The Pro editor features several panels that display summary data for the current income plan scenario. Some of the datapoints are only visible when relevant to the scenario.

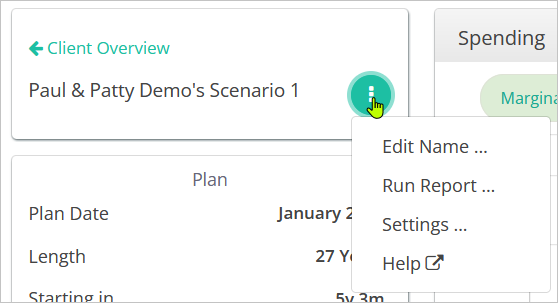

From the header panel, you can navigate back to the Client Overview area. There is a menu from which you can edit the name of the scenario, generate a report, or adjust some general Settings for the scenario. You can also access the Knowledge Base via the Help option.

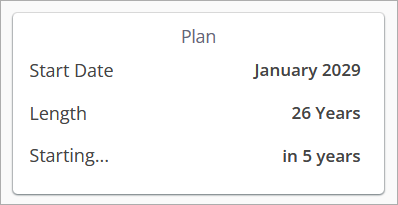

Plan

- Start Date: Month when the scenario begins, which is always the earliest retirement date assigned to either client.

- Length: Length of the scenario in years, which always carries out to the latest longevity date.

- Starting: Number of years until the Start Date.

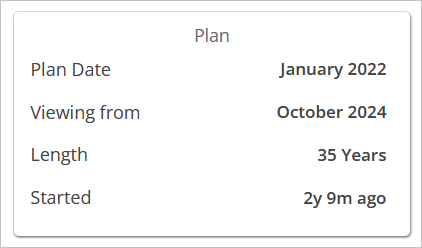

If you are viewing a plan that has already started, the editor will “window” the view of the plan from the upcoming month forwards. All segment start dates remain the same, but projections are only made into the future. In this case, you will see different items in the Plan panel.

- Plan Date: Month when the scenario started and the first month of Segment 1.

- Viewing From: The first month used in the projections and illustrations shown.

- Started: The count of years and or months since the Plan Date.

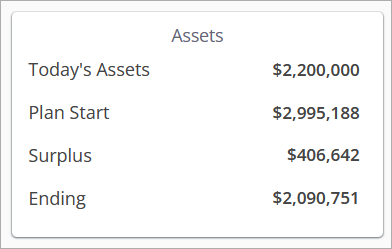

Assets

- Today’s Assets: Sum of the current value of all accounts owned by the clients in this plan. If you have linked accounts through one of the data aggregators, this figure may change on a daily basis. For Custom Investments, you will need to update the values manually.

- Plan Start: Projected sum of the values of all accounts at the plan start date. This figure is impacted by the pre-retirement rate of return assumptions for each account, contributions, and any annuity purchases or Roth conversions that take place before the scenario Start Date.

- Surplus: Projected total value of assets that can be allocated to the Surplus segment as of the plan start date. This figure does not include the projected value of re-invested excess income allocated to the Surplus segment after the plan start date. The allocation of accounts to the Surplus segment can be seen in the Allocations view of the Segments tab.

- Ending: Projected total value of assets remaining in accounts and annuity cash values at the end of the final year of the plan.

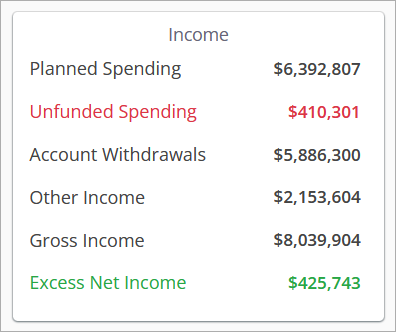

Income

- Planned Spending: Total value of all expenses across the duration of the plan, including projected healthcare costs.

- Unfunded Spending: Total value of projected Planned Spending that cannot be met by the available income sources and account balances. This figure only appears when it is greater than $0.

- Account Withdrawals: Total value of all projected gross (pre-tax) withdrawals from accounts. This figure does not include the value of income riders modeled for annuities.

- Other Income: Total value of all projected gross income modeled via the Other Income tab as well as any projected income riders modeled for annuities.

- Gross Income: Total value of all projected gross income combining account withdrawals and other income.

- Excess Net Income: Total value of projected after-tax income remaining in all years when expenses and tax liabilities are met. Excess income is a result of other income and/or RMD obligations exceeding the income need in one or more years.

By default, excess income is assumed to be spent as it is incurred. However, it can be modeled as re-invested immediately following the year in which it is incurred by assigning a Sweep Account.

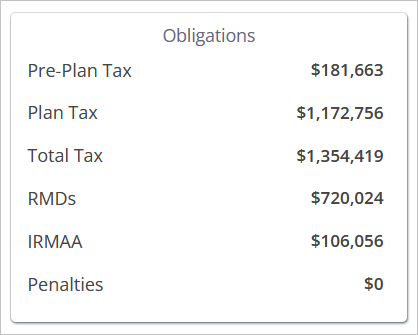

Obligations

- Pre-Plan Tax: Total projected value of all taxes projected prior to plan start/start of Segment 1. This figure is generated using any Other Income, Roth conversions, or annuity purchases that would be considered taxable events and exceed the standard deduction.

- Plan Tax: Total projected value of all taxes projected during the plan/after the start of Segment 1. If a plan starts mid-year, the entire calendar year’s worth of taxes are included in this figure.

- Total Tax: Total projected value of all taxes projected prior to and during the plan.

- RMDs: Total projected amount of Required Minimum Distributions from tax-deferred accounts incurred by clients during the plan. Learn More

- IRMAA: Total projected Income-Related Monthly Adjustment Amount surcharges incurred by clients during the plan. IRMAA surcharges will only be projected when Medicare Part B and/or Part D are included in the scenario under the Healthcare tab. Learn More

- Penalties: Total projected value of all early withdrawal penalties incurred in the scenario.