Income Plan Goals is a report module that outlines key highlights around the assumptions used to arrive at projected Pro plan scenario results.

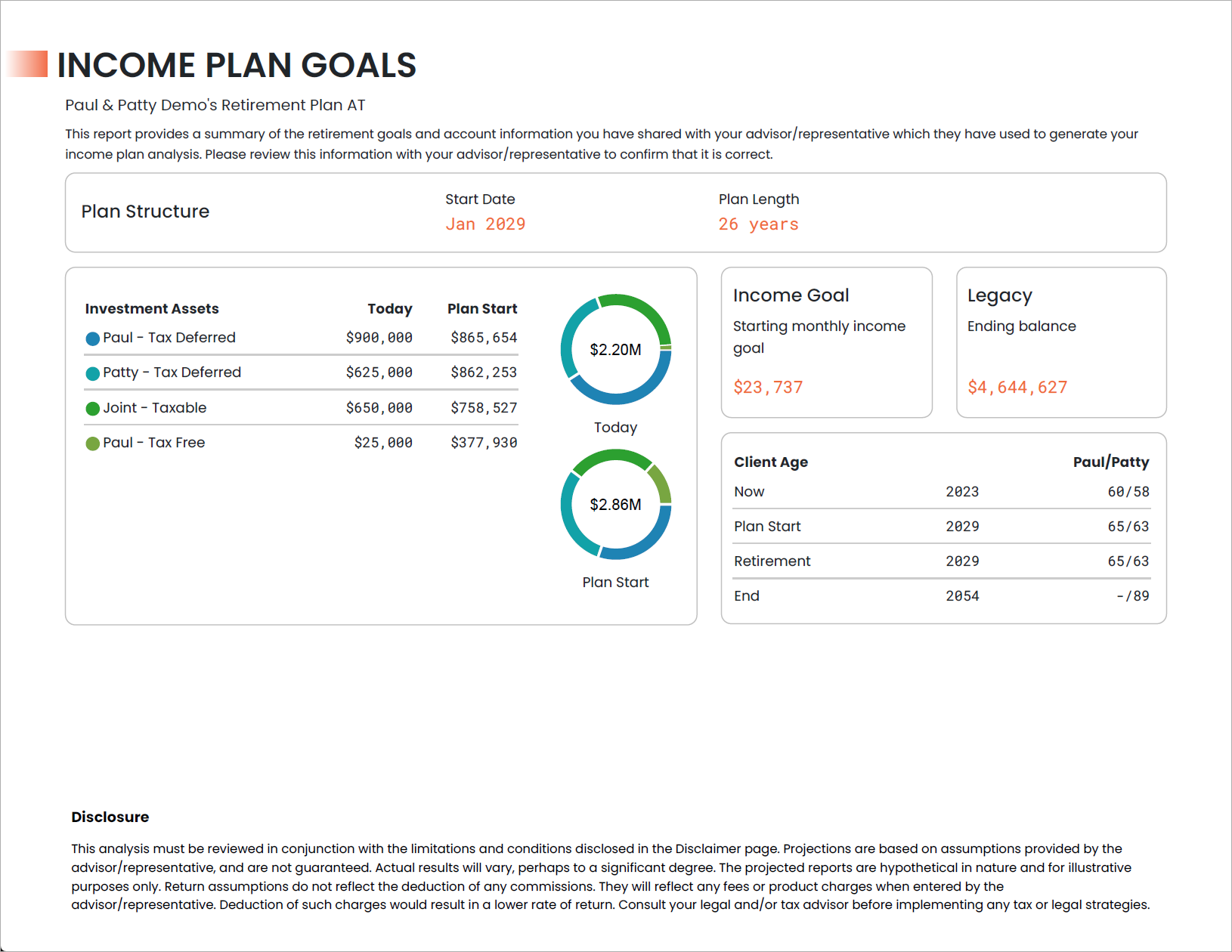

Start Date is the month in which the first client in the plan retires.

Plan Length is the duration of the income plan period in years.

Investment Assets rolls up the accounts included for use in the plan by owner and tax treatment. Values are shown as a of Today, and the projected value at the Start Date based on the pre-retirement growth RoR, contributions, and capital flows.

- Taxable refers to non-qualified accounts types such as Joint, Individual, etc.

- Tax Deferred refers to qualified account types such as IRA, 401k, 403b, etc. as well as qualified or non-qualified annuities.

- Tax Free refers to account types such as Roth IRA, Roth 401k, etc. as well as tax-free (Roth) annuities.

Income Goal is the sum of all projected expenses in the first month of the plan.

Legacy is the projected balance across all accounts/annuity cash values as of the end of the plan.

Client Age is given for each client as of Today, Plan Start, each client’s respective retirement date, and plan end.

Standard disclosures are provided in the footer, as well as additional disclosures specific to this illustration in the Disclosures section at the end of the report.

Jump to the next report module: