Spending is a collection of views that focus on projected outflows based on expenses and taxes. Each view has a chart and table view that can be switched between using the toggle in the upper right hand corner of the view panel.

You can isolate specific items on the chart by click on their name in the legend. Please note that this will not exclude them from the plan, just temporarily hide them from view in the chart.

All ages shown in table views are as of year-end.

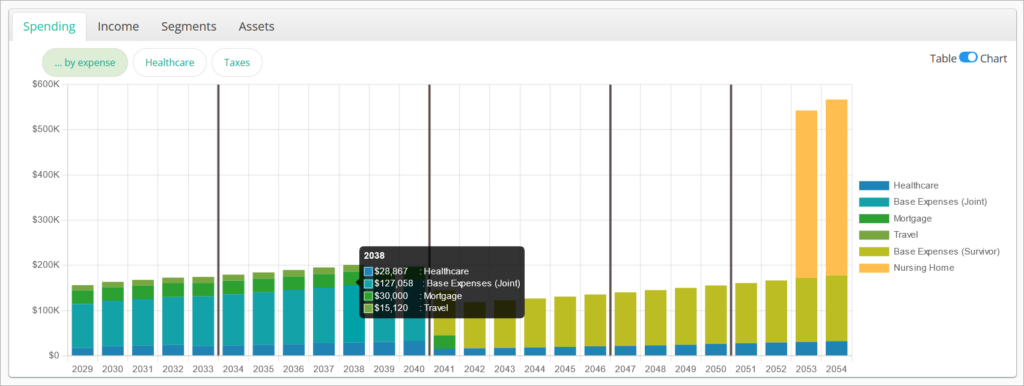

By Expense

Spending By Expense shows an individual item for each expense entered for the scenario. All of the selections for various coverage options under the Healthcare tab are combined into a single item for this view.

Hovering over a column will show the total projected amount for each expense incurred during the associated year. The table view shows all projected amounts for all expenses in all years, including totals.

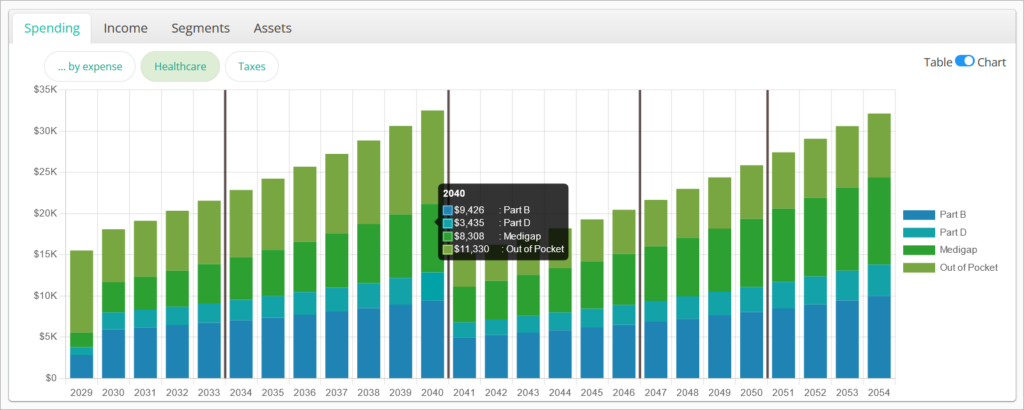

Healthcare

Healthcare shows an individual item for each coverage option enabled under the Healthcare tab. These coverages can include:

- Medicare Part B

- Medicare Part D

- MediGap (Supplemental insurance)

- Out of Pocket

- Commercial

Hovering over a column will show the total projected amount for each coverage option incurred during the associated year. The table view shows all projected amounts for all coverages in all years, including totals.

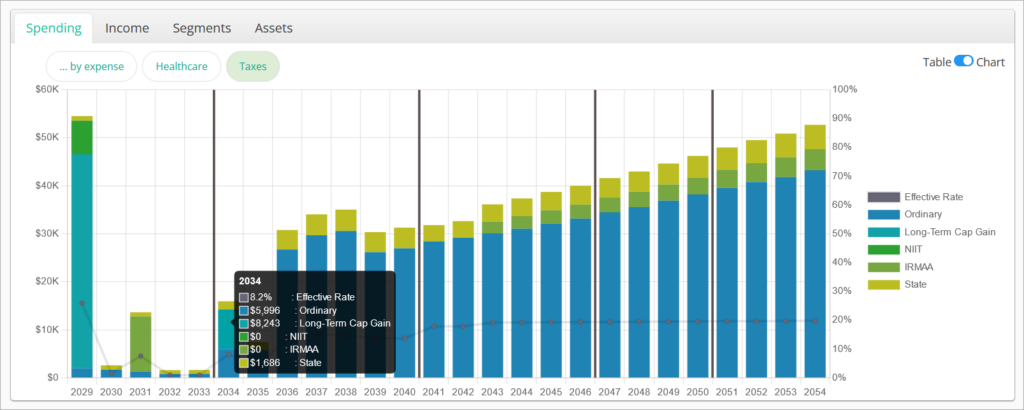

Taxes

Taxes shows an individual item for each type of tax incurred over the length of the plan as well as an annual effective rate (total tax paid / total gross income) for each year. The items on this chart can include:

- Ordinary

- Long-Term Cap Gain

- NIIT (Net Investment Interest Tax)

- IRMAA (Income-Related Monthly Adjustment Amount)

- State

- FICA (Federal Insurance Contributions Act payroll tax)

- SECA (Self-Employed Contributions Act payroll tax)

- Medicare Tax

- Penalties

- Effective Rate

Hovering over a column will show the total projected amount for each tax type and effective rate incurred during the associated year. The table view shows all projected amounts for all taxes in all years, including totals.

The Taxes view is also available under the Assets tab.

Jump to the next view: