Plans can be built using a targeted income, a targeted asset level, or both. Learn about the options available in the Solve Settings tab below.

The Solve Settings tab allows you to select how you would like to approach solving the income plan. There are three options.

- Starting Monthly Income Goal (Net)

- Investment Goal

- Both Monthly Income Goal and Investment Goal

Based on the amount of information you may have about the client, you can approach the plan creation process from different starting points using these solve types.

Values on this tab can be affected by changes made to the plan Start Date, as well as other plan parameters found on the Inflation, Income Floors, Expenses, Segments, and Outside Segments tabs.

Any changes to selections and fields on the Solve Settings tab will automatically re-calculate the plan and update the charts and tables above.

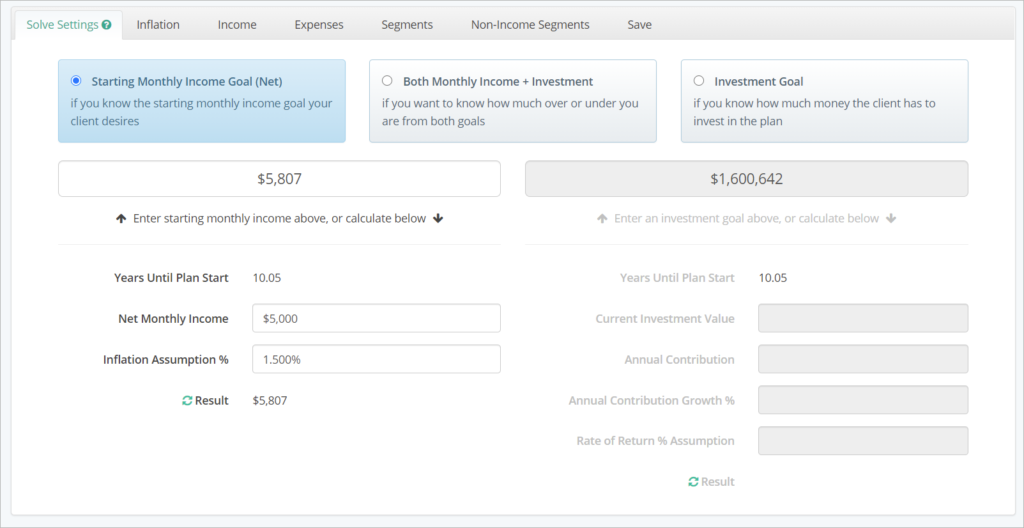

Starting Monthly Income Goal

By selecting Starting Monthly Income Goal, you can enter a specific starting net-of-taxes monthly income target for the plan. If the plan start date is more than a year away, you can use the calculator below to determine the future value of an income goal.

You can simply enter the income goal in today’s dollars, then enter an inflation assumption for the years prior to plan start. The future income goal will adjust automatically. The system will then calculate what investment asset level is required to meet the specified income need.

If you change the plan start date, be sure to click on the green arrows next to Result to refresh the FV calculator.

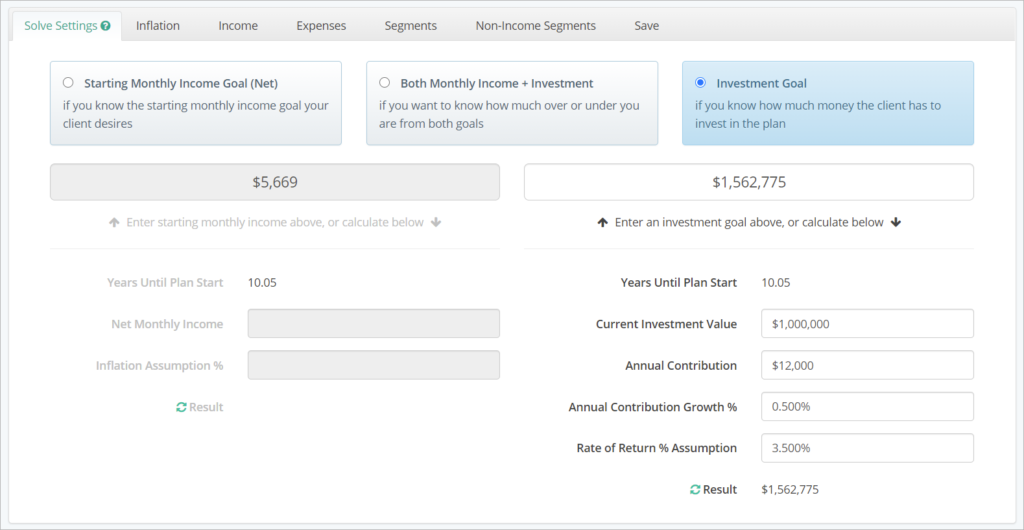

Investment Goal

When Investment Goal is selected, you can enter a specific investment asset level available for the plan. Like Starting Monthly Income, if the plan start date is more than a year away, you can use the calculator below to determine the future value of your client’s current assets.

This calculator will factor in planned contributions, growth in the rate of contributions, and estimated Rate of Return that the contributions and principal may achieve in the years until plan start. The system will then calculate the maximum starting net monthly income for the plan.

If you change the plan start date, be sure to click on the green arrows next to Result to refresh the FV calculator.

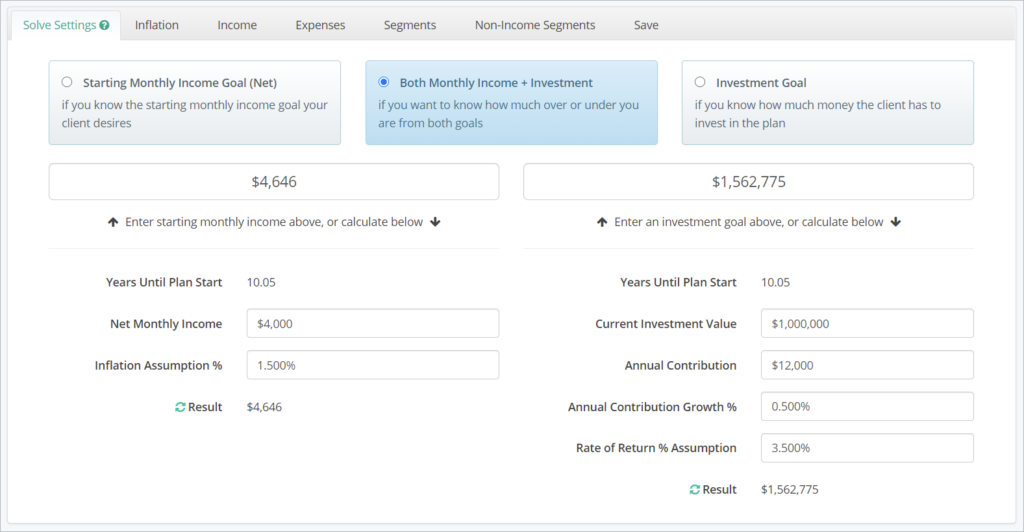

Both Monthly Income + Investment

When Both Monthly Income and Investment Goal is selected, you can enter both values, or use both calculators. The system will then calculate whether the plan has enough assets to meet your income goal.

If there is a surplus of assets, a Legacy\Longevity segment will be automatically created with the surplus. Read more about Legacy\Longevity segments and other Outside Segments. If there is a deficit of assets, the system will determine the level of the deficit and illustrate which goals will fail to be met in the charts and tables above. Deficit plans can only have Retirement Readiness Reports run on them.