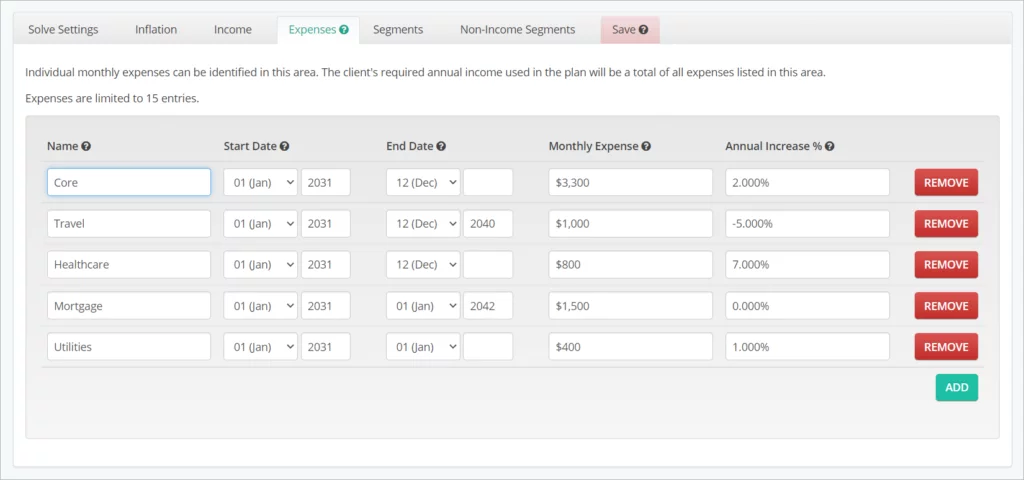

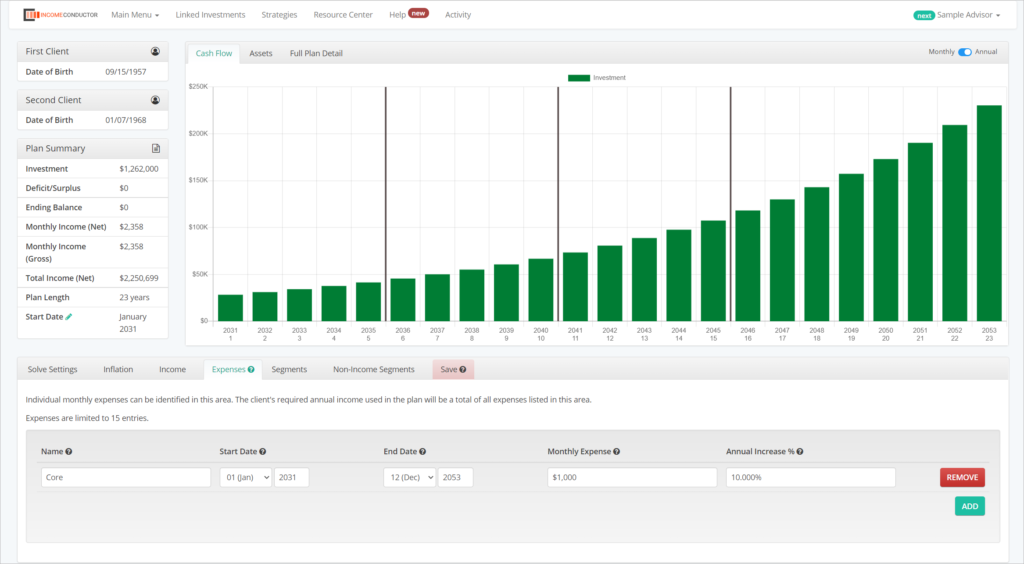

Build the income need at the budget level by breaking spending into separate categories that can start and end throughout the plan, and growth or decrease at different rates. You can add up to 15 different expense categories to a plan.

Expenses are a simple and flexible way to customize a changing income goal over time. You can see how easy it is to create a unique cashflow illustration that fits the client’s needs in just a few minutes. All details of the expenses added here will be visible in client reports.

Activating the Expenses tab

To utilize the Expenses tab, you must first have a Solve Setting of type

- Starting Monthly Income Goal

- Both Monthly Income and Investment Goal

As well as your inflation setting assigned to Expense-Level Inflation. If these conditions are not met, you will notice a warning message on the Expenses tab and will not be able to input any expenses.

For an expense to factor into the plan, it must have a Name, Start Date, Monthly Expense, and Annual Increase. If any of these fields are missing values, or the value is invalid, the plan will not re-calculate and incorporate the expense. Like the Income Floors, an End Date input is not required. If left blank, the system will assume the expense will continue through the end of the plan.

To add a new expense, simply click the green ADD button under the last expense row. To complete remove an expense you have already entered, click the red REMOVE button in the corresponding expense row.

Name (Required)

The name field is free-form and can be up to 20 characters long. Some examples of expense categories are Core Spending, Mortgage, Travel, Healthcare, or Utilities.

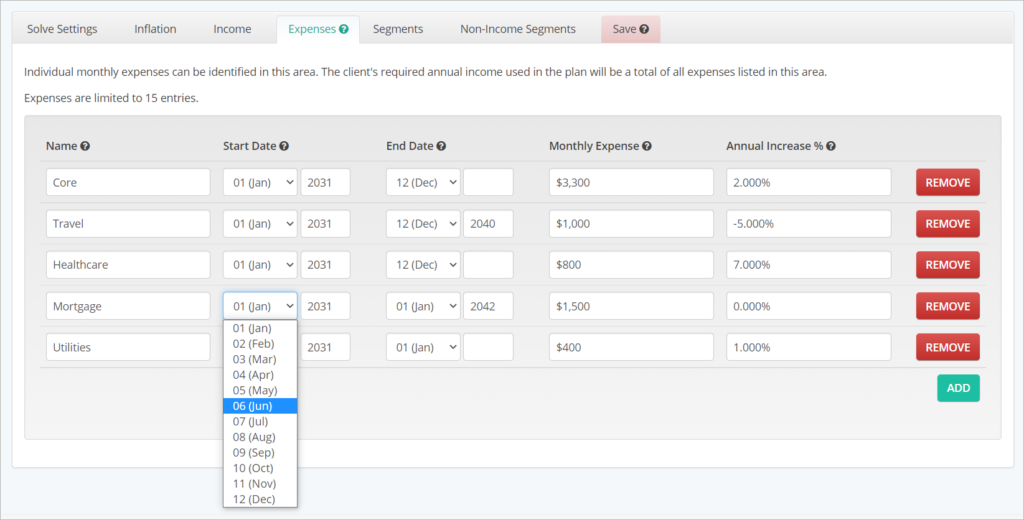

Start Date (Required) and End Date (Optional)

Expenses can be illustrated to begin and end at any point during the plan, so Start Date and End Date entries can be any month within the plan period. By default, Start Date will be set to the first month of the plan and End Date is the last month of the plan.

Monthly Expense (Required)

Monthly Expense values should be entered based on their assumed level at plan start. Depending on the current settings for the Cash Flow chart, you may see the expenses illustrated as starting monthly values or cumulative annual values for each year.

Annual Increase % (Required)

Annual Increase percentage can be a positive or negative value to demonstrate the expense increasing or decreasing over time. This field allows each expense to have its own growth rate and create a blended income need inflation rate for each year of the plan. By default, this field is set to 0%.