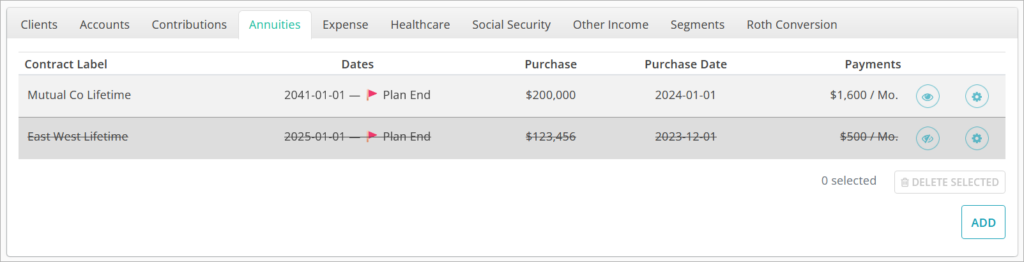

The Annuities tab allows you to model the purchase of annuity products to create income riders or non-qualified tax shelters. Projected cash values over time for the products will be modeled and visible in the Balances view of the Assets tab.

The Annuities table will have a row for each product modeled, displaying their Contract Label, (income) Dates, Purchase (price), Purchase Date, and Payments.

Clicking the 👁️ icon in a row will toggle whether the annuity purchase is included or excluded from the plan scenario.

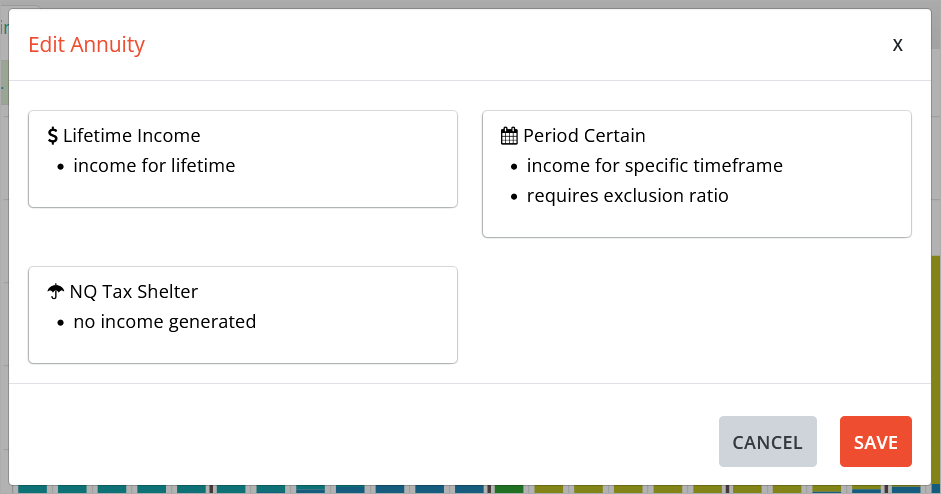

Clicking the ADD button in the bottom right will bring up a window where you can choose which type of annuity purchase you would like to model.

