The Roth Conversion tab allows you to model one or more conversion schedules to move assets from qualified tax-deferred accounts into tax-free Roth accounts before and/or during the income plan scenario.

All taxes projected, including those generated by Other Income sources as well as Roth conversions before plan start are added into the Pre-Plan Tax figure in the Obligations Summary Panel. Be sure to enter any other income, including wage income that is expected to be earned leading up to each clients’ retirement date to more accurately estimate the net tax impact of Roth conversions. Taxes generated by conversions after plan start are included in Plan Tax. Pre-Plan and Plan Tax are summed to arrive at Total Tax.

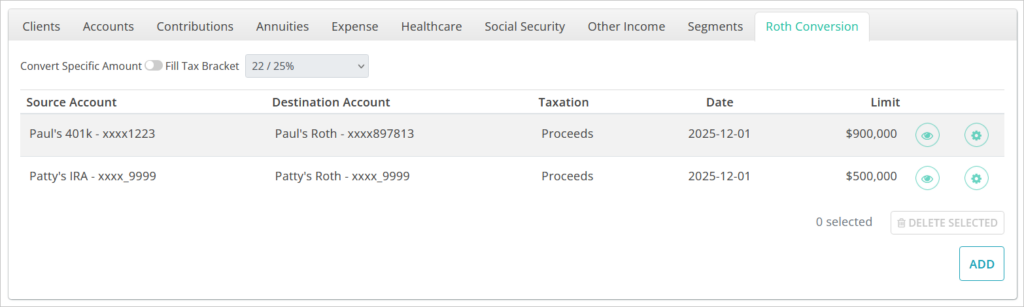

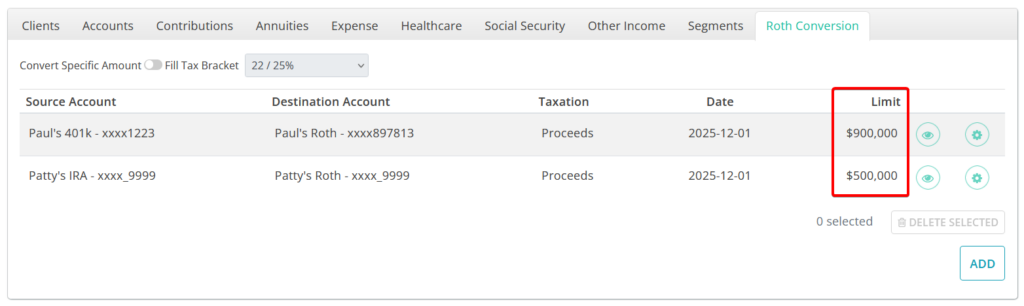

The Roth Conversion table has a row for each conversion schedule, showing the Source Account, Destination Account, (start) Date and Limit.

Clicking the 👁️ icon in a row will toggle whether the Roth conversion schedule is included or excluded from the plan scenario.

Clicking the ADD button in the bottom right will bring up a window where you can create a new conversion schedule. Clicking the ⚙️ icon in a conversion row will open a window where you can edit the conversion’s attributes.

Roth Conversion Method

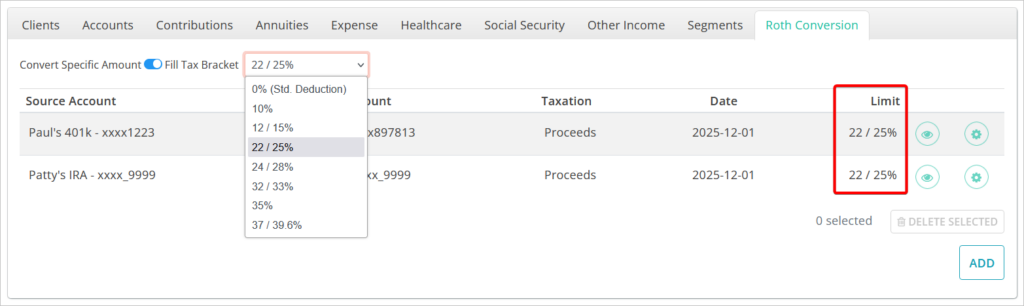

There are two methods available to determine how much Roth conversion is performed: “Convert Specific Amount” and “Fill Tax Bracket”. You can switch between them using the toggle located just above the conversion scenario table.

Convert Specific Amount is the default method and uses the Total Conversion Amount figure entered in the Add/Edit window to dictate how much conversion occurs. The amount entered is treated as pre-tax and is spread evenly over the specified conversion period. This is not a periodic annual amount. For example, a conversion of $800,000 spread over 10 years will convert $80,000 a year.

When selected, the Limit column will display the Total Conversion Amount entered.

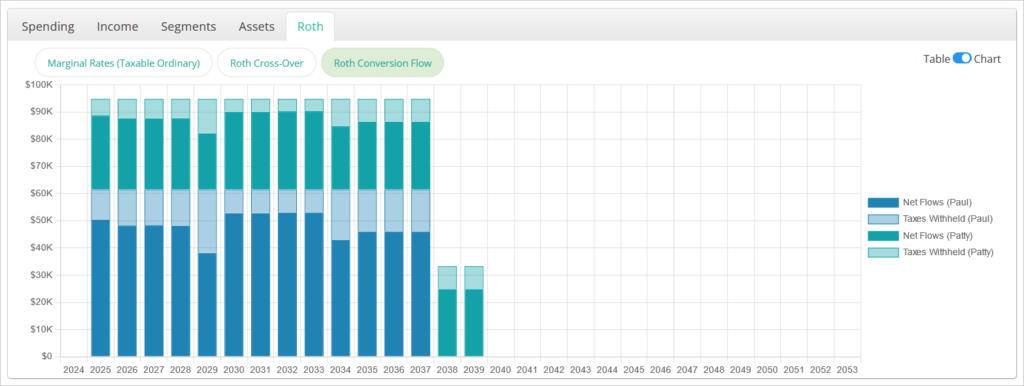

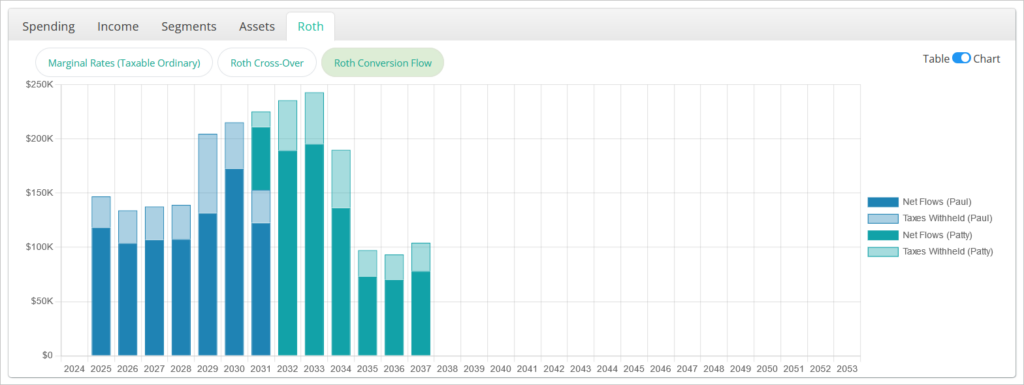

The Roth Conversion Flow chart shows that the same pre-tax conversion amount for both clients is occurring each year based on the total amount divided by years from conversion start to end. The amount withheld if using the “Pay Taxes from Proceeds” tax method may vary year to year as the projected AGI of the household changes and the marginal rate bracket exposure of the conversion increases or decreases.

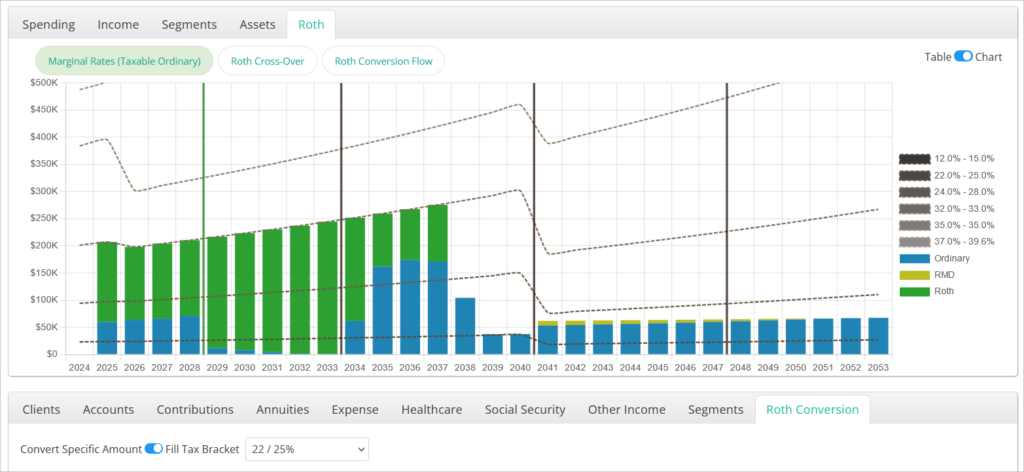

Fill Tax Bracket will only perform conversions up to the point at which the household taxable ordinary income would start to exceed the specified bracket. Thus, the pre-tax amount converted each year will vary based on how much room there is in the specified bracket after all other income sources and account withdrawals are accounted for.

