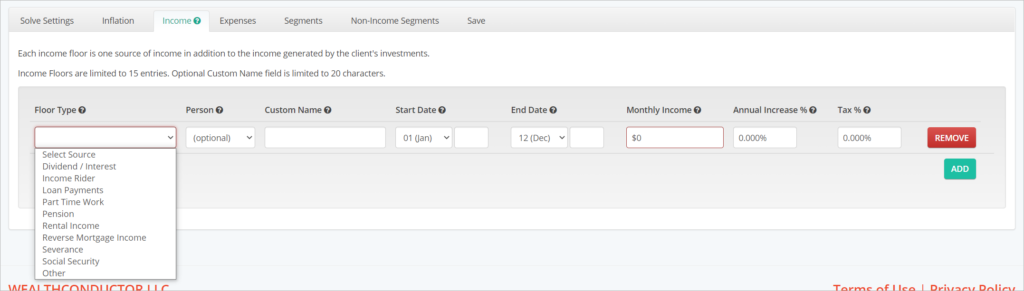

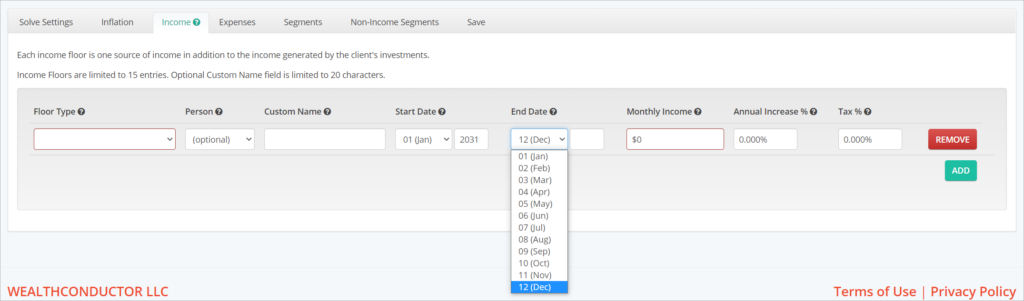

The Income tab allows you to enter all the other income sources that the client may have available to them during their plan besides the income that will be provided by their investments. These sources typically include Social Security, Pensions, Rental Income, Income Riders, and more.

Floor Type (Required)

There are some standard categories listed in the Floor Type field. If the income floor you are entering does not fit one of these categories, you can simply choose “Other”. Floors that are placed in the same type will be grouped together in the same color on the Cash Flow Chart.

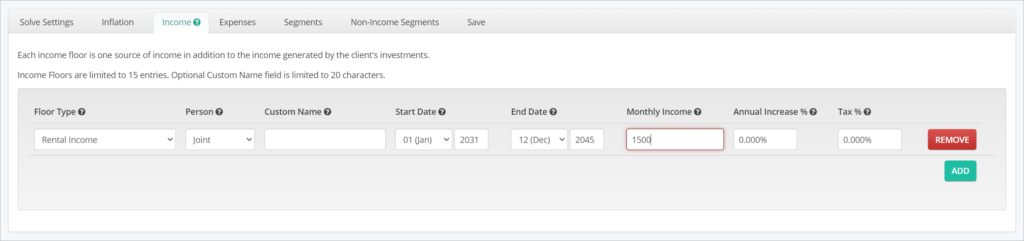

Person (Optional)

The Person field will appear if there are two clients associated with the plan. This field allows you to associate an income floor with one of the plan household members or select Joint to indicate that it is shared. The specified owner of the income floor will appear in the income illustration on client reports.

Start Date (Required)

The Start Date is the first month and year that this floor will appear in the plan. You can choose a month and enter a calendar year. By default, when a Floor Type is chosen, the system will start the income floor in January of the first year of the plan.

End Date (Optional)

The End Date can be used to terminate an income floor prior to plan end. If the floor will be available for the whole plan, you can simply leave this field blank and it will default to December of the last year of the plan. Like Start Year, you can enter this value in calendar years or plan years.

Monthly Income (Required)

The Monthly Income should be entered as what this income stream is estimated to provide in the first calendar year of the plan. You can enter a gross figure and apply a tax rate to net the income down, or enter a net figure and leave the tax rate at the default of 0%.

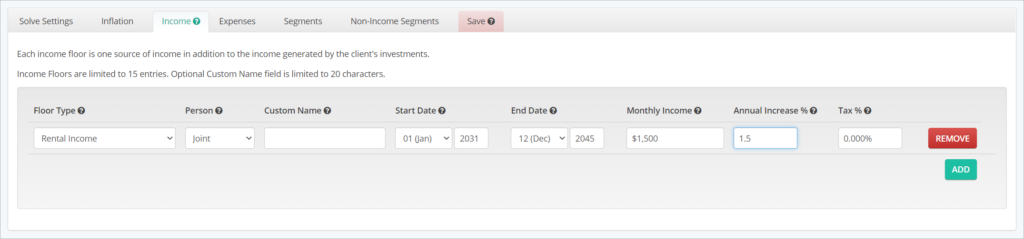

Annual Increase (Required)

The Annual Increase field allows you to grow and shrink the floor’s income stream over time. You can enter positive or negative annual growth rates here, with up to 3 decimal places. By default, the Annual Increase value is set to 0%.

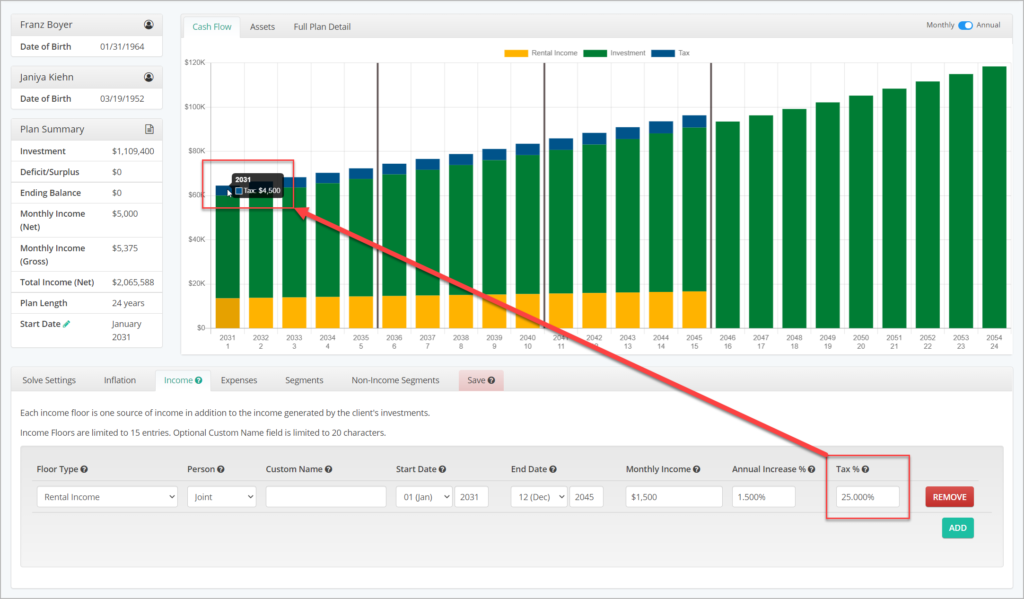

Tax % (Optional)

The Tax field allows you to enter an assumed effective tax rate on this income floor. The gross income available to the plan from this income floor will be reduced by the percentage value input in this field, resulting in a net income.

If you are not sure what to enter here, or wish not to use this calculation, simply leave it blank and it will default to 0%t. If you do enter an estimated tax rate, you will see the plan re-calculate and the tax liability from this income stream is now visible in blue on the Cash Flow chart above. The bars in the Cash Flow Chart for income floors that are taxed always illustrate the net income from that floor.

You can continue to create additional income floors for a total of up to 15, by clicking the green ADD button beneath the first row. If you wish to entirely remove a floor that you have added, simply click the red REMOVE button in the corresponding income floor row. Remember, the plan will not recalculate until you have entered valid inputs into the required fields for each income floor.