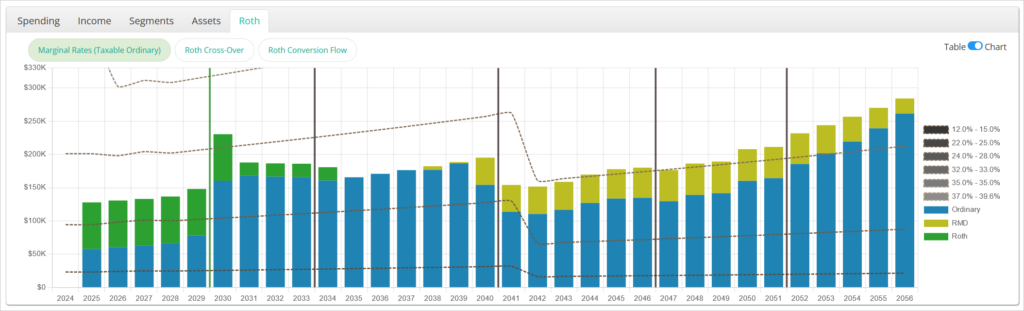

Roth is a collection of views that focus on analysis related to Roth conversion strategies. Each view has a chart and a table view that can be switch between using the toggle in the upper right hand corner of the view panel.

You can isolate specific items on the chart by clicking on their name in the legend. Please note that this will not exclude them from the plan, just temporarily hide them from view in the chart.

All ages shown in table views are as of year-end.

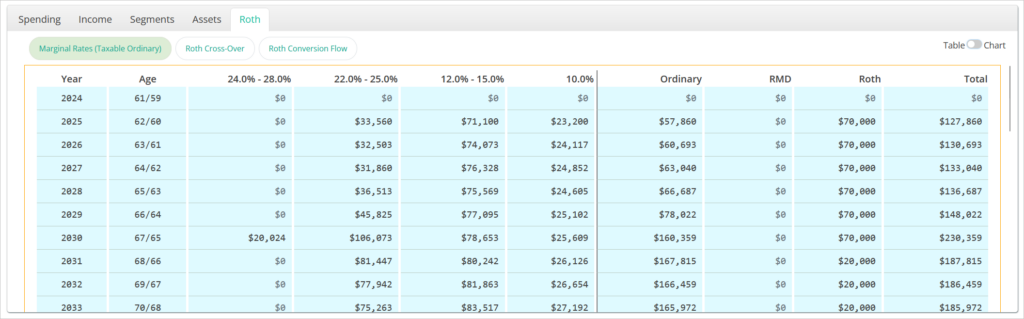

Marginal Rates (Taxable Ordinary)

Marginal Rates (Taxable Ordinary) illustrates the total taxable ordinary income each year for both pre-plan and in-plan periods, broken down by whether it is attributable to Roth conversions, RMDs, or any other type of taxable ordinary income. Any pre-tax contributions to qualified accounts as well as the standard deduction have already been applied.

Marginal ordinary income tax rate thresholds are illustrated in lines that overlay the chart. This view gives insight into whether income is entering a higher tax bracket each year and whether this outcome is a result of Roth conversions and/or RMDs.

If the expiration of the Tax Cuts and Jobs Act is enabled in the scenario Settings, rate threshold line labels will reflect both the current marginal rate and the post-expiration rate.

The rate at which the marginal thresholds increase over time is set by the Tax Bracket Inflation figure in the scenario Settings.

Upon the projected death of a client, the filing status automatically switches to Single filer and the new thresholds are reflected in each line.

The table version of this view has two components. On the left half, ordinary income marginal tax rates are shown with the projected amount of income subject to that rate each year. This gives visibility into how far over the highest rate threshold the income falls in a specific year.

On the right half, the amount of ordinary income attributable to Roth conversions, RMDs, or any other type of taxable ordinary income is shown. The standard deduction is modeled as impacting “Ordinary” first. If the standard deduction reduces ordinary taxable income other than that from RMDs or Roth conversions to $0 in a year, then the remaining impact will be illustrated on the RMD amount. If taxable RMDs are reduced to $0, the impact will be illustrated on Roth conversions.

The Marginal Rates (Taxable Ordinary) view is also available under the Income tab.

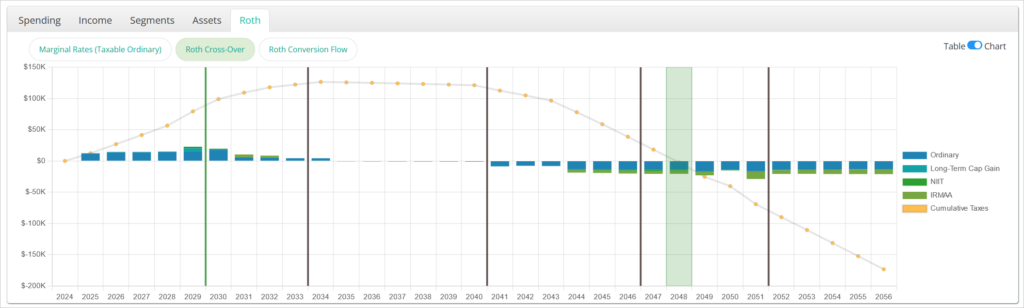

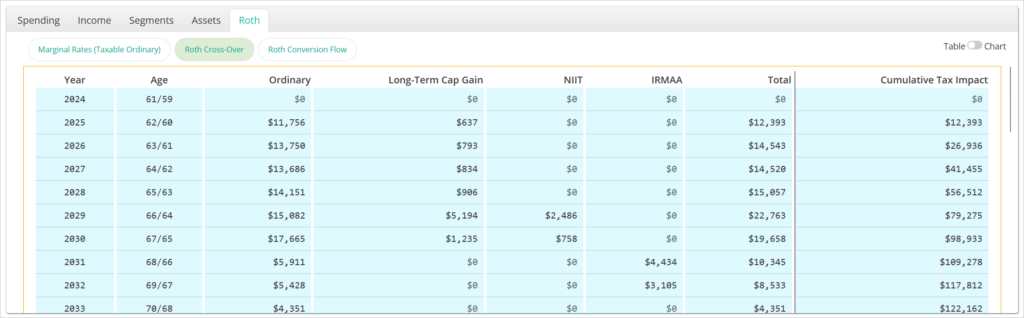

Roth Cross-Over

Roth Cross-Over illustrates the projected tax impact of performing all of the modeled Roth conversion strategies. Each year, the net difference in taxes between performing all Roth strategies vs. no Roth strategies is shown by type of tax. A positive value indicates that additional taxes are projected, while a negative value indicates tax savings.

The line represents the running cumulative tax impact. It will go up in years where additional tax is projected, stay flat in years where the conversion is projected to have no impact, and decline in years where tax savings are projected.

The green annotated year is the “break even” year, or estimated year in which the total cumulative tax impact transitions from a net increase to a net savings. This will not be present if the total cumulative tax impact remains positive until the end of the plan.

Typically, additional tax will be incurred in the years where conversions are performed. Tax savings later in the plan may be a result of withdrawals being performed from a Roth account vs. a taxable or tax-deferred account, the avoidance of excess income due to RMDs that exceed the stated income need, or other variations in the projected tax situation.

The table version of this view shows the exact projected net tax difference each year by tax type. A positive value indicates that additional taxes are projected, while a negative value indicates tax savings. A total annual net tax figure is given, as well as the running cumulative total tax impact.

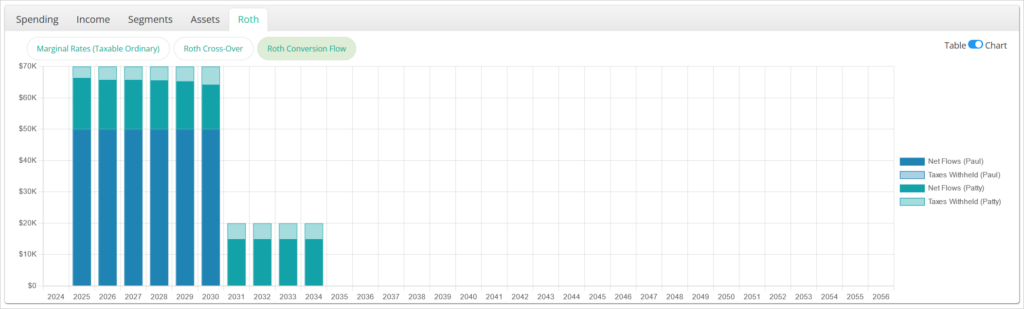

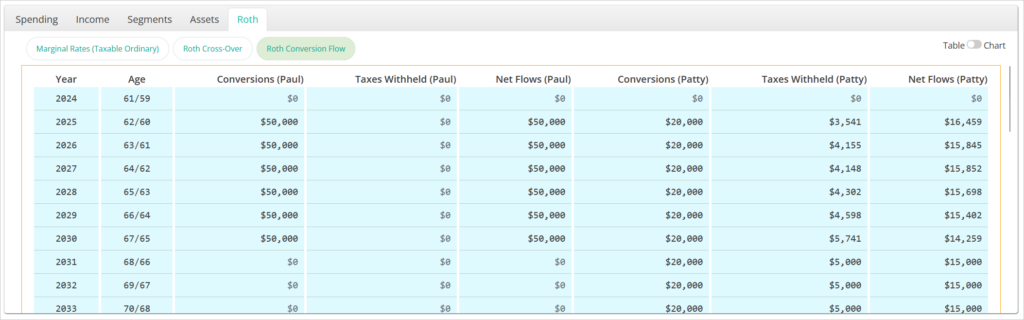

Roth Conversion Flow

Roth Conversion Flow illustrates the projected total conversion amount per client each year as well as the projected tax withholding required to cover the tax liability of the conversion if the tax treatment is set to “Pay Tax From Proceeds“.

The table version of this view shows the specific dollar amounts of each client’s total conversion, any taxes withheld, and the net proceeds deposited into the Roth account. In this scenario, Paul is paying taxes for his conversions from a NQ account thus there is no withholding shown, whereas Patty is withholding taxes from the proceeds, so the net deposit into the Roth is less than the withdrawal from the source qualified account.