Studies have shown that planning for healthcare costs in retirement is one of pre-retirees’ top concerns. The healthcare projection functionality of Health+ gives you the tools and data to have informed discussions with your clients about Medicare and out-of-pocket healthcare expenses that they may face. You can incorporate these projections seamlessly into their income plan.

Calculation Methodology

Drawing on actuarial and government data, as well as 530 million medical claims, these projections use a patented data process that utilizes simple user inputs to create personalized estimates of retirement healthcare costs. The data also incorporates inflation projections for each component of retirement healthcare: Medicare premiums, supplemental insurance, commercial coverage and out-of-pocket spending.

Required Information

As with longevity estimates and Social Security modeling, the healthcare projection engine requires the following information to have been input for the client during the new client workflow process or subsequently in the Clients tab:

- Date of Birth

- Retirement Age

- State of Residence

- Gender

- Health Conditions / Lifestyle Choices

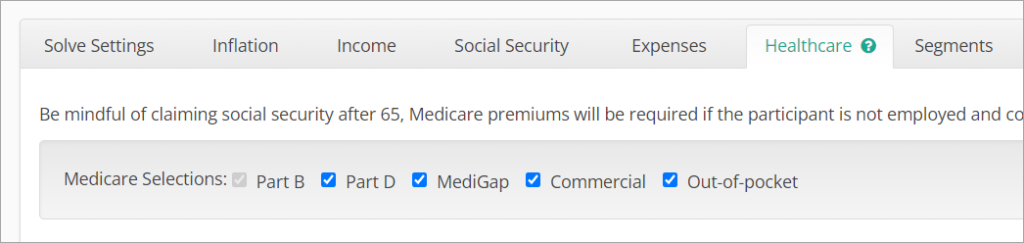

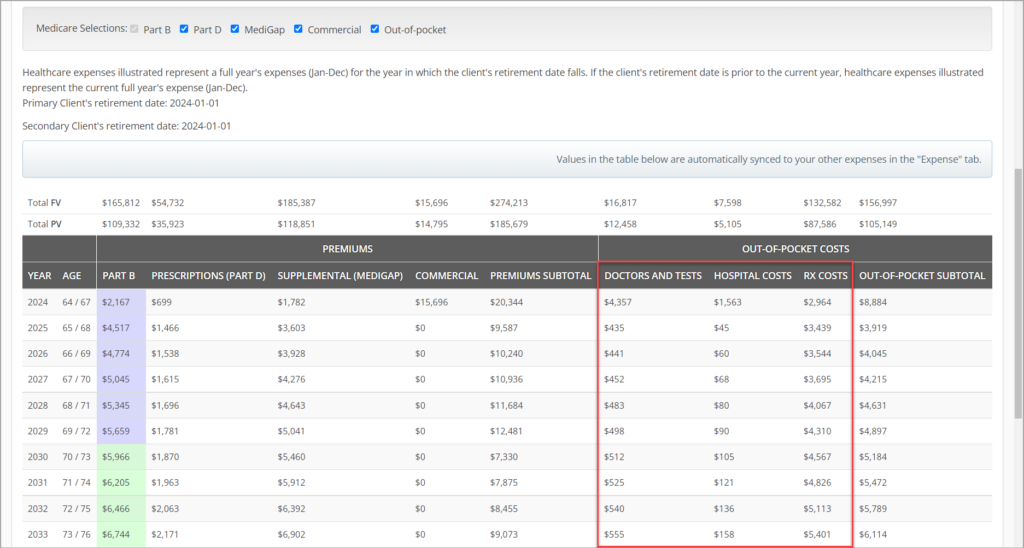

Spending Categories

Spending estimates are split into five major categories. Any categories that are selected will contribute to the annual value of the resulting Healthcare Expense. You can include or exclude each category from the resulting expense item by checking or unchecking the corresponding box.

- Medicare Part B

- Medicare Part D

- MediGap (Supplemental) Insurance

- Commercial Premiums

- Out-of-Pocket, composed of:

- Doctors & Tests

- Hospital Costs

- Prescription Costs

Medicare Part B Premiums

Medicare Part B covers medical treatments and services under two classifications: “medically necessary services” and preventive services. In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. These include services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Projected costs include premiums only. Associated deductibles are included as part of the Out of Pocket category. The estimated changes in Part B premiums for the coming eight years is based on projections published in the Medicare Trustees Report (Pgs. 198/199).

Your client has a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to their 65th birthday, the month containing their 65th birthday and the three months that follow their birthday month.

Part B is included in all illustrations because your clients will generally incur auto-enrollment, especially if they are already receiving Social Security benefits by age 65. Delaying enrollment may result in a penalty.

Because Part B is automatically deducted from an available Social Security benefit payment, the associated premium for any years in which a client is enrolled in Medicare and collecting Social Security is excluded from the resulting Healthcare Expense item.

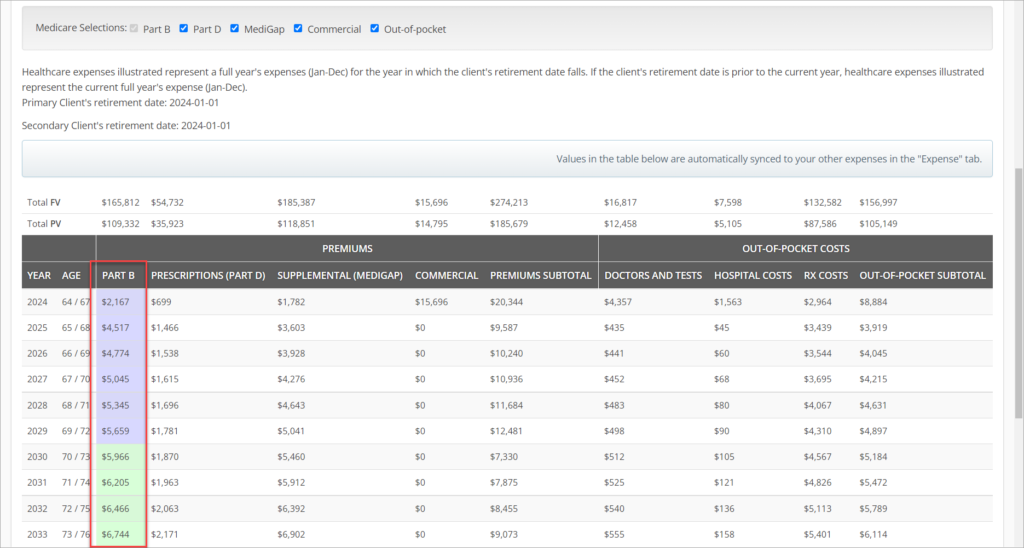

The cells in the data table for years when the Part B premium is deducted from Social Security are highlighted in green, and years in which Part B is billed directly to the client are highlighted in blue.

In the example below, both clients are claiming at age 70, so all of the Part B premium is billed to them in 2024-2026, and the primary client’s part B continues to be billed in 2027-2029. In 2030, both clients have enrolled in Medicare and claimed Social Security benefits.

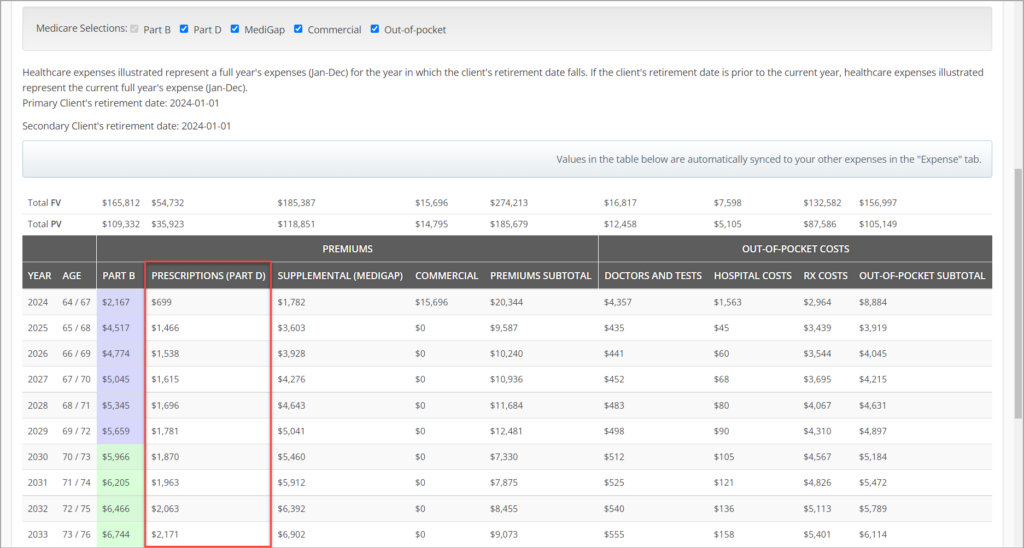

Medicare Part D Premiums

Sold by private insurance companies, Medicare Part D covers prescription drugs for those who choose to enroll. Although plans vary by state, there are several plans offered throughout the United States with similar coverage and premiums. Part D coverage is voluntary. In order to make the best decision, your client should to take into consideration their health, prescriptions, income and budget.

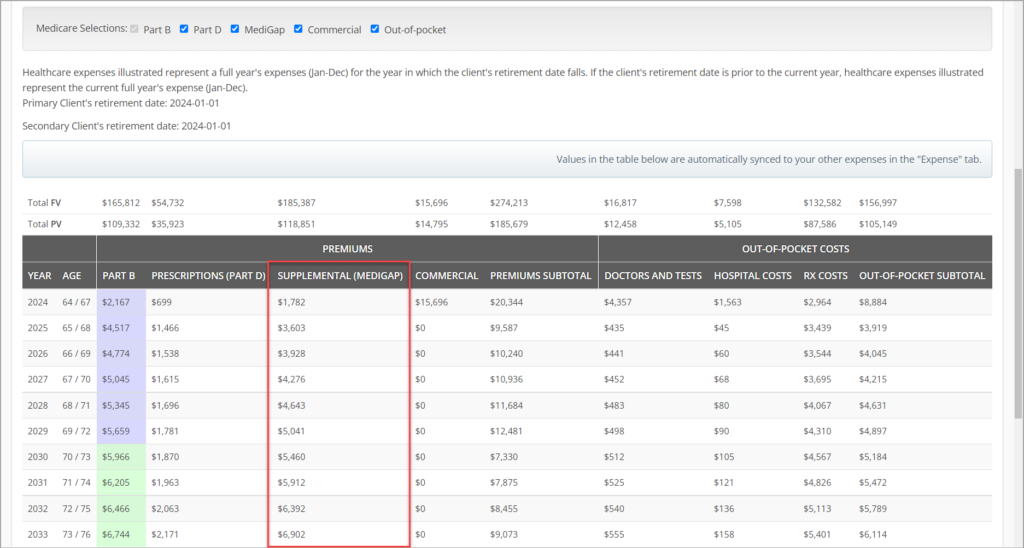

MediGap (Supplemental) Insurance

Medigap coverage is a Medicare supplemental insurance policy. It is offered by private companies to assist in paying for healthcare expenses that are not covered by Original Medicare (Part A and Part B). Your client must have Medicare Part A and Part B if they wish to purchase a supplemental Medigap policy. Medigap policies are available from any insurance company licensed in their state.

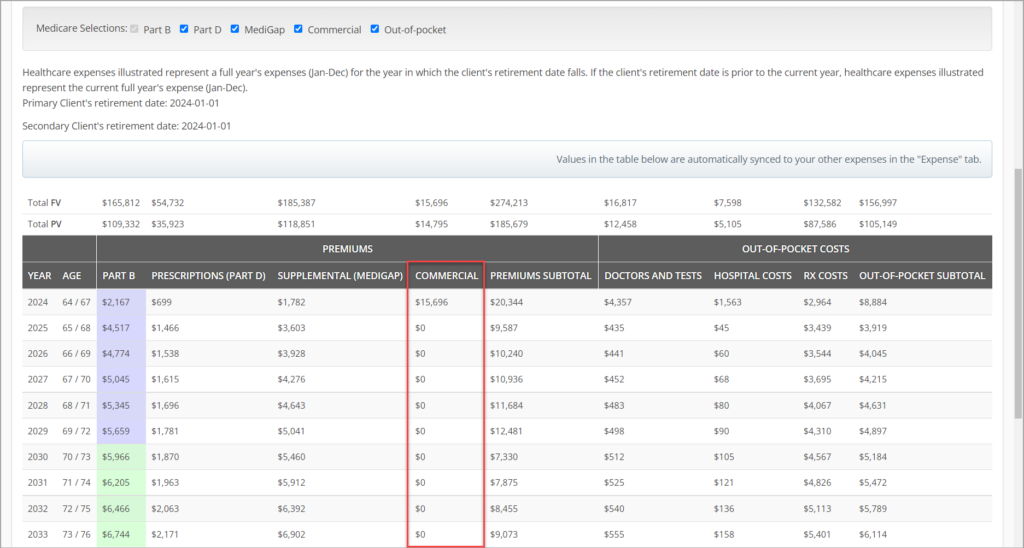

Commercial Premiums

In instances where a client is planning to retire before 65, and is either single or will not be covered by a working spouse’s insurance, you can elect to illustrate estimated commercial insurance premiums. These figures represent estimates of what a client may pay when signing up for a policy through a private insurer on the open marketplace.

Out-of-Pocket Costs

Any medical costs incurred by the client that are not covered by their insurance fall under this category. This typically includes co-pays, co-insurance, and deductibles. The category is broken out into the sub-categories of Doctors & Tests, Hospitals, and Prescriptions for illustration purposes. All of these sub-categories will be included or excluded when you choose to out-of-pocket cost estimates or not.

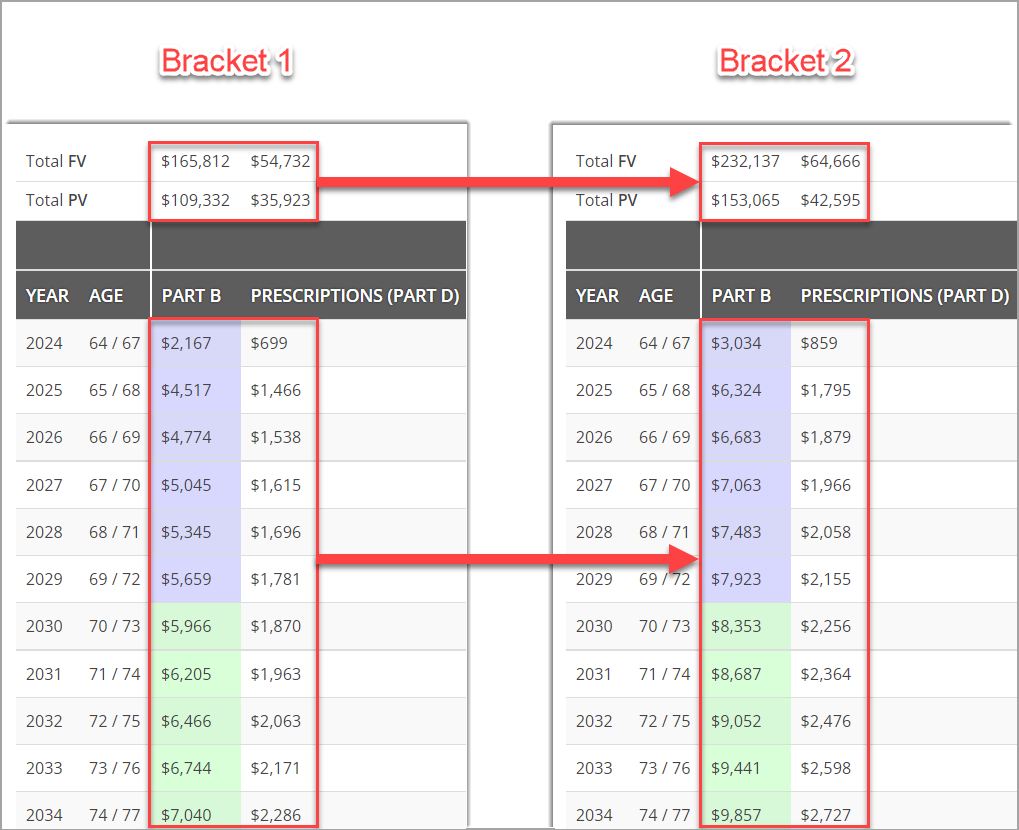

IRMAA Surcharges

Depending on the selection made for your client’s Modified Adjusted Gross Income (MAGI) bracket, there may be IRMAA (Medicare Income-Related Monthly Adjustment Amount) surcharges applied to the Part B and Part D premium estimates.

For example, by moving the client shown below from the lowest MAGI bracket to next bracket up, we can see that annual costs in 2024 have risen by over $1000. The impact becomes more significant over time.

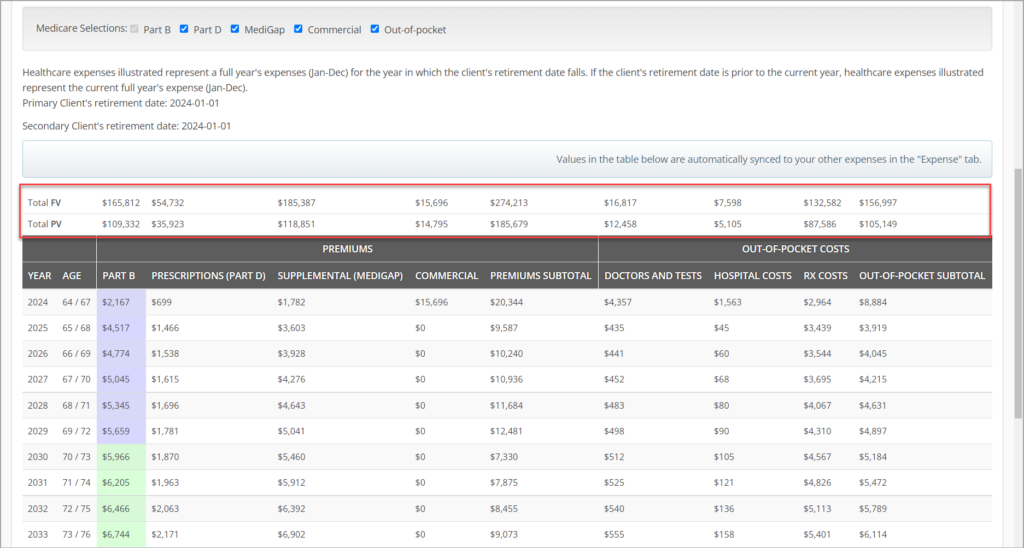

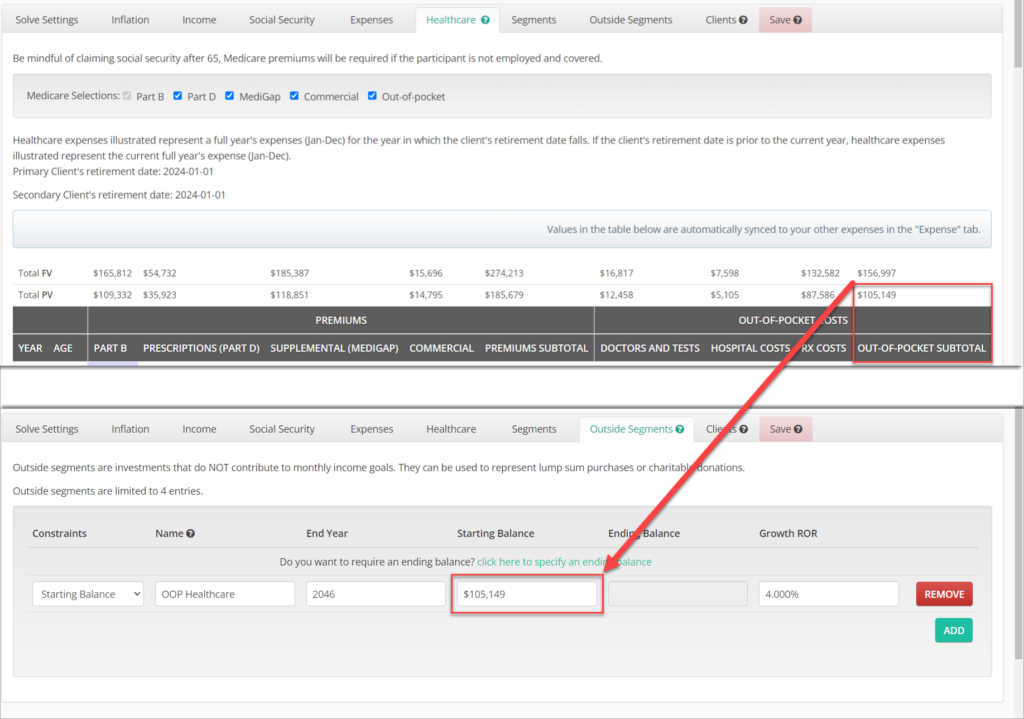

Total FV / Total PV

Each spending category includes a Total FV (Future Value) and Total PV (Present Value). Total FV is the sum of all spending for the category or subtotal of category groups (Premiums vs. Out-of-Pocket Costs) over the course of the plan. Total PV is derived by applying a 3% discount rate to Total PV.

Total PV can be useful for electing whether you prefer to illustrate spending on out-of-pocket costs as a regular part of the monthly healthcare expense stream, or by dedicating assets into an Outside Segment at the beginning of retirement that can be drawn from as needed.

By creating a separate segment with a starting value equal to the Total PV of out-of-pocket costs, you can set aside a medical spending fund that can be accessed as healthcare is consumed vs. on a scheduled basis.

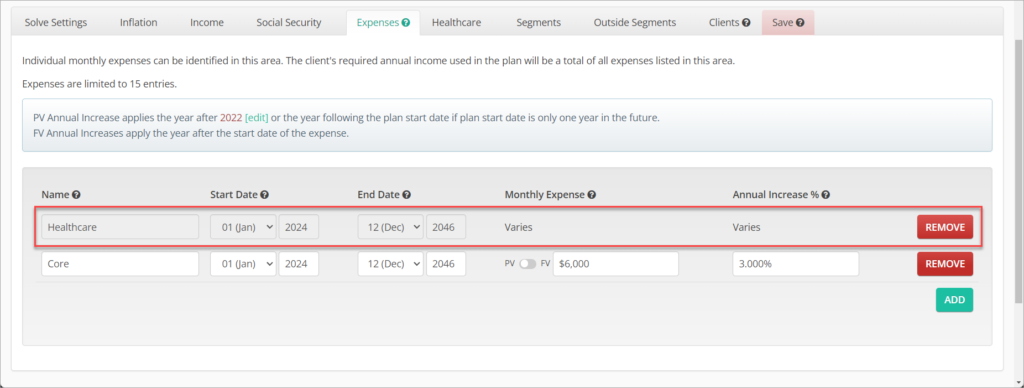

Auto-Generated Expense Item

When you have expense-level inflation selected, upon opening the Healthcare tab a new expense line item will be generated. By default, it will only include Part B cost estimates. As you add or remove other coverage options, the expense will update and the plan will recalculate to incorporate the new elections.

The expense cannot be edited in the Expenses tab, as the contributing factors are controlled in the Healthcare and Clients tabs. If you no longer wish to incorporate the healthcare cost estimates, you can click the REMOVE button to delete the expense item.

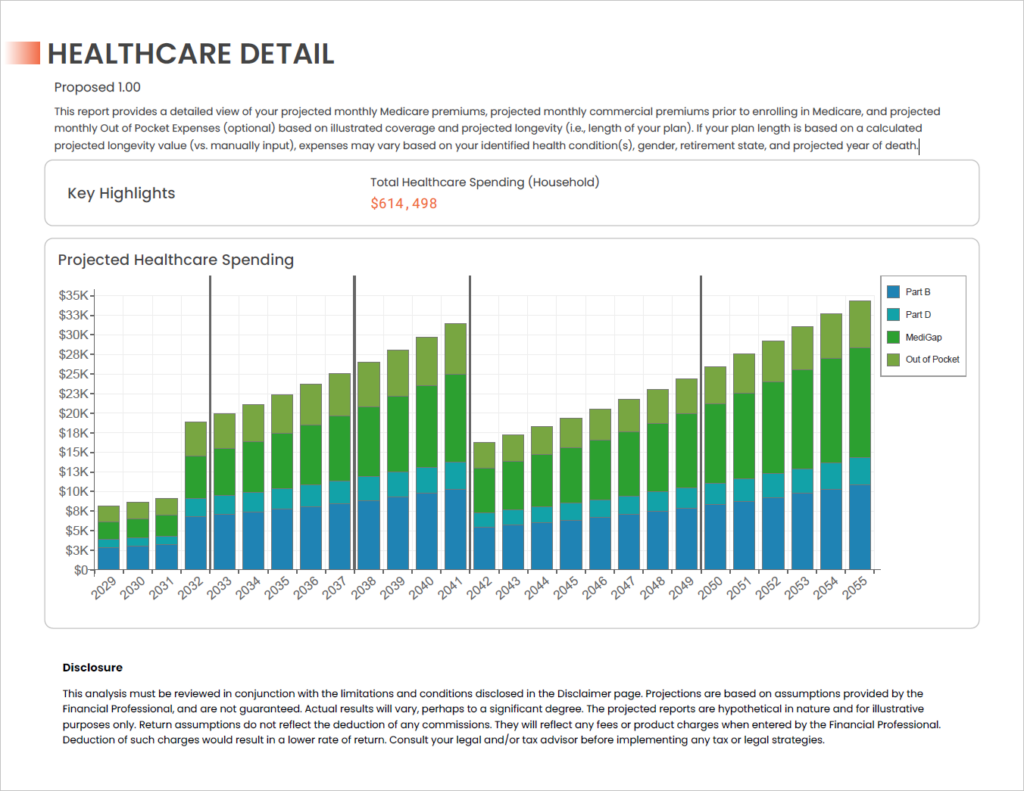

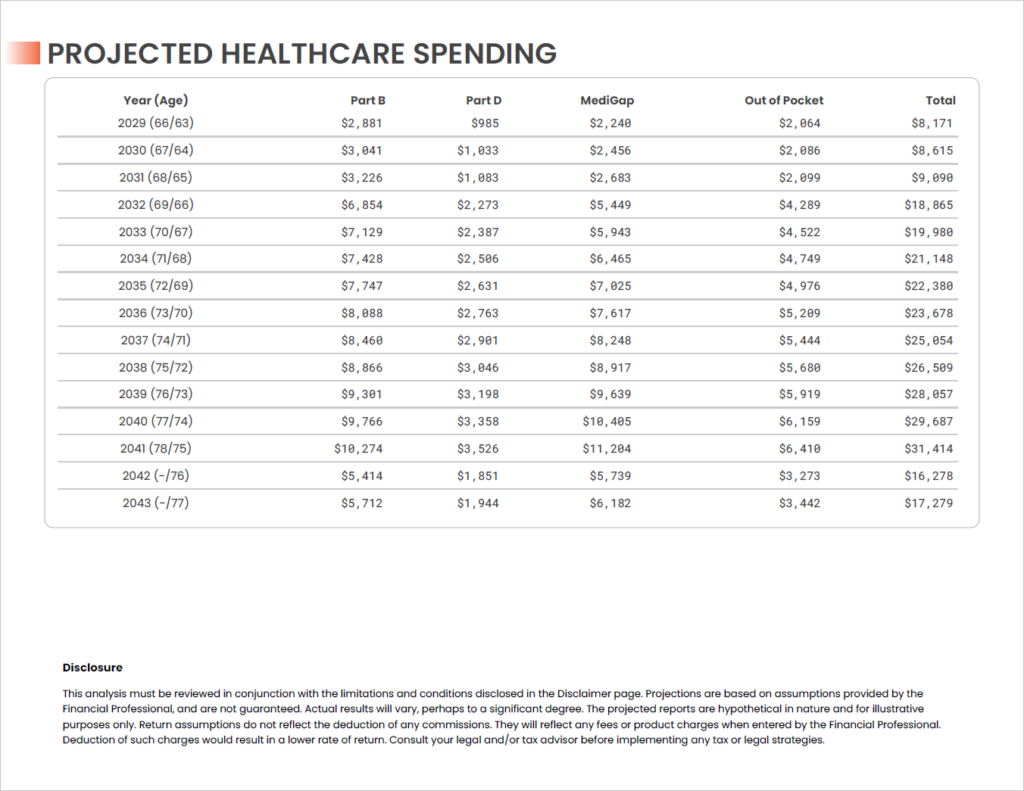

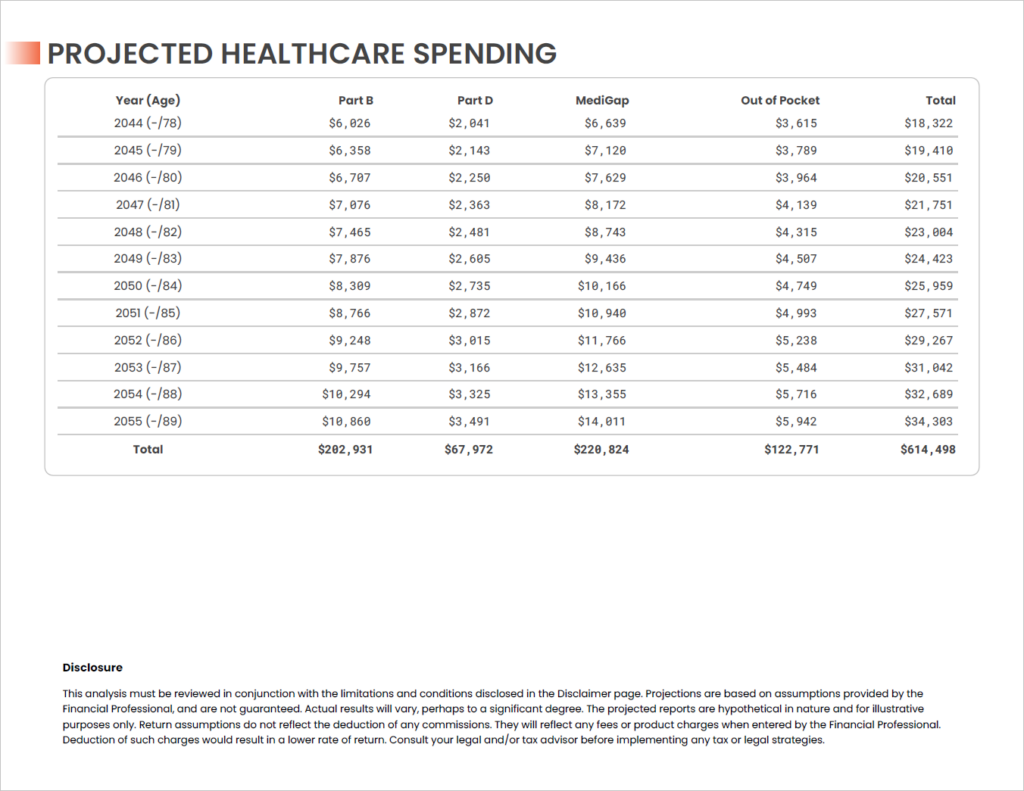

Healthcare Detail Report

When running a Retirement Readiness, Proposal, or Approved Plan report for a plan with an auto-generated healthcare expense item, a new section will appear at the end of the report after the Plan Summary page. This new section illustrates the healthcare cost estimates included in the plan both visually in a bar chart as well as below in a data table.