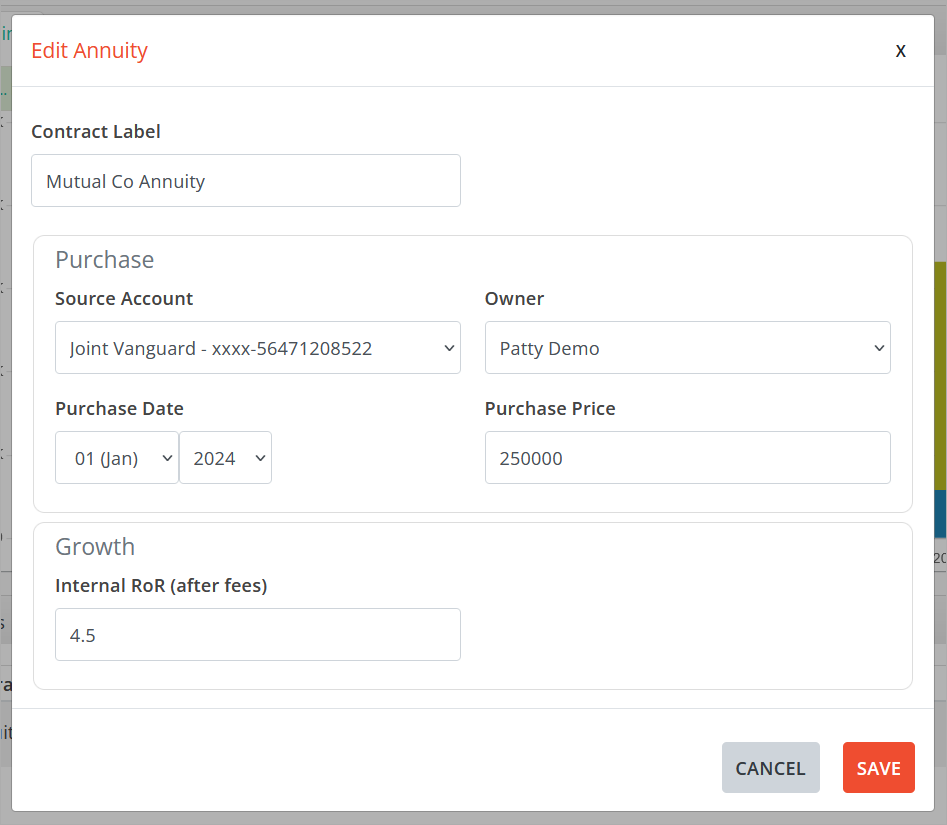

Clicking the ⚙️ icon will open the annuity window for editing. Once created, you cannot change an annuity’s type, but only the parameters within its existing type.

The three types of annuities are Lifetime Income, Period Certain, and NQ Tax Shelter.

