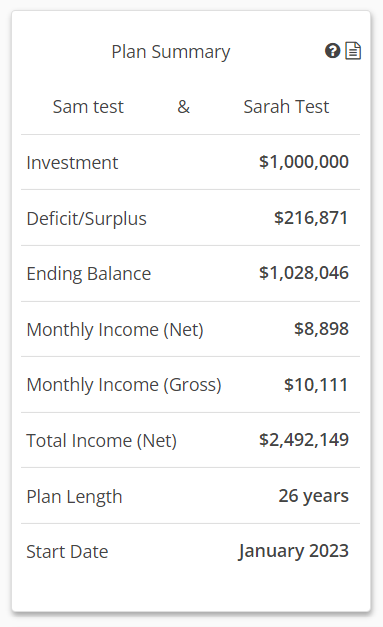

The Plan Summary panel contains several key metrics of an income plan that will update dynamically as changes are made to plan assumptions. The client(s) in the plan area shown with their dates of birth above the Plan Summary panel.

Investment: Sum of total investment assets that can be deployed to plan segments. This figure can be entered or calculated. Read more about Solve Settings.

Deficit/Surplus: When using the solve type “Both Monthly Income and Investment”, there will usually be an excess or lack of funding to meet the stated goals. If the Investment level exceeds the need, a positive Surplus value will be shown. If the Investment level does not meet the need, a negative Deficit value will be shown. The Deficit or Surplus value is always as of plan start.

Ending Balance: If money is put aside, or there is a surplus in the plan, you can specify or calculate a target ending balance to be available after the last year of the plan. Read more about Legacy/Longevity goals in the Outside Segments tab.

Monthly Income (Net): Starting after-tax monthly income goal for the first year of the plan.

Monthly Income (Gross): Starting pre-tax monthly income goal for the first year of the plan.

Total Income (Net): Total income targeted for distribution over the length of the plan including both investment liquidation from Segments, as well as income from Income Floors.

Plan Length: Number of years the plan is designed to deliver income.

Start Date: The date at which the income need begins. This is often the estimated retirement date, but it may be after retirement if the client is found not to need additional income early in retirement. You can edit this date by clicking the green pencil icon next to the label.