ordinary: 100% ordinary.

- Business Sale – LT Cap Gains: 100% long-term capital gains capital gains between the provided cost basis and amount.

- Inherited IRA Distributions: 100% ordinary.

- Wages – W2: 100% is subject to Federal Insurance Contributions Act (FICA) tax.

100% ordinary income after the deduction of contributions made to qualified accounts for the year.

0.9% Additional Medicare Tax applies above the applicable filing status thresholds: $250,000 married filing jointly, $125,000 married filing separately, and $200,000 for all others. - Wages – Self-Employed: 100% is subject to Self-Employed Contributions Act (SECA) tax.

100% ordinary income after the deduction of contributions made to qualified accounts for the year.

0.9% Additional Medicare Tax applies above the applicable filing status thresholds: $250,000 married filing jointly, $125,000 married filing separately, and $200,000 for all others.

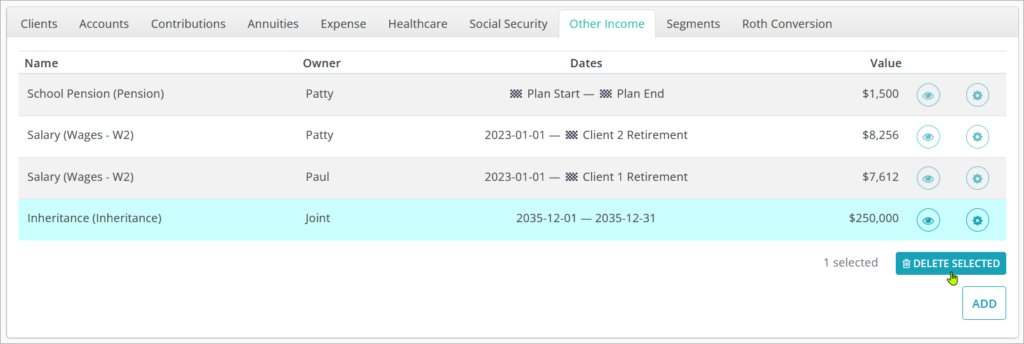

Deleting Other Income Sources

To delete an income source, highlight it in blue by clicking its row and then click the 🗑️DELETE SELECTED button in the bottom right. This action is not reversable.

Jump to the next controls tab: