The Social Security tab allows you to model different claiming scenarios for the plan and maximize the lifetime benefit automatically.

A focused annual illustration of projected Social Security benefits is found in the Social Security view under the Income tab.

Spousal benefits will be automatically calculated, and if higher than the primary benefit of the client, assumed to be claimed. If the primary benefit will be higher than the spousal benefit when the specified claim age is reached, the benefit will switch over from spousal to primary automatically.

The system to models what percentage (up to 85%) of the Social Security benefit will be taxable as ordinary income based on the household income and filing status each year.

Configuring Benefits

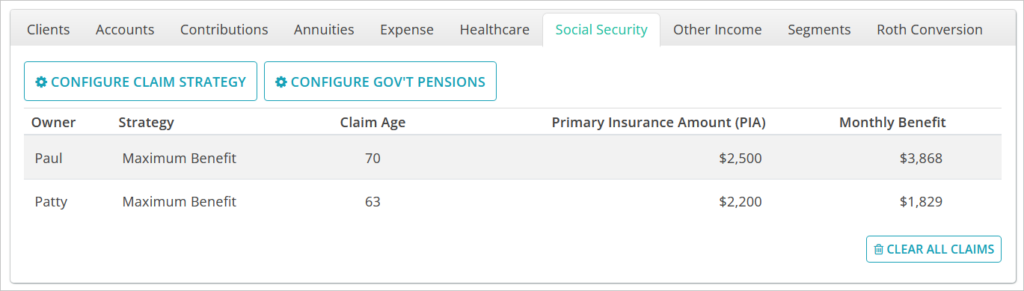

The Social Security table has a row for each client, showing their modeled Claim Age, Primary Insurance Amount, and Monthly Benefit.

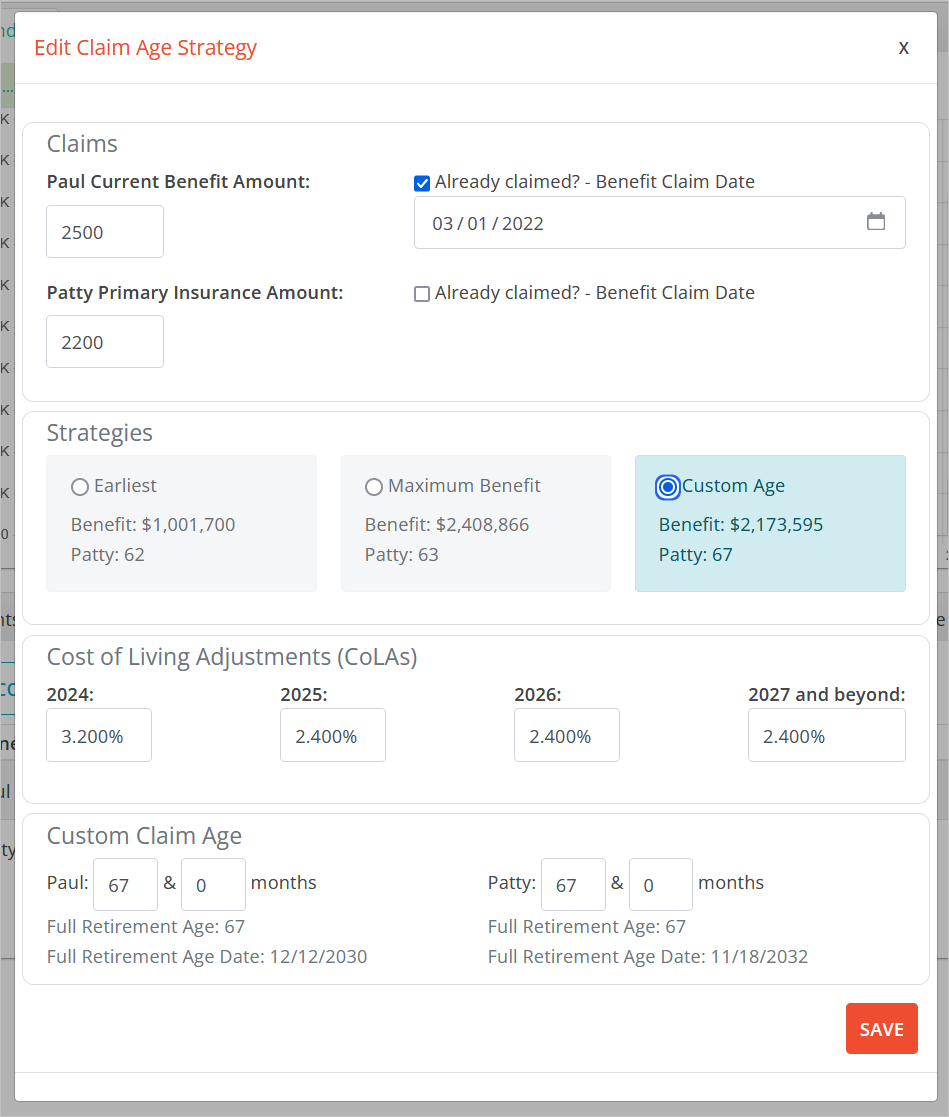

Clicking on the CONFIGURE CLAIM STRATEGY button will launch a window where inputs can be made and claim strategies can be adjusted.

Primary Insurance Amount inputs are available for each client. The PIA is the projected benefit for the client if they were to claim at their Full Retirement Age (FRA). Read more

Already claimed? allows you to enter a current benefit amount for a client who is already receiving Social Security payments. The value entered should be pre-tax and before any withholding for Medicare premiums and IRMAA.

When indicating that clients have “Already Claimed” their Social Security benefits, a new date input field now appears. This is designed to collect the date at which the client originally claimed their benefits. By entering the client’s current benefit as well as their original claim date, the system now calculates their Primary Insurance Amount that was applicable at their Full Retirement Age to more accurately project spousal benefits.

If both clients are listed as Already Claimed, there will be no difference in benefit projection between the Strategy chosen below.

Strategies represent different combinations claim ages.

- Earliest will choose the earliest age at which each client could claim. If they are over 62, it will assume their current age.

- Maximum Benefit will select the ages at which the highest benefit would be provided over the entire plan, including the survivorship period.

- Custom Age will default to using each client’s FRA, or their current age if they have already passed their FRA. When selected, the Custom Claim Age year & month fields at the bottom of the form will become available for editing so that you can enter any combination of valid ages.

Cost of Living Adjustments (CoLAs) are the inflationary assumptions made for future years’ benefits. If available, next year’s benefit will default to the figure published by the Social Security Administration. If unavailable, the HealthView Services default estimates will be used. These figures can be adjusted and are specific to this plan scenario.

Clicking SAVE will apply your changes, fetch updated benefit projections, and recalculate the plan accordingly.

Jump to the next controls tab: