The age at which clients are intending to retire and their associated longevity estimates will dictate the length of their income plan. Sometimes it may be necessary to change the assumptions for these figures to illustrated different scenarios. The Clients tab has the controls necessary to change these figures.

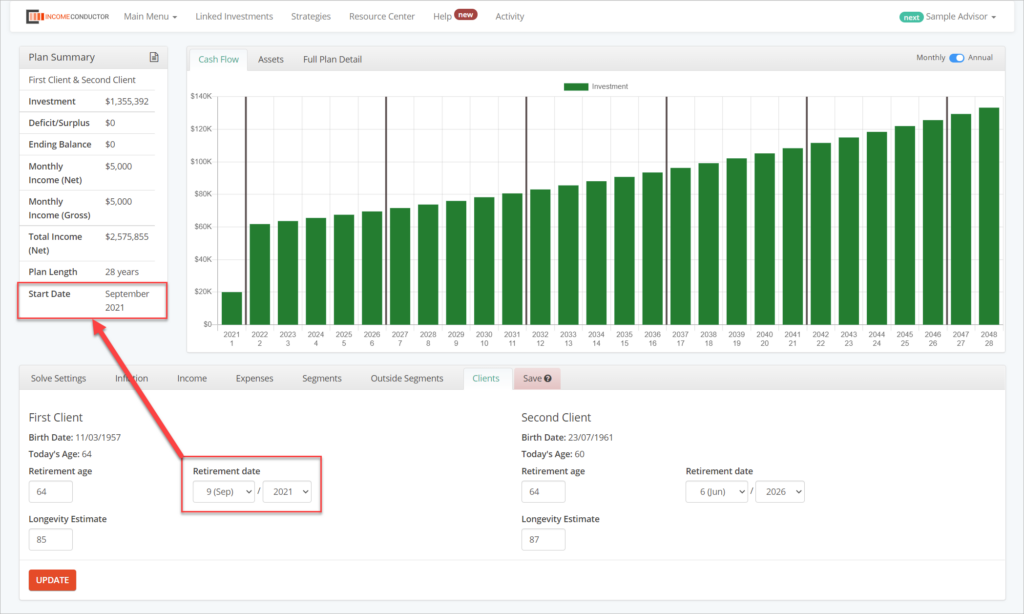

Retirement Age / Retirement Date

Each client can have their own anticipated retirement age and corresponding date. Just as when you are first creating a client, the sooner of the clients’ retirement dates will dictate the plan start date.

Changing the retirement date for a client such that the other client’s retirement date is still sooner will have no effect on plan length. Changing a retirement date to now be later than the other will change the plan start date.

After editing figures, be sure to select the Update button to effect the changes to the plan.

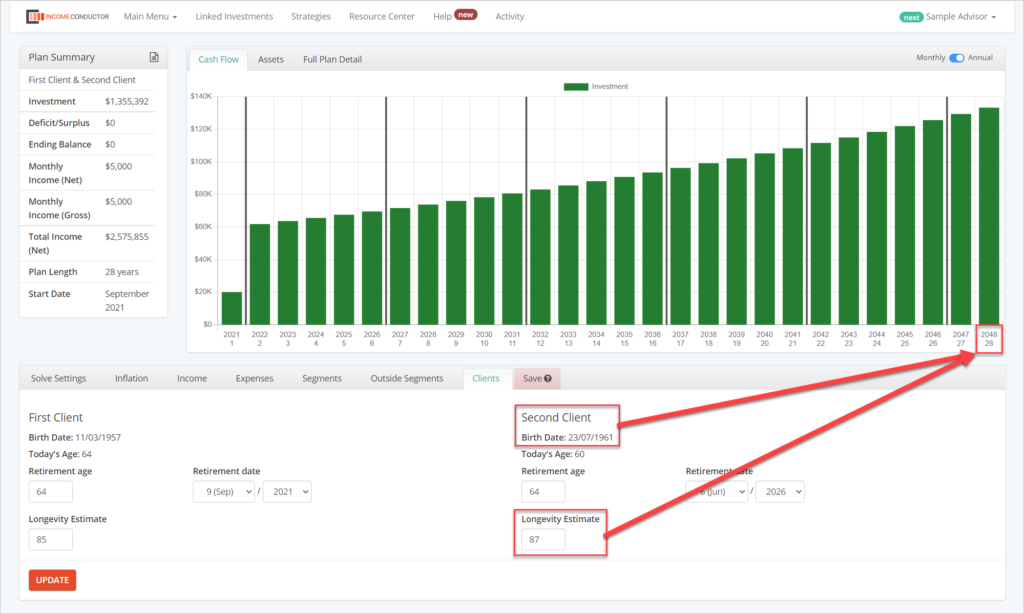

Longevity Estimate

Each client has their own longevity estimate, or age to which they are anticipated to live. The latest longevity date will dictate the year in which the plan ends.

Changing the longevity estimate for a client such they are anticipated to live to a later date than the other client with lengthen the plan accordingly.

After editing figures, be sure to select the Update button to effect the changes to the plan.