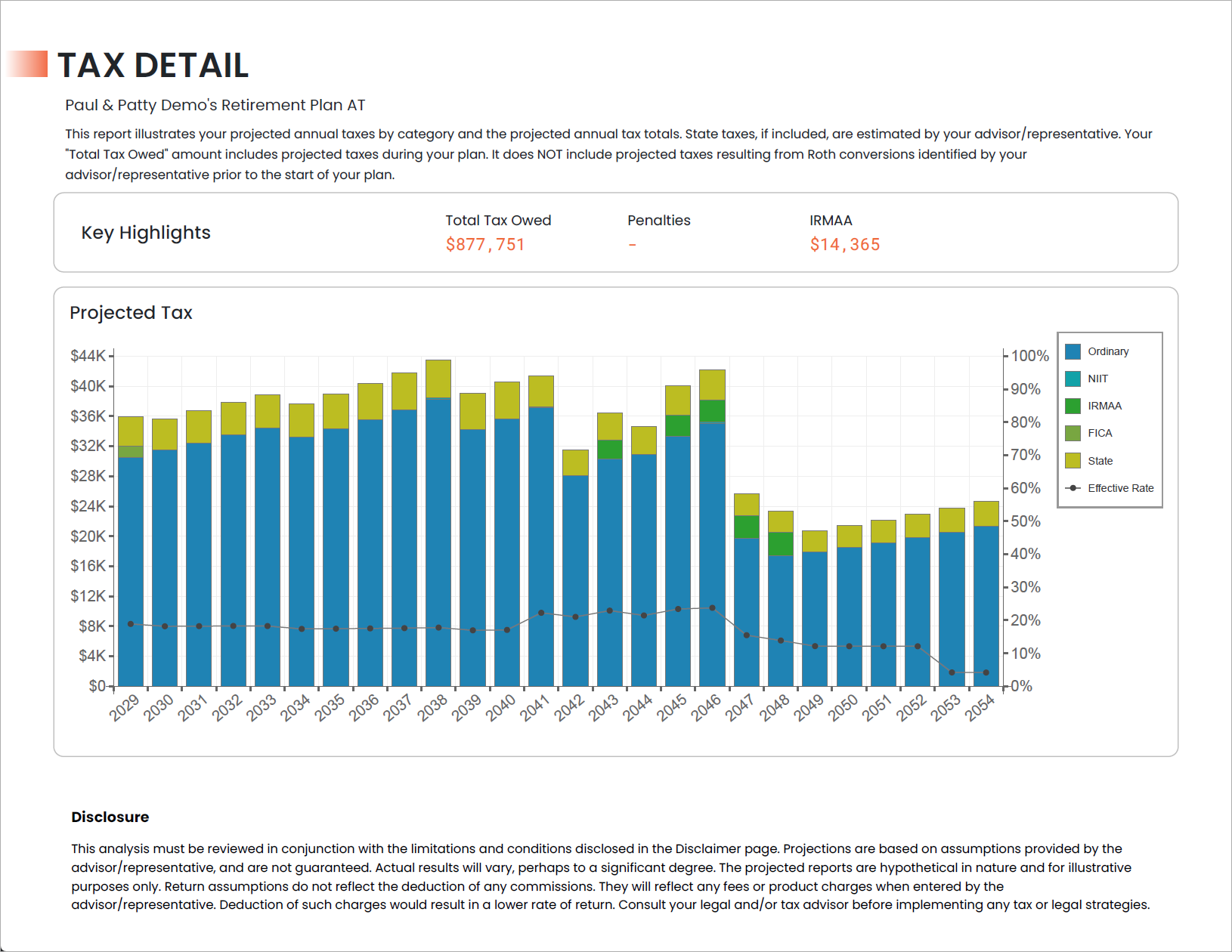

Tax Detail is a report module that focuses on the projected taxes, surcharges, and penalties throughout the plan.

The first page of the module includes a chart as well as the following Key Highlights:

Total Tax Owed is the total projected tax obligation throughout the plan, including penalties and IRMAA surcharges.

Penalties is the total projected amount of early withdrawal penalties throughout the plan.

IRMAA is the total projected Income Related Monthly Adjustment Amount surcharges on Medicare Part B / Part D throughout the plan.

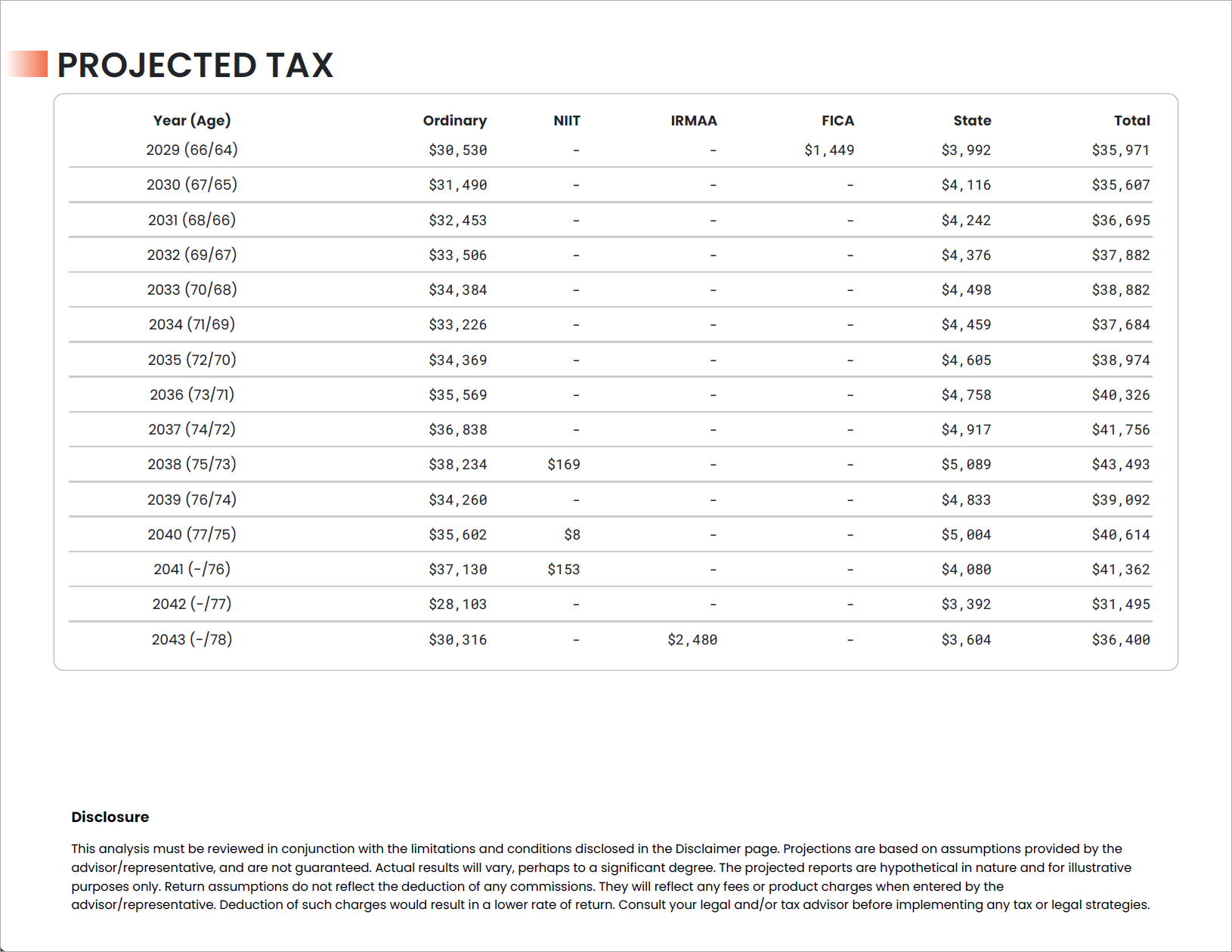

The following pages of the module include a data table that gives specific projected annual amounts by tax type in the plan as well as totals by year and type. All ages shown are as of year-end.

The following types of taxes may appear in this report:

- Ordinary

- Long-Term Cap Gain

- NIIT (Net Investment Interest Tax)

- IRMAA (Income-Related Monthly Adjustment Amount)

- State

- FICA (Federal payroll tax)

- SECA (Self-Employed Contributions Act tax)

- Medicare Tax

- Penalties

Standard disclosures are provided in the footer, as well as additional disclosures specific to this illustration in the Disclosures section at the end of the report.

Jump to the next report module: