Choosing an efficient Social Security claiming strategy with your client can result in significant differences in total plan income generated and the relative level of reliance on risk assets vs. “guaranteed” income streams. This tab encompasses all of the controls necessary to settle upon and implement a claiming strategy, resulting in new income floors for the plan.

Calculation Methodology

The calculation engine takes into account the estimated longevity of both clients in the plan, their Primary Insurance Amounts (PIA), assumed Cost of Living Adjustments (COLA), and Medicare Income-Related Monthly Adjustment Amount (IRMAA) bracket as determined by Modified Adjusted Gross Income (MAGI).

With this information, three strategies will be calculated: Earliest, Maximum Benefit, and Alternate. Maximum Benefit represents the strategy for achieving the maximum lifetime benefit, including consideration for survivorship benefits.

Required Information

As with longevity estimates and healthcare expense projection, the Social Security tools require the following information to have been input for the client during the new client workflow process or subsequently in the Clients tab:

- Date of Birth

- Retirement Age

- State of Residence

Additional data points are added in the Social Security tab to complete the calculations:

- PIA or Claimed Monthly Benefit (plus original claim date if already claimed)

- COLA (default estimate will be present upon plan creation)

- MAGI (default to lowest bracket)

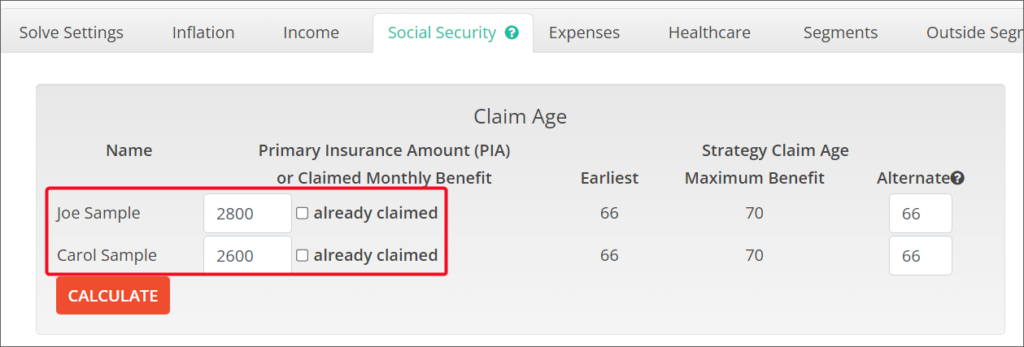

Primary Insurance Amount (PIA)

The “Primary Insurance Amount” (PIA) is the benefit (before rounding down to next lower whole dollar) a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement, or “full retirement” age. At this age, the benefit is neither reduced for early retirement nor increased for delayed retirement. Read more

Each client has their own PIA input field. As soon as a PIA is input into either client field, the Full (or Normal) Retirement Age (FRA) value for each client will appear in the Alternate age field and three claiming strategies will appear in the table below: Earliest, Maximum Benefit, Alternate. An income floor for each client will also be created using the Maximum Benefit strategy as the default selection.

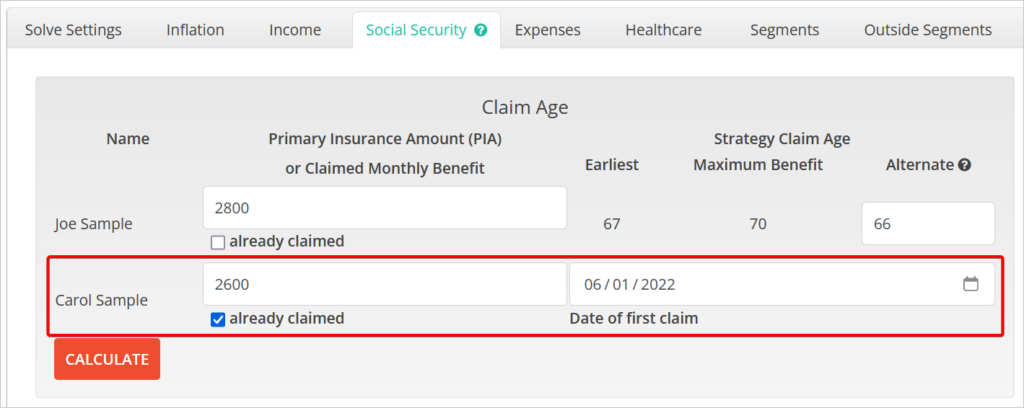

Already Claimed & Claimed Monthly Benefit

If one or both of the household members has already claimed their Social Security benefits, you can select the Already claimed checkbox next to their name and enter the gross monthly benefit that they are currently receiving. You will also be prompted to enter the date at which they claimed their benefits. Part B deductions will be applied to this benefit amount, so be sure to enter the entire benefit amount prior to Medicare deductions.

If only one member of the household is already receiving benefits, the Maximum Benefit claim strategy will still recommend the optimal claim age for the household member who has not yet claimed benefits.

If both members have already claimed, the choice of claiming strategy (Earliest/Maximum Benefit/Alternate) is irrelevant.

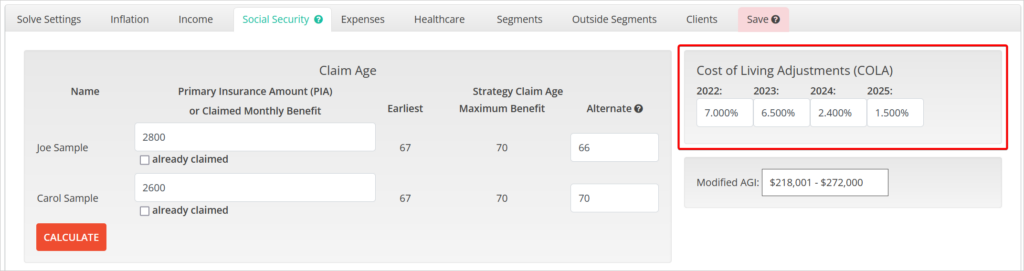

Cost of Living Adjustments (COLA)

Multiple COLA assumptions can be applied to the benefit streams. The four values available for input are:

- Current Year (ex. 2022)

- Second Year (ex. 2023)

- Third Year (ex. 2024)

- Fourth Year and Beyond (ex. 2025 and later)

By default, there will be assumed COLA estimates present in the fields. These can be modified at any time and will immediately update the claiming scenarios and associated income floors. Negative values are not accepted.

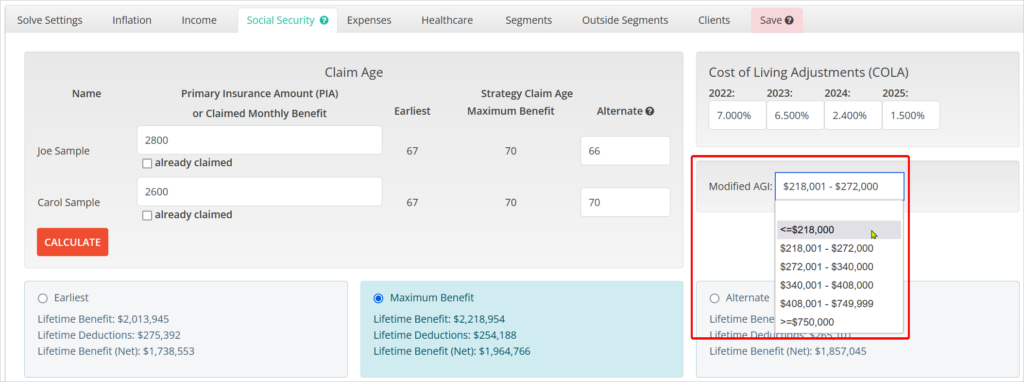

Modified Adjusted Gross Income (MAGI)

MAGI refers to an individual’s adjusted gross income (AGI) after taking into account certain allowable deductions and tax penalties. Medicare premiums and any IRMAA surcharges are based on your filing status and MAGI with a two-year lookback (or three years if you haven’t filed taxes more recently).

There are six income brackets within which the household can fall. These brackets vary whether the household is a single individual or a married couple filing jointly. Information on the current brackets can be found on the Social Security Administration website.

If the plan start date is within the next year, current brackets will be displayed. If the plan start date is more than a year from now, the bracket ranges will be adjusted upwards by a small inflation estimation. Changing brackets will immediately update the claiming scenario data and the associated income floors. If healthcare cost projections are being used, it will update those projections and associated expense item as well.

Claiming Strategies

There are three default claiming strategies generated upon entry of valid PIA values. Each scenario calculates household figures for Lifetime Benefit, Lifetime Deductions, and Lifetime Benefits (Net). Deductions include Medicare Part B premiums, as well as an IRMAA surcharges on Part B and Part D premiums. Lifetime Benefits (Net) = Lifetime Benefit – Lifetime Deductions. No taxes are included in the deductions. However, a tax rate can be assigned to the resulting income floors in the Income tab.

Switching between strategies will immediately update the associated income floors, and may update the projected healthcare spending data to reflect a change in years during which Part B will be deducted vs. billed directly due to the presence or absence of a Social Security benefits stream.

Data for all three strategies will be included in the Social Security Strategy Detail page of reports, with the chosen strategy highlighted in green.

Earliest

The “earliest” scenario will default to either 62, or the current age of the client if they are over 62 up to a maximum of 70.

Maximum Benefit

The “Maximum Benefit” scenario will present the ages at which each household member should claim their benefits to maximize the lifetime benefit of the household. This calculation recognizes survivor benefits and may result in a claiming strategy where a spouse with a lower longevity estimate may be suggested to claim later so as to increase the resulting survivor benefit.

Alternate

The “alternate” scenario will default to either the client’s Full Retirement Age, or their current age if they are past their FRA up to a maximum of 70. The alternate ages are customizable to create any combination of claiming ages. Valid entries are limited to the higher of either the client’s current age or age 62, or above their current age up to a maximum of 70.

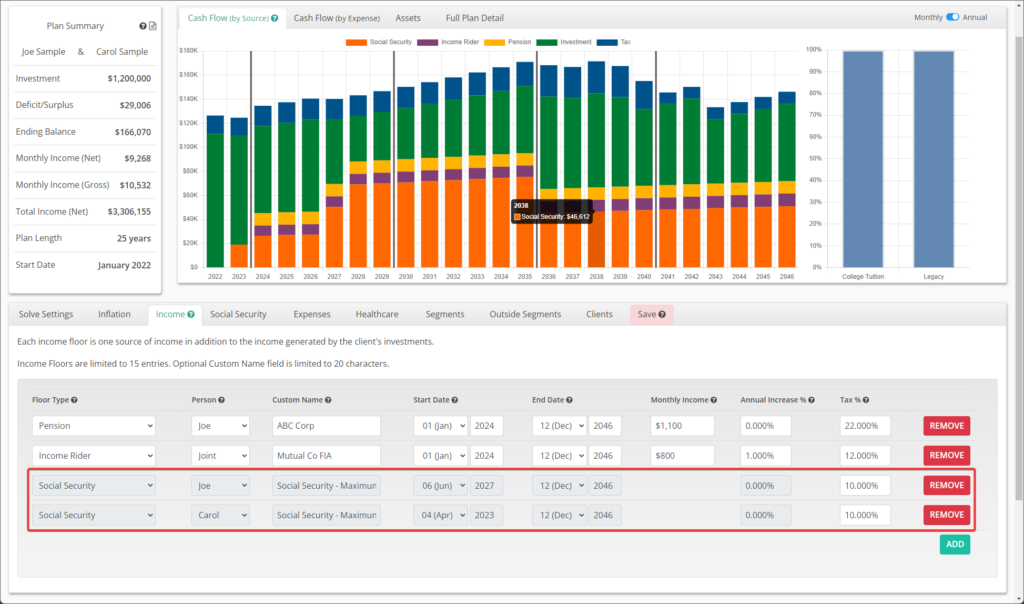

Auto-Generated Income Floors

Each time a Social Security claiming strategy is selected, the editor will add or update the existing income floors that represent the projected benefit stream for each client. You can view them along with any other income floors added under the Income tab.

Unlike standard income floors, you are not able to edit most attributes of the floor line item in the Income tab. All updates should be made in the Social Security tab. The only value that can be added is an assumed Tax % rate.

If you choose not to illustrate one or both of the new floors, you can click the red REMOVE button to delete them. If you want to re-add then, open the Social Security tab and click the CALCULATE button.

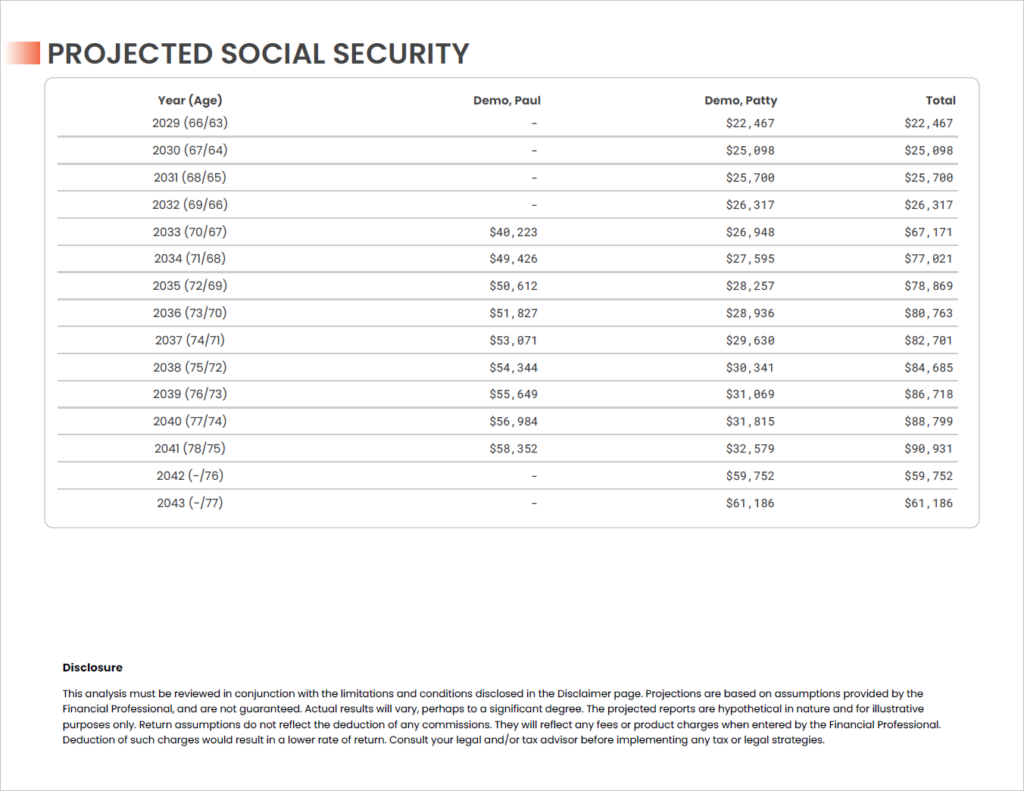

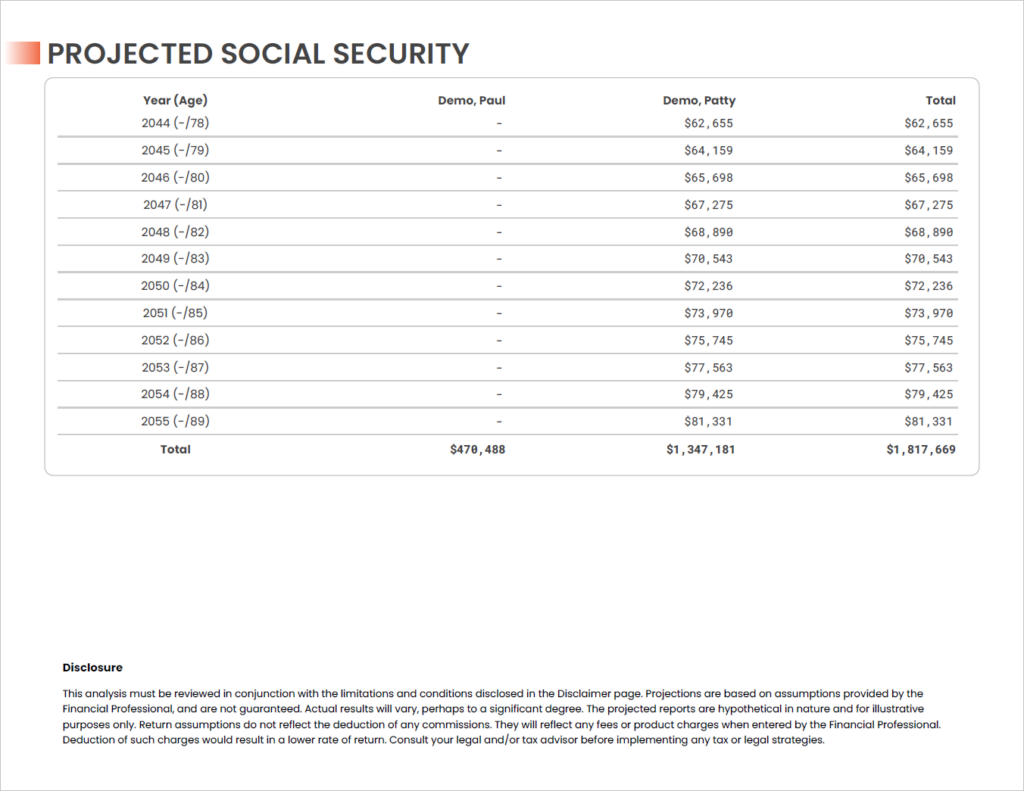

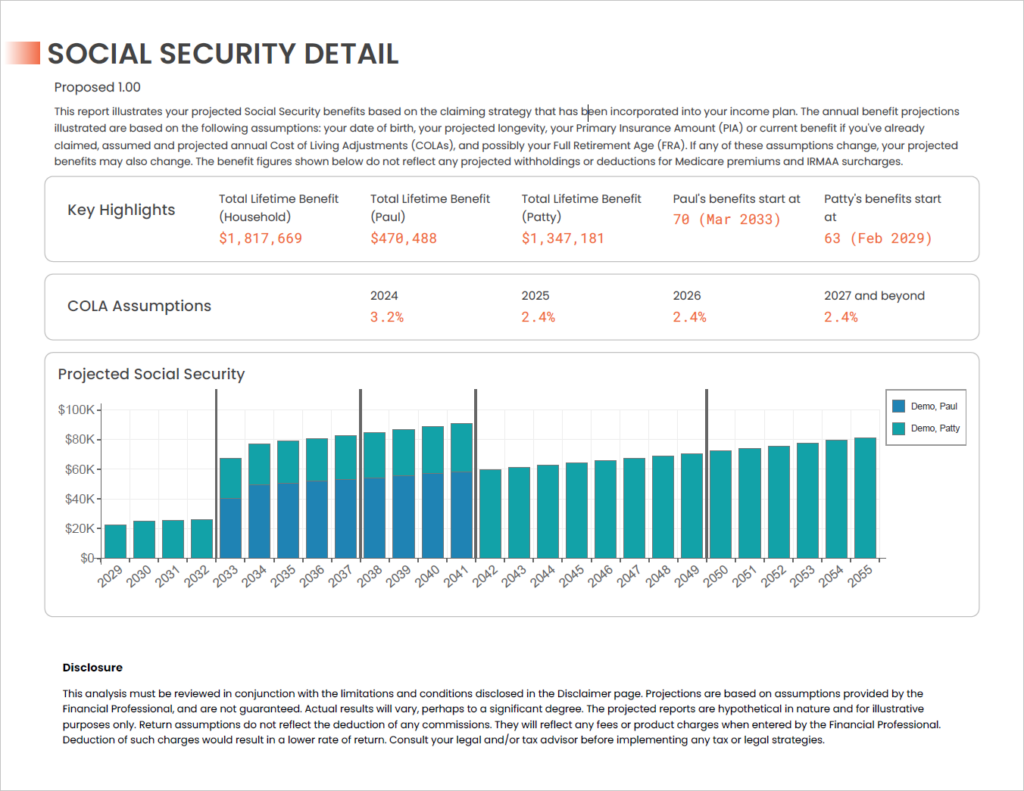

Social Security Detail Report

When running a Retirement Readiness, Proposal, or Approved Plan report for a plan with an auto-generated Social Security income floor, a new report section will appear after the Income Detail section. This section illustrates the chosen strategy both visually in a bar chart as well as below in a data table.

The bar chart shows benefits after both Part B/IRMAA deductions and any associated tax assumptions.

The data table does not illustrate the impact of any tax assumptions.