When selected, the Limit column will display the specified bracket.

The order in which conversions are entered is used to determine which client/source account has priority for conversions. When the first conversion reaches its end year or source qualified assets are exhausted, the next conversion in the order will begin.

The Roth Conversion Flow chart shows that the pre-tax conversion varies each year and that the second conversion in this example begins after the assets from the first conversion are exhausted in 2031.

The Marginal Rates (Taxable Ordinary) chart also shows how the conversion amounts (illustrated in green) fill the selected bracket consistently each year until the end of the conversions.

Add & Edit Roth Conversion

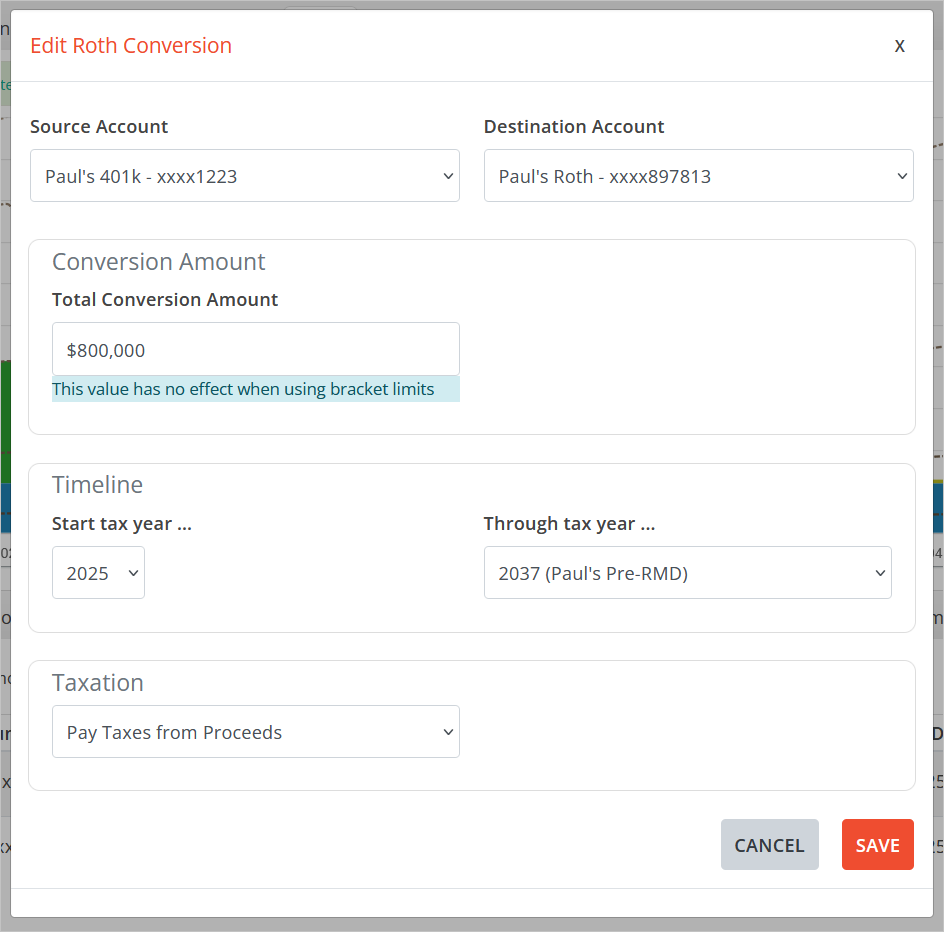

Source Account is the account from which assets will be drawn to perform the conversion. Only qualified accounts are presented as options.

Destination Account is the account into which conversion proceeds will be invested. If the household does not currently have a Roth account, you can create one for use as a destination in the Accounts tab.

Total Conversion Amount is the pre-tax dollar amount that will be modeled for the conversion over the full period. This is not a periodic annual amount.

Taxation gives three options for how the taxes that result from a conversion are modeled in the scenario. Details on how these taxation options work are provided in the next section of this article.

Start tax year… is the calendar year in which the conversions will begin.