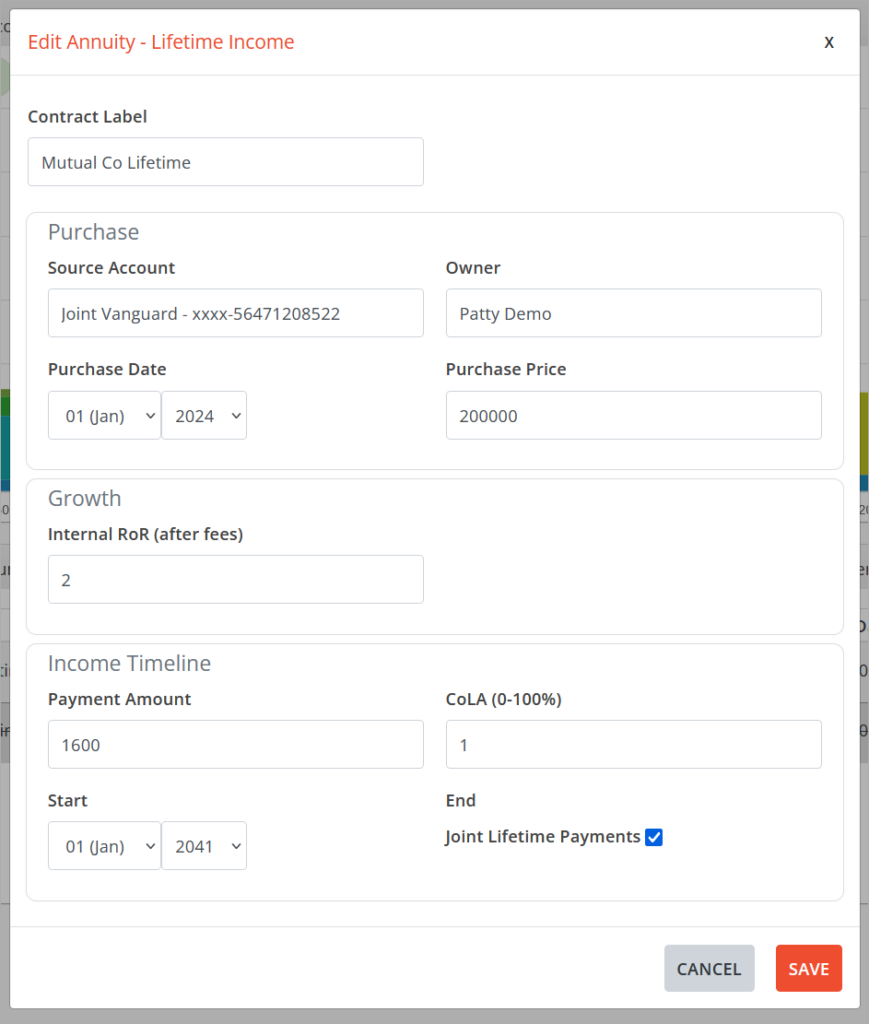

Lifetime Income

Annuities with lifetime income riders can be set up to provide floor income that continues through the end of the income plan scenario. When rider income is generated, the system will project what portion of it will be taxable each year based on the Purchase Price, Internal RoR, and Payment Amount.

Contract Label is a free-form field to name the product.

Source Account is the account from which the assets for the product purchase will be modeled as coming from. If the source account is non-qualified, the annuity is assumed to be non-qualified as well, whereas a qualified source account will assume to be used to purchase an annuity within an IRA. The projected cash value will then be used in the calculation of the owner’s projected RMDs.

Owner will automatically be set if the source account has a single owner. If funding from a jointly held account, the option to choose an owner will be given.

Purchase Date is the month/year in which the purchase will be modeled and the funds withdrawn from the Source Account.

Purchase Price is the amount of assets assumed to be used in buying the product. This will be used as the initial cash value and for non-qualified products, the cost basis.

Internal RoR (after fees) is the rate of return assumed on the cash value of the product starting from the purchase date onwards. The estimated rate of return entered should be net of assumed internal fees as they are not independently modeled.

Payment Amount is the monthly payment that will be modeled.

COLA (0-100%) is the annual Cost of Living Adjustment for the payment that will be modeled as taking place on the anniversary of the payment start date.

Start Date is the month/year during which the payment stream will begin. For Lifetime Income, the income is assumed to be maintained at 100% for survivors and continue through the end of the plan.

Joint Lifetime Payments allows you to choose whether payments will be modeled as continuing after the owner of the annuity is deceased or if the payment stream will end and the projected cash value will drop to $0 at that time. Default is disabled.

