Segments that have not entered their distribution phase yet are typically invested to provide market opportunity. The assets in these segments will often fluctuate in value due to market volatility which can potentially create situations where the segment’s growth is ahead of plan.

As discussed in the Tracking Dashboard article, the segment’s surplus or deficit vs. plan will influence the Required ROR for that segment to reach its end of segment value goal. When the Required ROR for a segment reaches 2.0% or less, IncomeConductor will generate an email notification informing you.

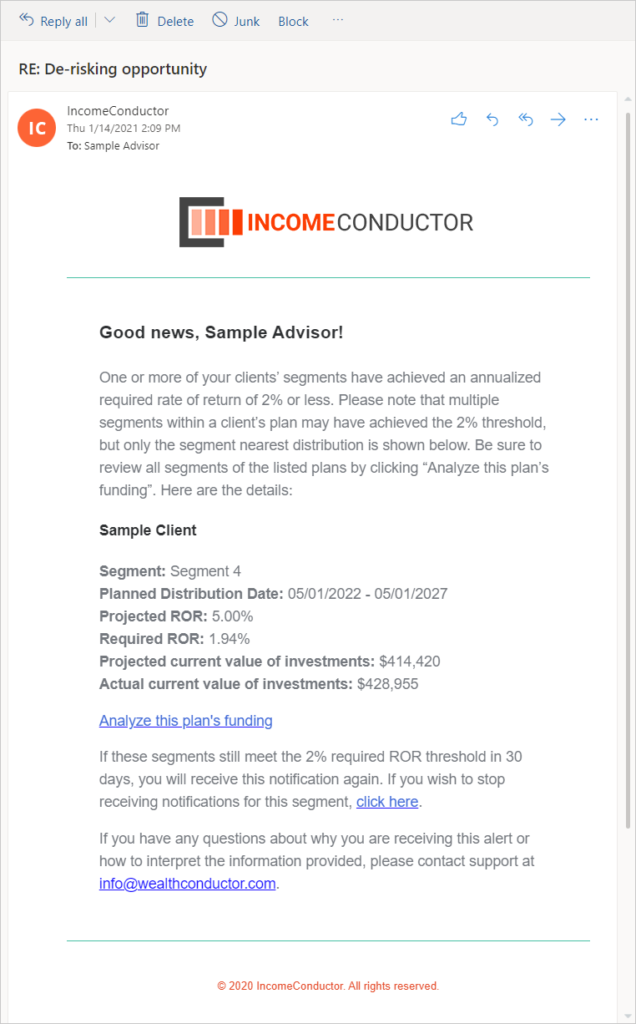

De-Risking Email

The automated email you receive has a number of data points on the segment in question.

Segment: The name of the segment generating the alert. Custom names for segments will appear here.

Planned Distribution Date: The period over which this segment is targeted to liquidate for income distribution.

Projected ROR: The ROR goal for this segment from the Approved plan.

Required ROR: The average annualized net rate of return necessary to reach the target end of segment value.

Projected current value of investments: Assuming linear growth, this is the dollar value that the segment’s assets should be worth as of today if the segment is exactly on target.

Actual current value of investments: The sum of the values of all securities linked to this segment.

By clicking Analyze this plan’s funding, you will be taken into IncomeConductor to view the plan in the Invest area.

Next steps

Check out the Tuning Tip: You Received a De-Risking Alert…Now What? to learn about discussing de-risking opportunities.