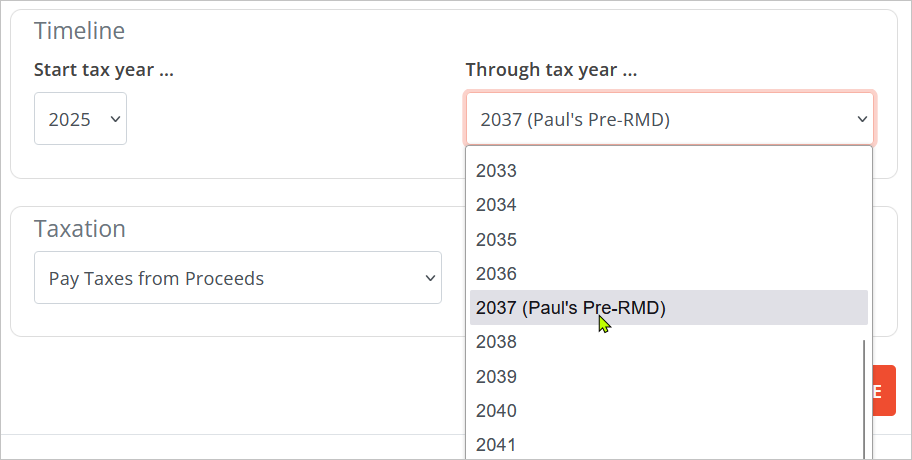

Through tax year… is the last year in which conversions will occur.

If the client in this conversion scenario has not yet reached RMD age, the year prior to them achieving RMD age will be labeled as “(Client’s Pre-RMD)”. This allows you to more easily set the conversions to end immediately prior to them beginning required minimum distributions which may be a desirable end year as account withdrawals to satisfy RMDs cannot be used for Roth conversions.

Roth Conversation Taxation

The taxation options described below affect illustrated Roth conversions that occur both before and after client retirements. If you are illustrating conversions that are taking place before the first client retirement, it is strongly advised that you include current sources of Other Income starting from today onward.

Pay Taxes from Proceeds will withhold the taxes attributable to the conversion from the converted amount, so less assets will end up in the destination Roth, but no additional withdrawals from other accounts will be performed.

For example, if the conversion in a year is $25,000 and the system calculates that of the overall tax burden of the household, $5,000 is directly attributable to the conversion, the destination Roth will reflect a $20,000 deposit that year.

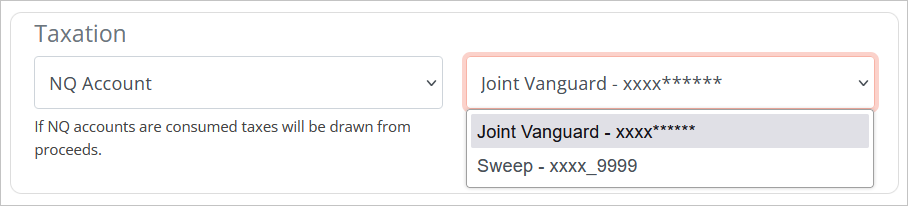

NQ Account prompts you to choose a non-qualified account from which the taxes attributable to the conversion will be withdrawn. The necessary liquidations within the NQ account to free up cash for withdrawals to cover the taxes will be performed each year that there is a conversion. This may result in long-term and short-term capital gains being realized which will also be satisfied by withdrawals from the NQ account.

This option ensures that the full conversion amount ends up in the destination Roth. If the NQ account assets are depleted in the process of paying conversion taxes, the system will automatically switch to Pay Taxes from Proceeds for the remainder of that year’s conversion taxes and all subsequent years’ conversions.

For example, if the conversion in a year is $25,000 and the system calculates that of the overall tax burden of the household, $5,000 is directly attributable to the conversion, the destination Roth will reflect a $25,000 deposit that year, and a $5,000 liquidation and withdrawal will occur in the NQ account. If that liquidation generates $500 of LTCG, additional liquidations/withdrawals will occur from the same account to cover it.

General Obligation will ensure the full conversion amount ends up in the destination Roth and will increase withdrawals from whatever accounts are due up for distribution in the year of the conversion based on the specified account liquidation order.

For example, if the conversion in a year is $25,000 and the system calculates that of the overall tax burden of the household, $5,000 is directly attributable to the conversion, the destination Roth will reflect a $25,000 deposit that year. If the scenario is designed to withdraw from an IRA in the year of the conversion, the existing withdrawal to cover expenses will be increased by $5,000 plus however much more is necessary to cover the additional ordinary income that results from the withdrawal will be made.