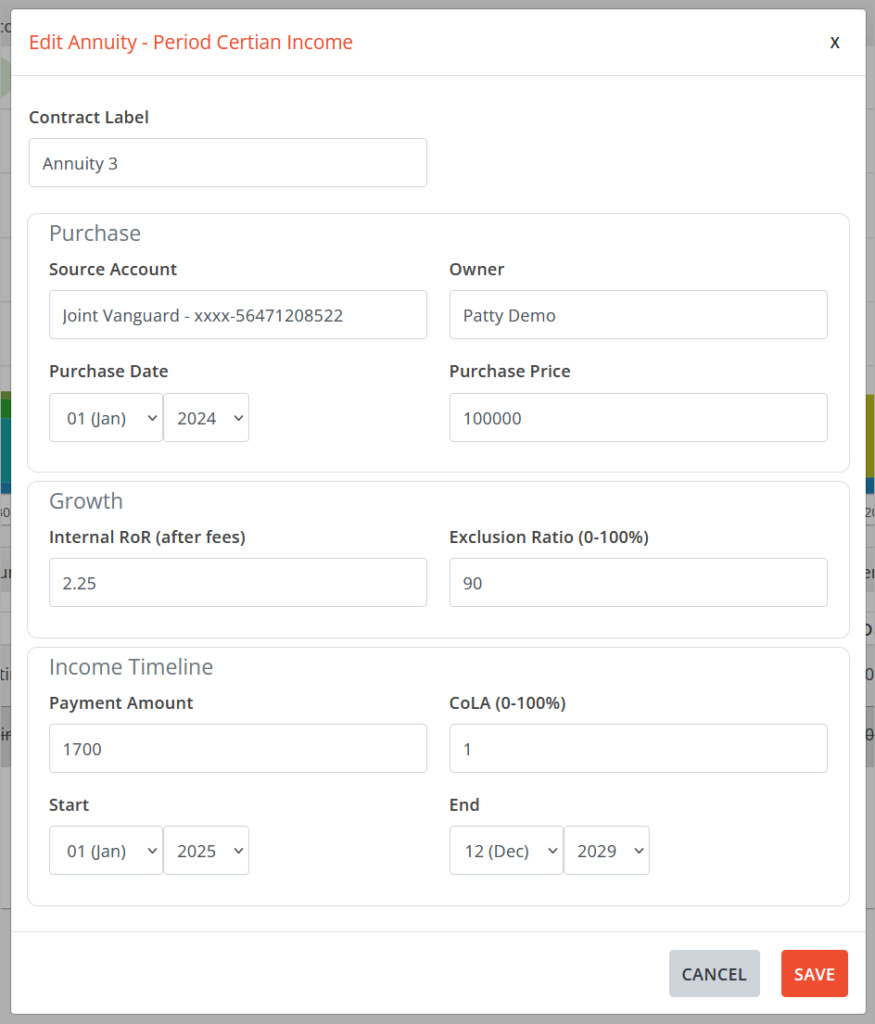

Period Certain

Annuities with period certain riders can be set up to provide income to meet the needs of a specific segment. An exclusion ratio must be provided so that the system can properly reflect expected taxation over the life of the product.

Contract Label is a free-form field to name the product.

Source Account is the account from which the assets for the product purchase will be modeled as coming from. If the source account is non-qualified, the annuity is assumed to be non-qualified as well, whereas a qualified source account will assume to be used to purchase an annuity within an IRA. The projected cash value will then be used in the calculation of the owner’s projected RMDs.

Owner will automatically be set if the source account has a single owner. If funding from a jointly held account, the option to choose an owner will be given.

Purchase Date is the month/year in which the purchase will be modeled and the funds withdrawn from the Source Account.

Purchase Price is the amount of assets assumed to be used in buying the product. This will be used as the initial cash value and for non-qualified products, the cost basis.

Internal RoR (after fees) is the rate of return assumed on the cash value of the product starting from the purchase date onwards. The estimated rate of return entered should be net of assumed internal fees as they are not independently modeled.

Exclusion Ratio is the % of the income that will be excluded from ordinary income taxation.

Payment Amount is the monthly payment that will be modeled.

COLA (0-100%) is the annual Cost of Living Adjustment for the payment that will be modeled as taking place on the anniversary of the payment start date.

Start is the month/year during which the payment stream will begin.

End is the final month/year in which a payment will be made.

Non-Qualified Tax Shelter

Annuities designed to shelter the household from taxation of passive, reinvested dividend income generated by non-qualified assets being held for the duration of the plan can be modeled. No payment details are collected and the final projected cash balance will be part of the plan’s Ending Balance.

Contract Label is a free-form field to name the product.

Source Account is the account from which the assets for the product purchase will be modeled as coming from. Selection is limited to non-qualified type accounts.

Owner will automatically be set if the source account has a single owner. If funding from a jointly held account, the option to choose an owner will be given.

Purchase Date is the month/year in which the purchase will be modeled and the funds withdrawn from the Source Account.

Purchase Price is the amount of assets assumed to be used in buying the product. This will be used as the initial cash value.

Internal RoR (after fees) is the rate of return assumed on the cash value of the product starting from the purchase date onwards. The estimated rate of return entered should be net of assumed internal fees as they are not independently modeled.

Jump to the next controls tab: