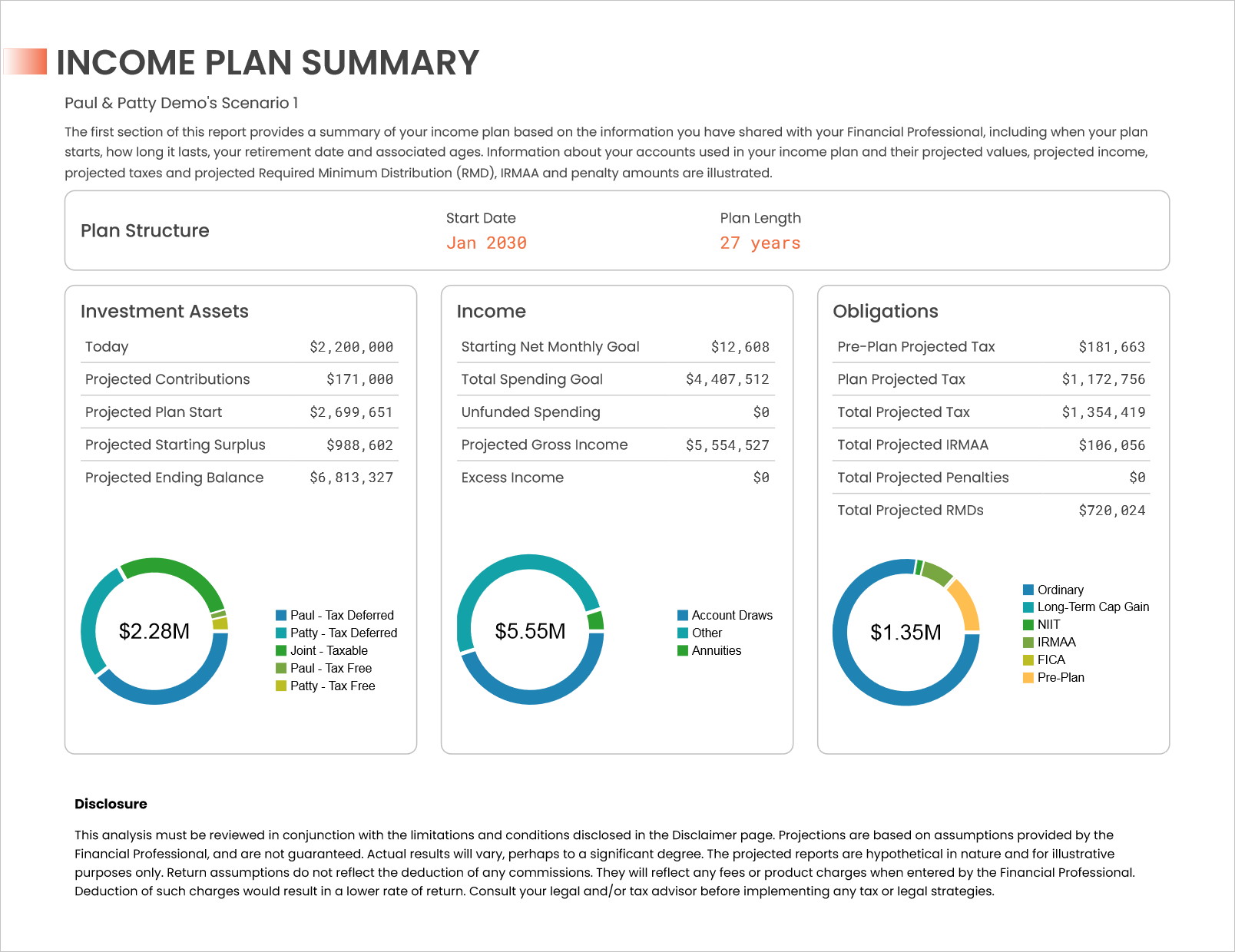

Income Plan Summary is a report module that shows key summary results about the plan’s Assets, Income, and Obligations.

Start Date is the month in which the first client in the plan retires.

Plan Length is the duration of the income plan period in years.

Investment Assets features a chart that rolls up the accounts included for use in the plan by owner and tax treatment as of today.

- Today is the sum of current balances for accounts included in the income plan scenario.

- Projected Contributions is the sum of all pre-retirement contributions projected to be made into accounts included in the plan.

- Projected Plan Start is the sum of all projected balances for accounts and products included in the plan.

- Projected Starting Surplus is the sum of all projected account balances to be allocated to the Surplus segment at plan start. Surplus assets are used solely to generate an ending balance.

- Projected Ending is the sum of all projected account and annuity balances available at the end of the plan.

Income features a chart that rolls up income by source of Account Draws, Other, and Annuities. If there is Unfunded Spending in the plan, it will be included in this chart.

- Starting Net Monthly Goal is the sum of all expenses incurred in the first month of the plan.

- Total Spending Goal is the sum of all expenses incurred in all months of the plan.

- Unfunded Spending is the sum of all expenses that cannot be met with the assets and income sources available to the plan.

- Projected Gross Income is the sum of all gross (pre-tax) account withdrawals, other income sources, and annuity payments/distributions projected throughout the plan.

- Excess Income is the sum of all net (after-tax) income that is received which exceeds the income requirement and associated tax liability throughout the plan.

Obligations features a chart that rolls up all projected taxes through the plan by type. More info on all included tax types can be found here.

- Pre-Plan Projected Tax: Total projected value of all taxes owed prior to the plan start/start of Segment 1. This figure is generated using any Other Income, Roth conversions, or annuity purchases that would be considered taxable events.

- Plan Projected Tax: Total projected value of all taxes owed during the plan/after the start of Segment 1. If a plan starts mid-year, the entire calendar year’s worth of taxes are included in this figure.

- Total Projected Tax: Total projected value of all taxes owed prior to and during the plan.

- Total Projected IRMAA is the sum of all projected Income Related Monthly Adjustment Amount surcharges throughout the plan.

- Total Projected Penalties is the sum of all projected early withdrawal penalties throughout the plan.

- Total Projected RMDs is the sum of all projected Required Minimum Distributions for both clients throughout the plan.

Standard disclosures are provided in the footer, as well as additional disclosures specific to this illustration in the Disclosures section at the end of the report.

Jump to the next report module: