Inflation-proofing income is a critical part of creating a realistic income plan. The Inflation tab allows you to model different inflationary scenarios to help you determine how a client’s income goal should grow over time and maintain their spending power. Learn about the different ways that you can grow future income needs in the Inflation tab.

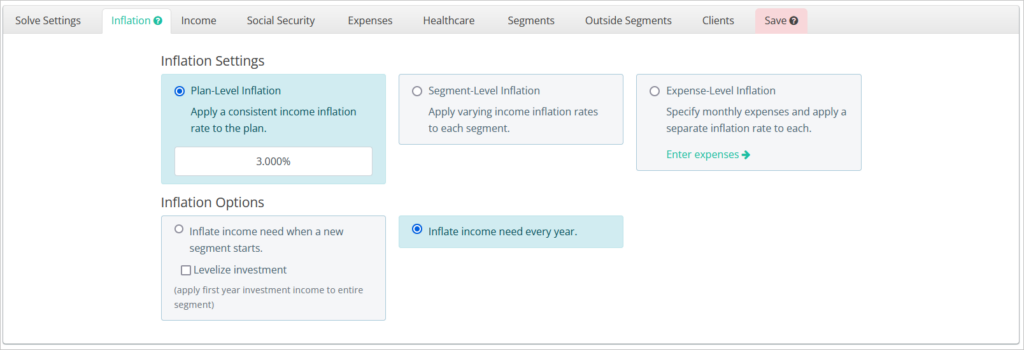

Inflation Settings

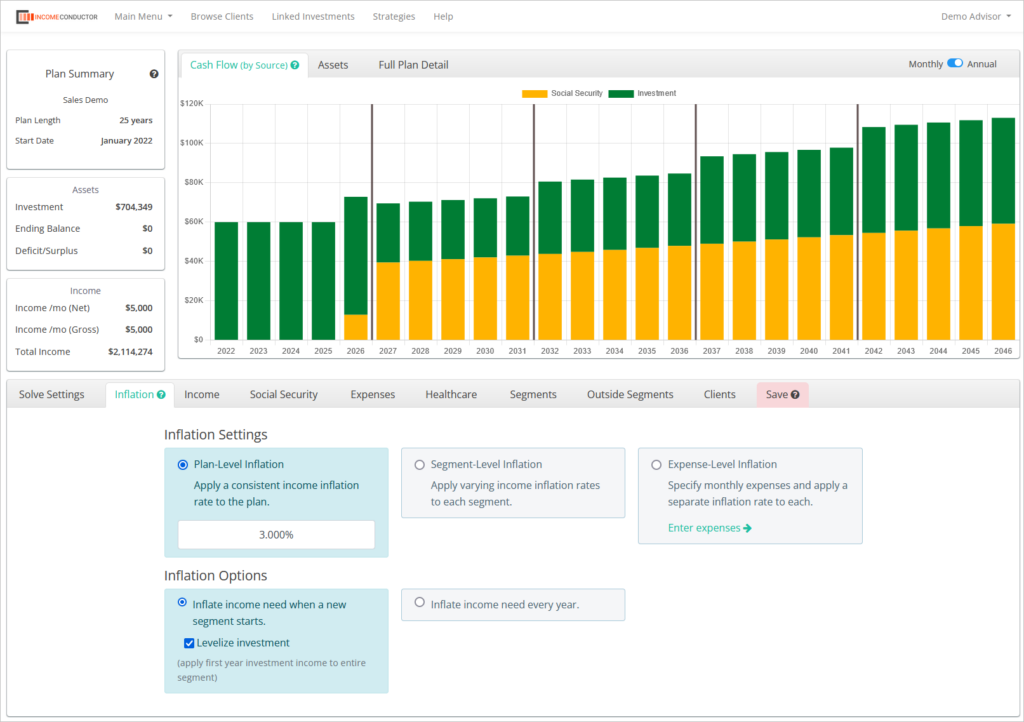

The first method is Plan-Level Inflation, which allows you to assign a consistent inflation rate to the income need across the entire length of the plan. The plan will automatically update when you enter a new inflation rate into the corresponding field.

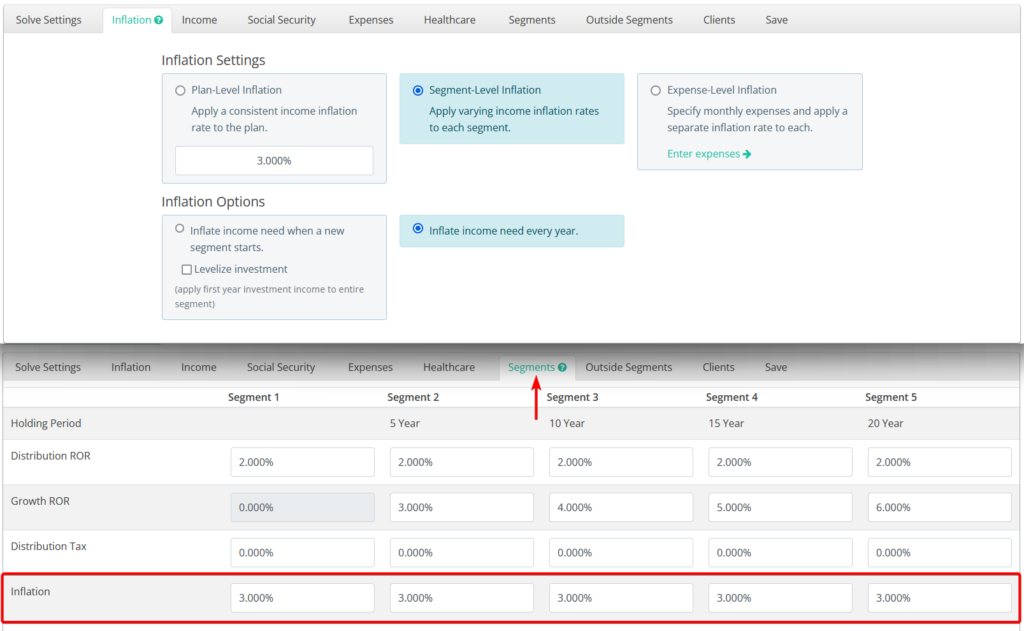

The second method is Segment-Level Inflation, which allows you to choose a different inflation assumption for each segment. When this option is chosen, you will see a new row appear in the Segments tab where you can set the inflation rate for each segment. The plan will automatically update each time you modify a segment inflation assumption.

The third inflation method is Expense-Level Inflation, which allows you to enter individual expense line items under the Expenses tab. You’ll notice that when Expense-Level Inflation is selected, the additional Inflation Options are no longer available. This is because expenses can come in and out of the plan after different times and grow at different rates, thus superseding the need to choose the frequency at which inflation is applied. Read more about Expenses.

Inflation Options

When using Plan-Level or Segment-Level inflation, there are two options available to choose the frequency with which inflation is applied.

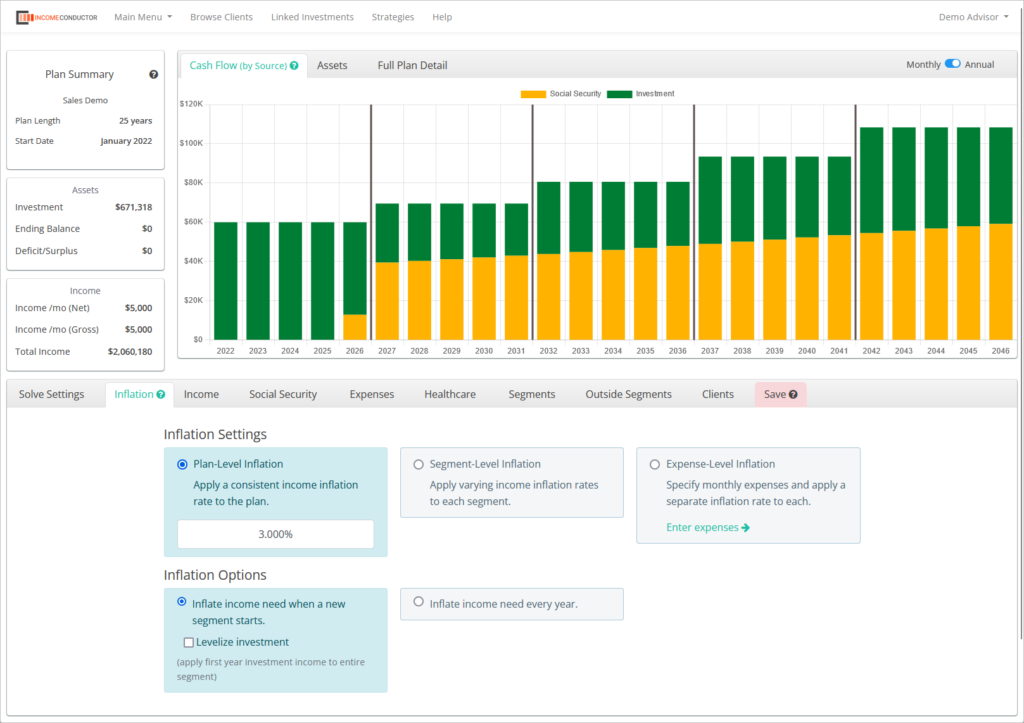

The first option is to inflate the income when a new segment starts. This option will level the income goal across a segment’s distribution period and then apply the accrued inflation to the next segment’s starting income goal. This may be useful when you plan to distribute segments from a fixed-payout vehicle.

You can see the distinctive stepped pattern in the cash flow chart as several years of segment inflation are applied all at once to the following segment’s starting income goal.

There is an additional option available when inflating at segment start called Levelized Investment. Checking this box will force the plan to maintain the calculated investment income distribution from the first year of the segment through all subsequent years of that segment. The distribution amount will reset at next segment start.

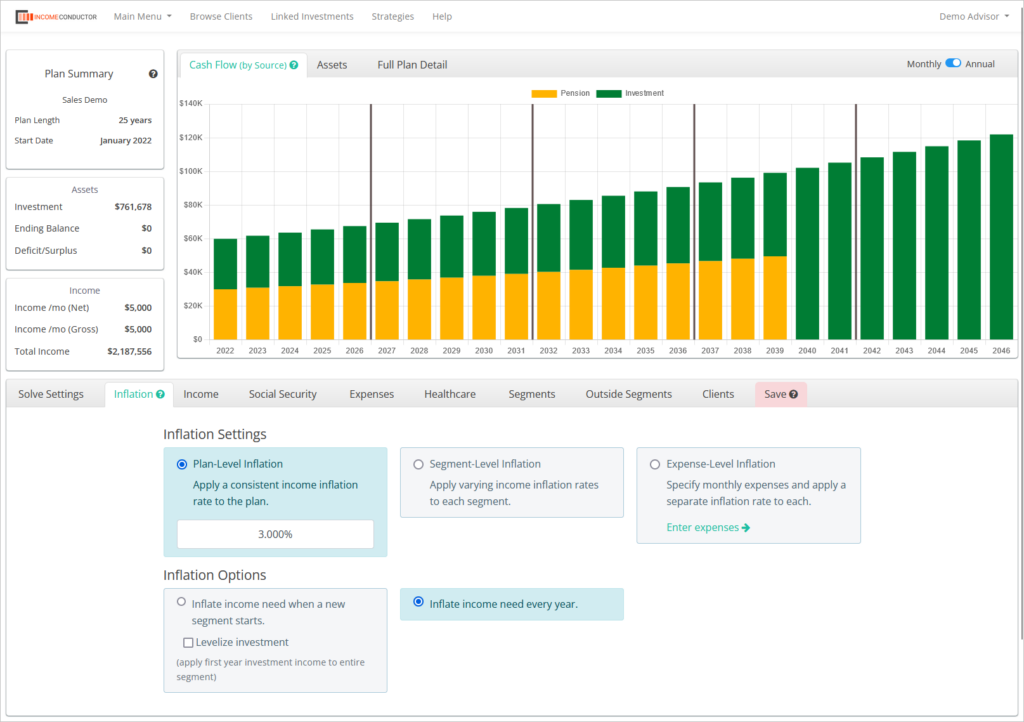

This option allows you to illustrate a consistent gross distribution across the segment based on decisions around implementation and execution of the plan operationally. Notice how the chart shows a slight incline year over year in each segment due to the COLA on the illustrated income floor vs. the flat steps on the image above.

When enabled, be sure to align the segment start dates with the start/end of income floors to avoid large spikes or dips in income due to the levelized distributions.

If an income floor ends in the middle of a segment with this setting enabled, you will see a deficit in the income for the remainder of the segment. Simply drag the segment divider to align with the ending year to recalculate with an inflation adjustment at the new segment start.

More info on modifying segment lengths and segment count can be found here.

The second option is to inflate the income goal every year. This option creates a smooth increase in the income goal year-by-year. You may notice the Total Income generated by the plan change under the Plan Summary area as you switch between inflation options.